While rapidly rising interest rates in the United States have caused more than a few financial institutions to topple, a group of well-known fintech companies are posting signs of a comeback.

Both Coinbase and Robinhood reported better-than-anticipated revenue in the first quarter. This is welcome news for the backers and employees of both companies, which saw their shares skyrocket during COVID and tank after those pandemic tailwinds tapered away.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

No comeback story is built on a single factor, though; there’s always more at play. But the changing revenue mix at both Coinbase and Robinhood makes it clear that their ability to generate material amounts of revenue off cash balances (and the crypto equivalent) is changing the game in their favor.

Studying public company performance is a great way to better understand what’s happening in that segment of the market, so that’s what we’re doing today with Coinbase and Robinhood. As always, we’ll relate what we’ve learned back to startups. Consider today’s column a rejoinder to the persistent doom and gloom around fintech these days.

Studying public company performance is a great way to better understand what’s happening in that segment of the market, so that’s what we’re doing today with Coinbase and Robinhood. As always, we’ll relate what we’ve learned back to startups. Consider today’s column a rejoinder to the persistent doom and gloom around fintech these days.

The power of costlier cash

As you know, when interest rates rise, money is more expensive to borrow and vice versa. For banks and credit unions, then, interest-rate hikes are more than welcome. For perspective, consider that net interest income at Wells Fargo in the first quarter amounted to $13.3 billion, up 45% from a year earlier. That’s a lot of money the bank can spend, save or invest.

The situation is a little different for fintech startups that went public in recent years. They make money off cash, but are less focused on loans, meaning that they have a chance to make lots of net interest income.

