Robinhood has been around for over a decade, and its foray into crypto isn’t necessarily new; however, the company is still trying to expand its efforts there — even in groups that have typically strayed from the platform.

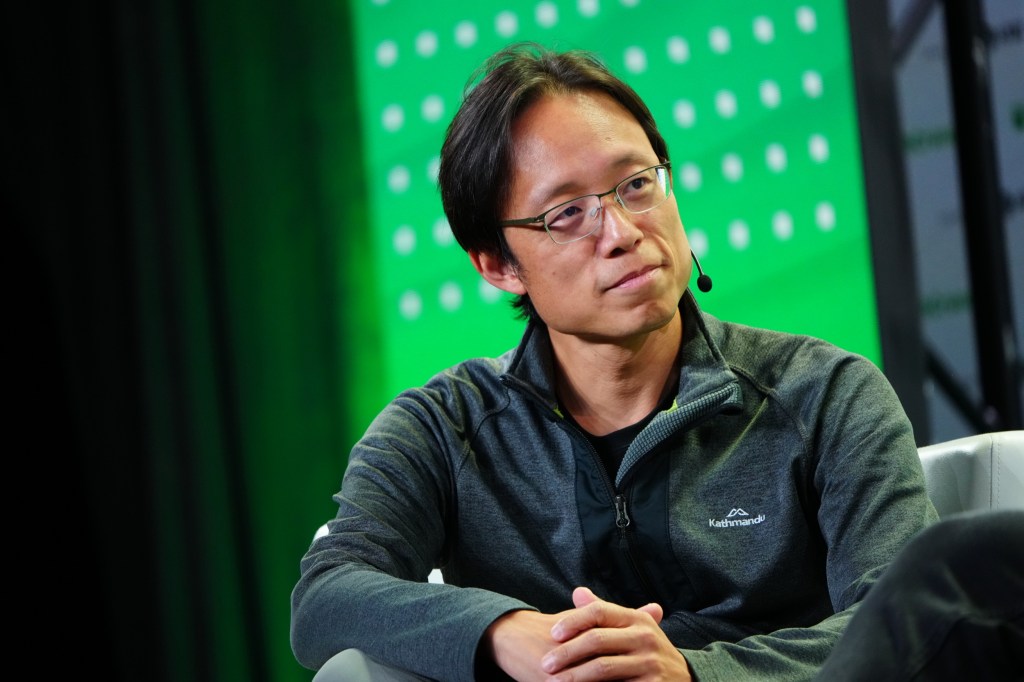

“I think crypto has always been made by very technical people and for technical people,” Johann Kerbrat, the general manager of crypto at Robinhood, said on the Chain Reaction podcast. “At the end of the day, I think customers, when they use crypto, they don’t really care what is the protocol under it? What is the network that you’re using? They just want the thing to work.”

While that may be true for novice crypto investors — the app has done a good job of onboarding that group by providing educational resources — it now wants to focus on everyone, even those who do care about underlying protocols. Robinhood users can do more technical things like transfer to its crypto wallet and use “advanced charts and autotypes where you can put, for example, a stop loss,” Kerbrat said.

The platform might not be as highly technical as one that’s crypto-focused, but Robinhood is doing research to understand what customers want and are missing.

Even though there are plans for growth, Robinhood has seemingly been wavering on its stance in the digital asset space. In June, the app chose to limit the trading and holding of certain cryptocurrencies for U.S. customers, at a time when the U.S. government was cracking down on big industry exchanges like Binance and Coinbase. With that said, the platform still has 14 cryptocurrencies and one stablecoin, USDC, available for users to buy and sell.

In the third quarter, Robinhood reported that its transaction-based crypto revenues decreased 55% to $23 million. That amount makes up only 12.4% of the business’ total $185 million for transaction-based revenue, the report showed.

Kerbrat talked about why Robinhood is still continuing to focus on crypto when it makes up such a nominal amount of the business. “The big difference from Robinhood versus other companies is that we have a very diversified business,” he said. Aside from crypto, it offers traditional securities or ETFs, retirement portfolios and options trading. “We can afford to weather these cycles when there’s a bit more traction on other products other than crypto.”

Given that Bitcoin and other cryptocurrencies have seen some refreshed interest in the past month, demand for Robinhood has also grown, Kerbrat said. Robinhood crypto launched in February 2018, when crypto was in “deep winter.” It launched with just Bitcoin and Ethereum, then added other cryptocurrencies over time.

“The reason why we still launched it at the time was because we believe crypto will be the financial framework of tomorrow, and we really want to be building for the long-term,” Kerbrat said. “We are not really optimizing for one particular month or one particular activity.”

At the end of November, the app made its first international expansion into the U.K. and deepened its crypto commitment last week by bringing its crypto-trading platform to the European Union.

“Our focus has been to build a platform that we can use and deploy in new markets,” Kerbrat said. While there are other regions like Asia, Latin America and the Middle East, Robinhood is going to keep those untouched, for the foreseeable future. “I have my hands full, I think, with the EU, for now, and the U.S., so we are going to really focus on that,” he said.

This story was inspired by an episode of TechCrunch’s podcast Chain Reaction. Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to hear more stories and tips from the entrepreneurs building today’s most innovative companies.

Connect with us:

- On X, formerly known as Twitter, here.

- Via email: chainreaction@techcrunch.com