The downturn in the technology sector — dragged by inflation, higher interest rates and geopolitical events — continues to persist, and one of the most acutely impacted areas has been VC funding for startups, particularly those outside the U.S. According to VC firm Atomico, companies in Europe are on track to raise just $45 billion this year — around half the $85 billion that startups in the region raised in 2022.

The figures come from Atomico’s big report on the state of European tech, which it publishes annually.

It also found that startups in the region are raising less at each stage of funding from Seed through to Series C (and beyond), with later stage and larger companies feeling a particular pinch: just 7 “unicorns” (startups with a valuation of more than $1 billion) are set to emerge this year in Europe, compared to 48 in 2022 and 108 in 2021.

Image Credits: Atomico (opens in a new window)

(opens in a new w

But there is a silver lining in the story. While overall investment amounts are definitely down on the last two years, Atomico’s theory is that 2021 and 2022 were outliers in terms of activity — a consequence of lower interest rates, a surge of technology usage during the peak of the Covid-19 pandemic, and a pent-up amount of funding among investors — raising ever-larger from LPs keen to reap big returns from a buoyant industry — that needed to be deployed.

In other words, taking those two years out of the mix, it looks like figures are following a slower, and perhaps healthier, growth curve upwards.

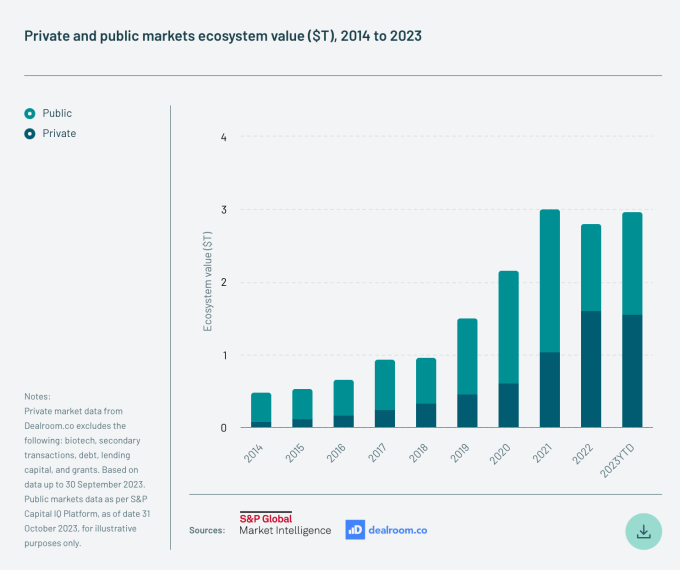

Another positive sign is that the overall total value of the European tech ecosystem — that is, the combined equity value of all public and private tech companies in Europe — has returned to its 2021 record of $3 trillion after dropping $400 billion in value in 2022. That’s thanks to a steady stream of new startups raising money offsetting down rounds, with the majority of fundraises made as flat rounds or up rounds.

Image Credits: Atomico (opens in a new window)

“This rebound in ecosystem value has also been supported by the continual influx of new companies starting and raising private capital for the first time, as well as the fact that, despite a large increase in the number of down rounds, the overwhelming majority of follow-on capital deployed into the ecosystem has been through flat rounds or up rounds,” the authors of the report write.

Atomico bases its figures on surveys it runs with startups and investors, and complements that with data from third party sources like Dealroom, CrunchBase and others.

Some of the other notable points from the report:

“Crossover investors” have crossed out Europe. Atomico notes that so-called crossover investors — those who invest both in private and public tech companies (Tiger Global is one well known example) — have all but disappeared after driving some of the biggest deals of previous years. In 2021, there were nearly 100 mega-rounds where these investors led or participated in Europe. 2022 started to see a slowdown of that pace. This year, spooked by the poor performance of both public and private tech companies, these crossover players made just four investments in the region.

Their absence has also impacted the overall picture for nine-figure rounds. Atomico notes that the first nine months of 2023 saw just 36 rounds of $100 million or more, compared to hundreds in the preceding two years. Notably these rounds do not follow the same upward curve as some other figures: there were 55 $100+ rounds in 2020.

