If at first you don’t succeed, wait and try again.

That seems to be the mantra at Circle, best known as the issuer of the “USDC” stablecoin. After calling off its SPAC combination in late 2022, the well-known crypto company is now seemingly considering going public in 2024, Bloomberg reported, citing anonymous sources.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

It may seem incongruous to see Circle considering going public at a time when the wider crypto industry is slogging through a downturn. But given how the company earns its keep, and the rising importance of stablecoins in the decentralized economy, the IPO does not come as a massive surprise. In fact, Circle is likely riding a wave that other fintech companies are also benefiting from: rising interest rates.

Much ado about stables

Stablecoins are a simple idea: A crypto token is pegged to an existing fiat currency, backed 1:1 with assets that make it easy to redeem.

Stablecoins are a simple idea: A crypto token is pegged to an existing fiat currency, backed 1:1 with assets that make it easy to redeem.

It’s certainly a bit ironic that one of crypto’s biggest products is effectively tokenizing U.S. dollars, but we don’t have to care much about the optics there. Instead, we care about Circle’s business, and why an IPO next year would be par for the course, no matter the crypto climate right now.

We first need to discuss interest rates. Fintech companies back in 2021 and earlier used to benefit the most from trading revenues, but of late, they have benefited hugely from another source: expanding interest-based income.

For example, equity trading platform Robinhood’s net revenue rose 29% in Q3 2023 to $467 million from a year ago, driven by a 96% increase in net interest revenue ($251 million). Its transaction-based revenue actually fell 11% to $185 million from a year earlier. The company said its interest-based revenues benefited from “growth in interest earning assets and higher short-term interest rates.”

Coinbase’s Q3 was similar. Total transaction revenue declined 21.1% to $288.6 million from $365.9 million last year. Meanwhile, stablecoin-derived revenues increased a whopping 124% to $172.4 million from $76.9 million, and interest income rose nearly 60% to $39.5 million, up from $24.9 million a year ago.

You can probably see where we’re going. Coinbase has an agreement with Circle regarding USDC. Here is the key text from the latter’s earnings report (emphasis ours):

Stablecoin revenues were $172 million, up 14% Q/Q. Prior to Q3, stablecoin revenue was included in interest income. Stablecoin revenue is income earned on USDC reserves under our updated arrangement with Circle. The primary driver of the Q/Q increase was higher interest rates. We ended Q3 with approximately $2.5 billion in on-platform USDC balances, up from $1.8 billion at the end of Q2.

Essentially, for many years sitting on cash or investable reserves generated minor income due to the low interest-rate environment, but now that interest rates have risen, such holdings are now worth a freaking mint.

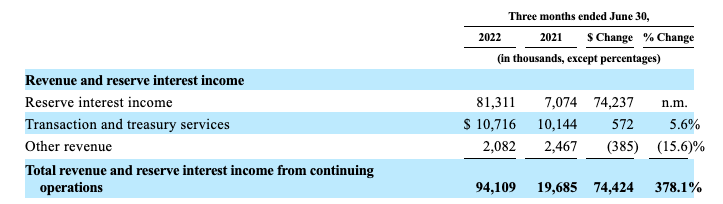

Enter Circle. Here’s how the company described its financial performance through the second quarter of the year:

Image Credits: Circle

According to data from the Federal Reserve Bank of St. Louis, the effective interest rate in June 2021 was 0.08%. A year later, it was 1.21%.

Now, a good chunk of the gains that Circle saw came from rising reserve balances. Between June 30, 2021, and June 30, 2022, total USDC in circulation more than doubled to around $55.5 billion from just over $25 billion. That gain and the rising interest rates gave Circle an even bigger lift.

Today, the effective Fed rate is above 5%. Circle’s total circulation today has contracted to $24.4 billion, according to CoinMarketCap, but 5% of that figure is $1.22 billion. I am not saying that figure is Circle’s current revenue run rate, but the number indicates that despite a decline in the number of USDC tokens in circulation — which would lower total reserves at the company due to 1:1 backing — the company is likely far larger than it was before. Hence, an IPO.

Reality is weird. Robinhood and Coinbase saw their fortunes rise as zero-interest rate policies made active trading more attractive and helped inflate the value of alternative assets. Rising rates undercut that model. But what the Fed took away, the Fed gave back in the form of rising interest-based incomes. Wild, yeah?