We have good news for tech companies big and small this fine Wednesday morning: valuations are heading higher, though at a modest pace.

New public market data indicates that software stocks are rising to their highest points so far this year. To make it sweeter, the underlying revenue multiples at public companies are expanding as well, especially at the faster growing subset of software companies.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Investors today seem to think public software companies are worth more per dollar of revenue in aggregate. That will lift some pressure from startups struggling to raise new capital at attractive prices or harmonize legacy private-market companies’ valuations with their hoped-for IPOs. Clearing the massive startup liquidity backlog will take more than a modest reinflation of software valuations, but it’s a start.

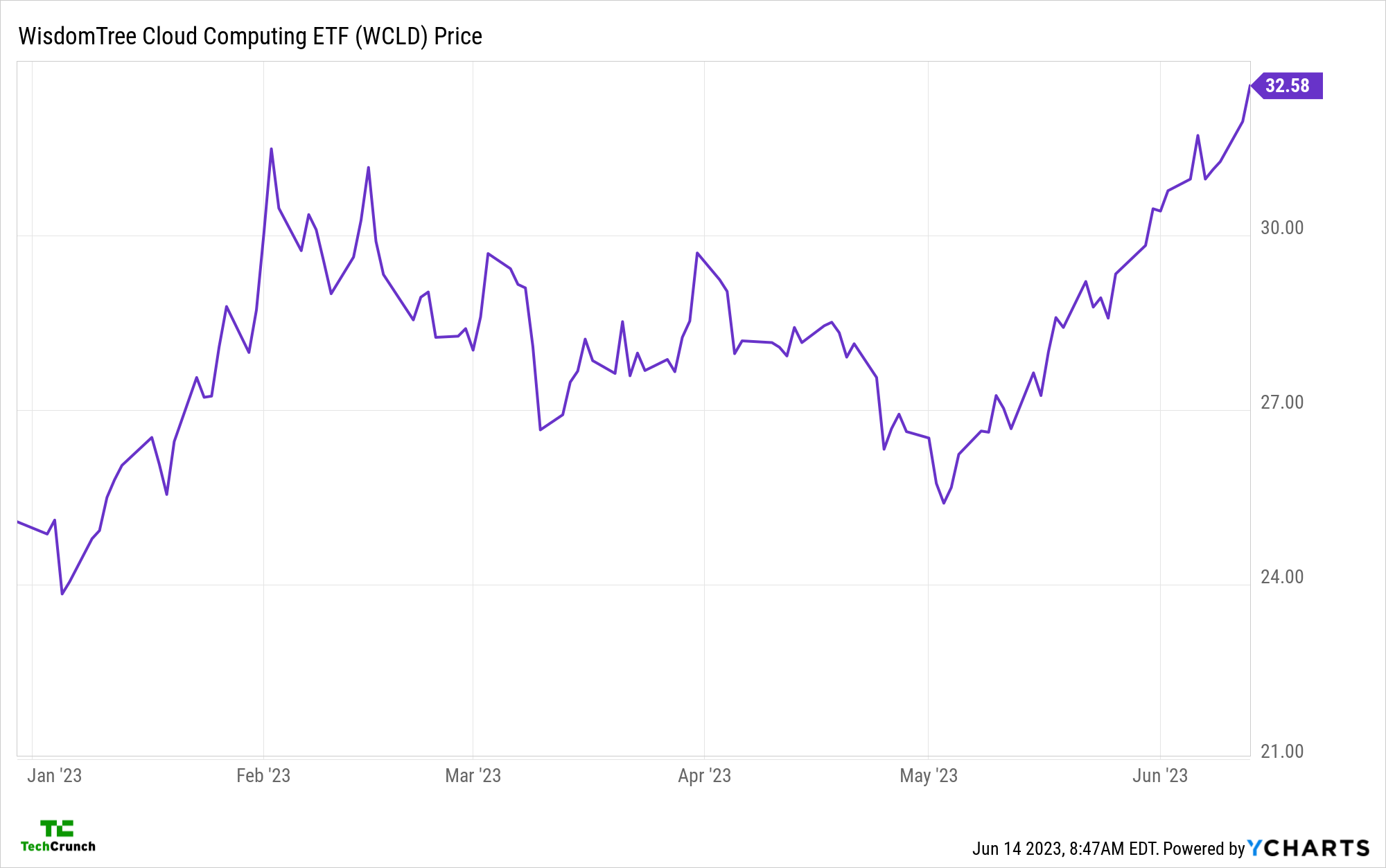

Starting with high-level numbers, here’s a look at the Bessemer Cloud Index’s performance this year. Note that the value of the constituent companies kicked off the year strong, gave back most of those gains, and then starting in May, began to pick up steam once again (YCharts data):

Image Credits: TechCrunch/Y Charts

To avoid overconfidence, we should remember that there is rarely a single factor driving the performance of a basket of companies. Still, I would say that the recent increases in the value of software companies have been built on the back of better-than-anticipated Q1 2023 performance at many companies. And, we’d be remiss to not acknowledge the positive effects of every single company talking up their AI-related work and expectations.

Investors love a growth story, so it’s easy to understand why stock prices have risen when you’re hearing every preacher (CEO) from every pulpit (earnings call) praising the power that AI will bring to their product suite and financial results.

Another factor could come into play today if the American central bank declines to raise interest rates as anticipated. A surprise rate hike could topple the punch bowl, but no movement and dovish comments from Fed staff could provide another puff of wind to tech valuations’ sails.

How big is the impact on revenue multiples?

Modest, but important.

When stock prices rise, they do not necessarily correlate to higher revenue multiples (or in stock-market terms, bigger price/sales ratios) for a simple reason: Companies tend to grow. If a company grew 30% and saw its share price rise 15%, you might not expect its revenue multiple to expand. That’s an incredibly stripped-down example, but you get my drift.

So, how much impact are rising share prices having on software companies’ revenue multiples? Turning to Altimeter investor Jamin Ball’s running commentary on the value of software shares, we can see in the following chart that while the slowest-growing bucket of software companies (those expanding at less than 15% per annum, the orange line) is largely flat, those in the 15%-30% growth bracket (red line) and those above the 30% mark (blue line) are seeing notable movement:

Image Credits: Jamin Ball, shared with permission.

Are we seeing massive gains? No. Have all software stocks recovered from a difficult six months of trading, at least when it comes to their multiples? No. However, we can see a clear change in investor demand for shares of companies that are growing at a decent clip or faster.

Keep the champagne on ice. Startups are hardly out of the woods, but the market is no longer moving away from their valuation marks and is instead bolstering the value of their public comparables. That’s great news, even if it is being delivered almost begrudgingly.

All startups are not equal

The market is not fair. Some tech companies, be they private or public, are doing better than their implied or real valuation indicates. Others are being valued with more gusto than they deserve. Observe:

Image Credits: TechCrunch

That’s a four-week-old company that’s now worth a cool quarter of a billion dollars after raising a nine-figure round.

Startups that aren’t primarily working on AI could find it tougher to raise money, go public or sell than it “should” otherwise be. But hype is a reality in business and it does impact the value of companies. That’s why every company you can shake a stick at is trying to slather themselves in AI language.

We’ll get venture capital data for Q2 2023 soon enough, but for now, rest content that the AI moment is not bringing a period of worse valuations for tech stocks. It’s likely helping to bolster startups trying to raise capital and keep working.

In 2023, getting even morsels of good valuation news feels like a feast. Let’s see if startup valuations rise in the coming months to mirror what the stock market is showing us today.