New U.S. inflation data is augmenting tech stocks listed on American exchanges, helping shares of cloud companies reach prices they haven’t been close to for nearly a year.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The new numbers on inflation indicate that the American central bank could soon halt its series of aggressive interest rate hikes, and if that causes interest rates to level off, it could spur investors to pivot their focus back toward tech shares. Given how far tech valuations have fallen in the past couple of years, any recovery feels welcome.

TechCrunch+ noted in late Q2 2023 that tech valuations were perking up, at least on the public markets. Today, following the new inflation data, a collection of cloud stocks tracked by VC firm Bessemer ticked 1.9% higher to reach gains of around 32% year to date.

TechCrunch+ noted in late Q2 2023 that tech valuations were perking up, at least on the public markets. Today, following the new inflation data, a collection of cloud stocks tracked by VC firm Bessemer ticked 1.9% higher to reach gains of around 32% year to date.

Inflation down, tech up

The past year has been tumultuous for many tech companies, which enjoyed attention from investors in an economic climate where low interest rates made them more attractive investments.

There’s a very basic trade-off between interest rates and growth-oriented companies. Lower interest rates engender lower bond yields, which makes for a less attractive investing climate for less-risky assets like bonds. At the same time, tech stocks, which are often valued based on their potential to grow quickly instead of their profitability, become more attractive as investors seek to maximize their returns.

A low interest rate environment also makes it cheaper for investors to raise money in the form of debt, which can bolster certain private equity strategies. In contrast, expensive debt makes private equity buyouts and other related transactions more expensive, potentially lowering market appetite to use debt to purchase and invest in tech companies. The end of interest rate hikes, therefore, could also help smooth PE-led exit avenue for startups.

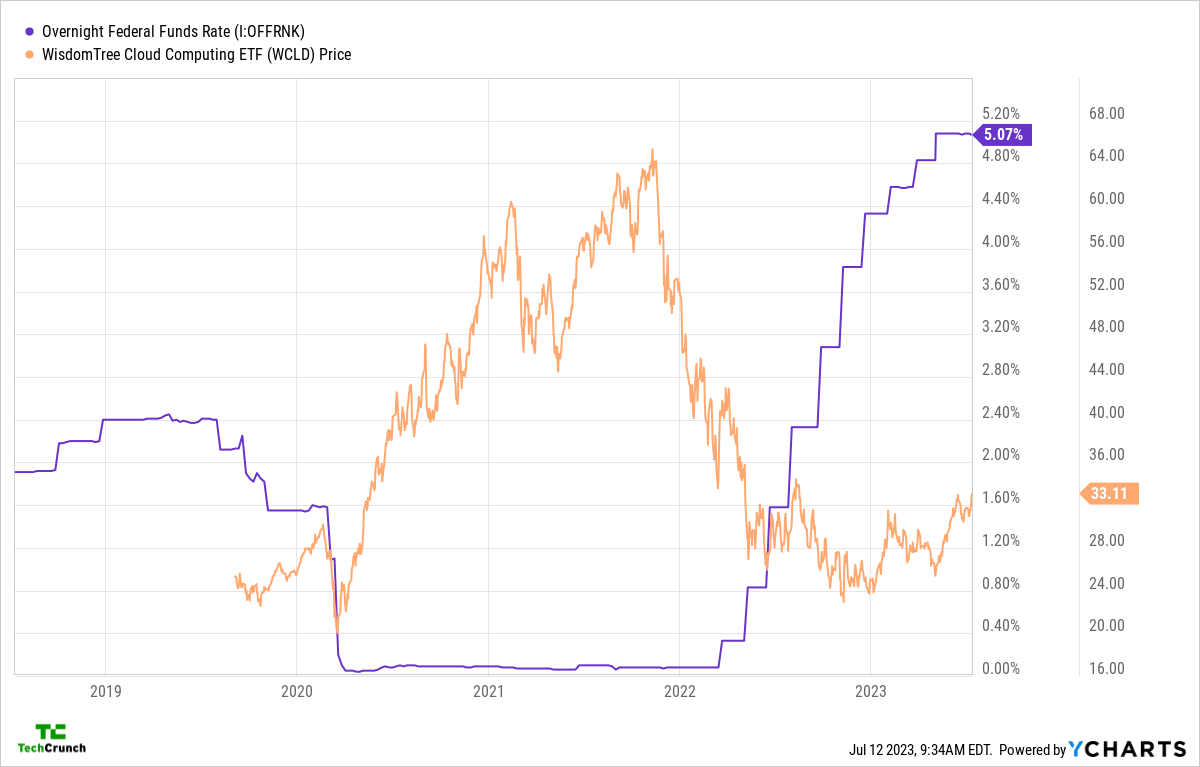

As interest rates have risen, the value of tech stocks has fallen. This chart compares the interest rate hikes with the performance of the Bessemer cloud index (WCLD):

Image Credits: TechCrunch / YCharts

As you can see, lower rates correlate to higher tech shares prices, and vice versa.

Of course, other macroeconomic factors also impact how well these tech stocks perform. Still, the relationship between interest rates and growth-y valuations is well established.

So, as inflation slows and the market expects interest rate hikes to diminish as well (rates are raised when inflation is up in an attempt to cool the economy down and the pace of price gains), it’s reasonable to infer that tech companies may not have to face so much pessimism much longer.

Just how far has inflation cooled? Yahoo Finance reports (emphasis ours):

Consumer prices rose at the slowest pace since March 2021 as inflation showed further signs of cooling in June, according to the latest data from the Bureau of Labor Statistics released Wednesday morning.

The Consumer Price Index (CPI) rose 0.2% over last month and 3% over the prior year in June, a slight acceleration from May’s 0.1% month-over-month increase but a slowdown compared to the month’s 4% annual gain.

Both measures were slightly better than economist forecasts of a 0.3% month-over-month increase and a 3.1% annual increase, according to data from Bloomberg.

The market expects another quarter-point hike from the Federal Reserve, but after that we should see a period of digestion as markets normalize the new interest rate into normal business operating conditions. Tech stocks might like to see rates being cut, but such a move might wind up being more poison than panacea. The Fed would only cut interest rates in the near term if there was significant macroeconomic uncertainty or evident pain, and if that were to happen, tech companies would prefer flat interest rates and a stronger underlying economy.

Tech companies are not out of the woods yet. I expect that concern around tech valuations will persist until higher-growth, public software companies have a median forward price/sales multiple of 10x. When we last checked, that figure had improved from recent lows to around 8.5x, but it’s still miles below the ~40x multiples we saw during the height of the last tech boom.

Getting back to 10x would imply that unicorns need only $100 million in forward revenue to defend their billion-dollar price tags. Easy? No. Doable? Often, I think.

No matter when rate hikes pause, or how much tech stocks gain in the coming weeks, keep in mind that it takes time for public-market signals to trickle down to the private markets. So, startups: The skies are clearing a little, but don’t expect that to help too much in your next conversation about equity round pricing. Not yet, at least.