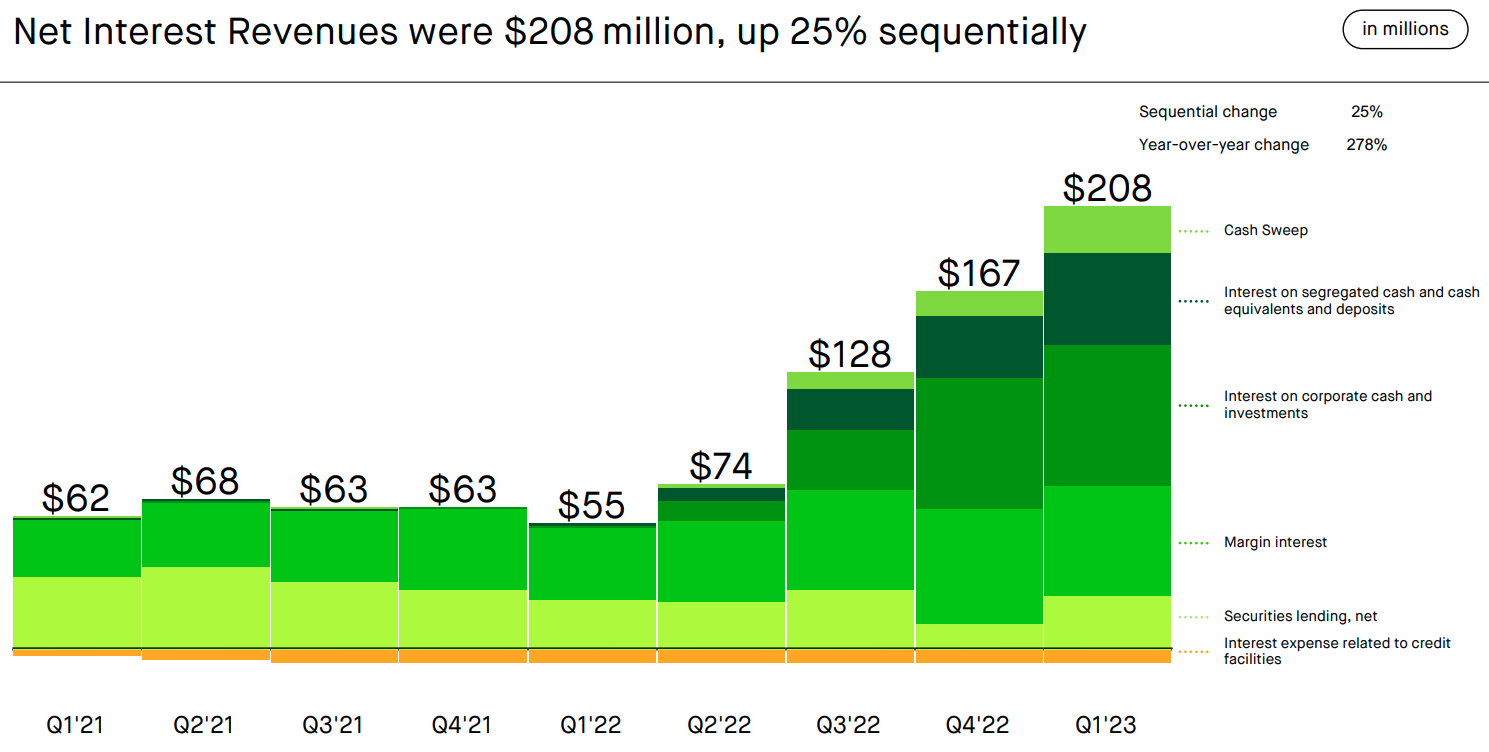

Let’s observe how that plays out for Robinhood. In the first quarter, Robinhood’s transaction-based revenue — the revenue stream it rode to the public markets — came to $207 million, while net interest revenue came in slightly higher at $208 million.

What’s more, interest revenue rose 25% from Q4 2022, while transaction-based revenue increased 11% in that period. This means not only is Robinhood now making more money from interest income, that portion of its revenue mix is accounting for more of its top line.

Per Robinhood, the gains in interest revenue were “driven by growth in interest earning assets, increased securities lending activity, and higher short-term interest rates.”

If you’d like a pictorial representation, this is how Robinhood’s interest-based revenue has expanded:

Image Credits: Robinhood public filings; image has been cropped.

Note that the mix of interest revenue started to break out of prior bounds and diversify in terms of its contributing components in Q2 2022. That’s around when the American central bank began to quickly hike interest rates, making money more expensive to borrow and more valuable to hold. Since then, Robinhood has enjoyed an incredibly useful revenue tailwind.

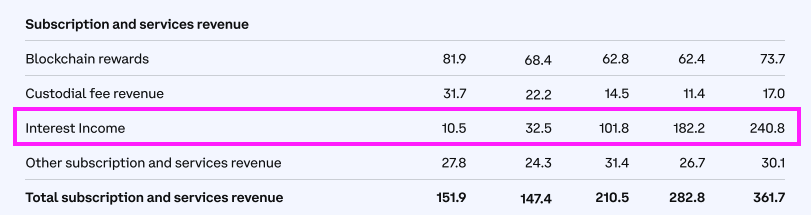

Next, we have Coinbase. Here’s how the company described its rising interest-based revenues in its earnings report:

Interest income grew 32% Q/Q to $241 million in Q1, of which $199 million was from USDC.

USDC, of course, is the stablecoin that Coinbase and its users hold a lot of. Putting those numbers in context, here’s Coinbase’s breakdown of the growth it has seen in interest-based revenues from Q1 2022 to Q1 2023:

Image Credits: Coinbase public filings; image has been cropped and amended.

Here’s a chart we put together to illustrate that:

Data visualization by Miranda Halpern, created with Flourish

Hot damn.

These tailwinds and the subsequent increase in interest incomes at Coinbase and Robinhood are music to investors’ ears. Coinbase’s shares rose after it reported results and Robinhood’s stock is up about 4%.

It is too soon to say that fintech companies are on their way to a comeback, but it is clear that any fintech startup with a large sum of deposits will enjoy a firm revenue boost this year.

Take the American neobank Chime as an example. The company’s savings accounts offer up to a 2% yield. It’s likely that Chime is able to derive a good margin of net revenue off that payout rate, meaning that rising rates are likely helping the fintech expand its revenues, and in a pretty darn high-margin fashion to boot.

Higher rates are a boon for fintechs, but there’s one more group of startups that is likely seeing a boost: overstuffed late-stage startups. A lot of companies raised years and years of cash during 2020 and 2021, and per conversations with investors, it’s clear that a number of those startups are still sitting on fat accounts. Those cash balances are now paying out more than they used to, meaning that some unicorns are seeing their accounts inflate simply by holding on to cash.

That fact increases the implied value of cost cuts even further. Reducing operating costs is useful for shoring up margins, but in this context, saving a dollar of cost yields more than a dollar in net savings. Ironically, startups that raised too much and are looking to bolster their runway today are being given a lift from central banking policies.