Image Credits: Atomico (opens in a new window)

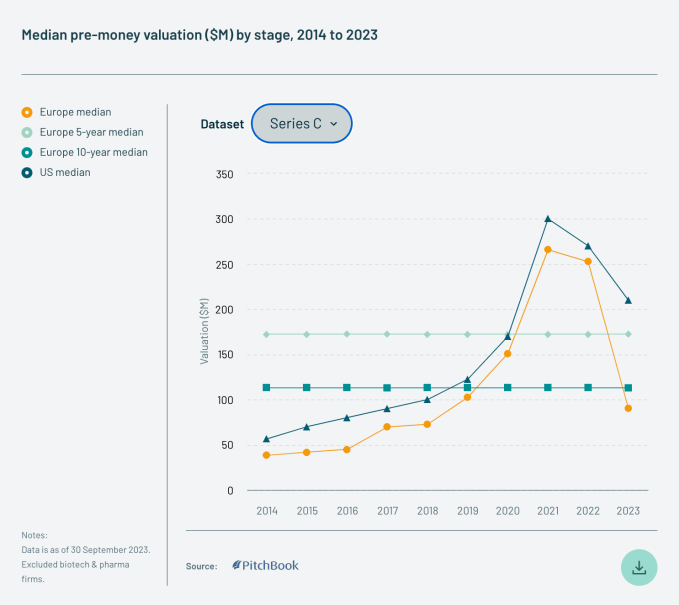

Planting the Seed. Startups at almost every stage are raising on average at down rounds, Atomico’s data shows. Generally, the later the stage, the starker the valuation drop. Here is the picture for Series C rounds:

Image Credits: Atomico (opens in a new window)

Overall, the median valuations for European startups remain considerably lower than those of their U.S. counterparts — specifically between 30% and 60% lower.

“This shift back toward longer-term averages in Europe mirrors what is happening in the U.S.,” Atomico writes. In fact, between the U.S. and Europe, funding has dropped in nearly every stage of investing between Seed and Series C. The only exception is Seed stage in the U.S., which continued to rise, albeit at a slower rate. (Median Seed rounds in the U.S. this year, Atomico said, was $11.5 million, while the European median figure was essentially half that amount: $5.7 million.)

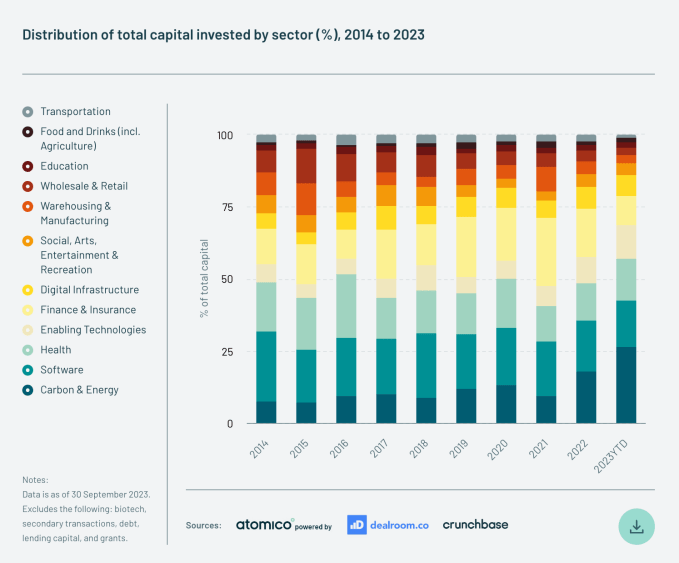

It’s not AI that is dominating investment in Europe. Although the focus in the tech zeitgeist right now certainly seems to be on artificial intelligence, when it comes to what segments are driving actual funding monies right now, if you jump on that bandwagon, you might miss the real show. Atomico says that its numbers indicate that climate tech — and the wider area it’s in, Carbon and Energy, accounted for a whopping 27% of all capital invested in European tech in 2023.

That is more than double what was invested in this area in 2023, and it’s even performing better than some of the other segments of tech that have traditionally be huge in the region.

“Carbon & Energy has soundly overtaken Finance & Insurance and Software as the single largest sector by capital raised,” the report authors note. “This not only represents a dramatic increase in the scale of capital invested behind the green transition, but also a clear slowdown in fintech investment volumes since the peak of the market.”

Image Credits: Atomico (opens in a new window)

Updated, correcting that the amount European startups are due to raise in 2023 is $45 billion, not $42 billion.