Stash, the micro-investing app that’s been a hit with first-time investors, announced today it has raised an additional $37.5 million in Series D funding in a round led by Union Square Ventures. Existing investors Breyer Capital, Coatue Management, Entree Capital, Goodwater Capital and Valar Ventures also participated.

The company competes with a range of new investment apps – like Robinhood, Acorns, and others. These apps have particular appeal to the often younger, less experienced investors who are uncomfortable using traditional tools

However, Stash isn’t just targeting the millennial crowd – though its average user is aged 29 – it’s also broadly going after anyone who felt like they couldn’t participate in investing because they didn’t make enough money.

Most of its users make under $50,000 per year, and come from all walks of life – like teachers, retail workers, nurses, and even gig economy workers, for example.

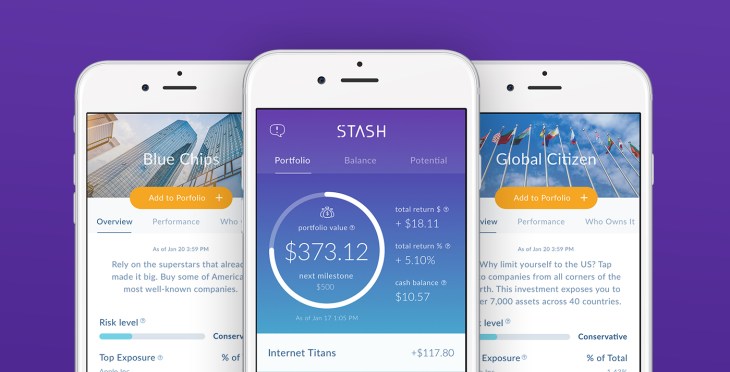

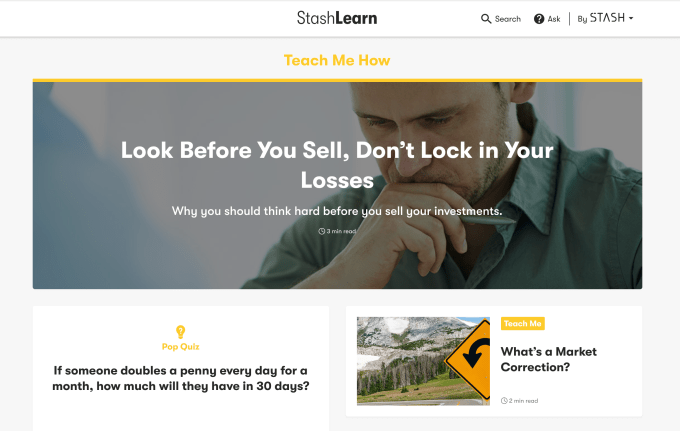

In Stash, users can start building a portfolio with as little as $5, choose those investments that reflect their beliefs and goals, and continue to fund the account with automatic or manual transfers, as they choose. Along the way, Stash offers tips and articles to help people learn more about investing and financial strategies.

The educational aspect is a big differentiator as well. In addition to in-app advice and tips, there’s online investment and financial education available. The company’s various products are also designed with the goal of helping people better understand their money, and participate in the large investment ecosystem.

“Our clients now have the chance to step off the sidelines, and do this thing they were effectively excluded from for way too long – that’s really what drives us. So many are saying now ‘I can save,’ ‘I can open a retirement account’ or ‘I can open an investment account,'” says Stash CEO Brandon Krieg. “Our extension of these products – and the fundraising – offer more accessibility to this huge group of people. We think it’s over 100 million in the U.S. that need this,” he adds.

Today, Stash’s app has grown to 1.7 million clients and 5 million subscribers. That’s up from 850,000 total users last year. The rate of growth has also increased. In 2017, Stash was seeing over 25,000 new users joining per week; now that figure is approximately 40,000 new clients per week. In addition, 86 percent of its users continue to be first-time investors.

The company has used its funding to continually create new features and products. Last summer, it launched support for retirement accounts with Stash Retire, which is now seeing significant traction. With Retire, users can automate investment into both Roth and Traditional IRAs with just $15 to start.

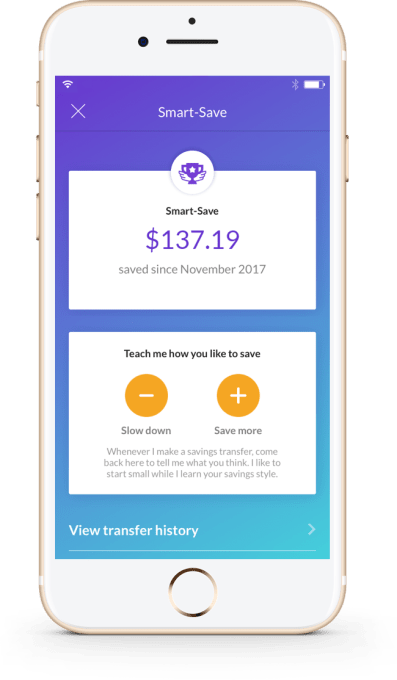

Over the past few months, Stash also launched a coaching system that trains people how to become an investor by doling out points and advice as they take particular steps, as well as a savings account product called Smart Save.

Over the past few months, Stash also launched a coaching system that trains people how to become an investor by doling out points and advice as they take particular steps, as well as a savings account product called Smart Save.

The latter analyzes the client’s spending and earning patterns, then automates savings on their behalf. Funds are held in FDIC-backed accounts and earn .6% interest.

Today, Stash has begun to roll out custodial accounts, where parents can invest on behalf of their children, with the intention to hand over the account to the child when they become of age to invest themselves – either 18 or 21, depending on the state.

Stash’s product ambitions aren’t stopping with investment, retirement, and savings, however. This year, it will also launch a new banking service.

Similar to a product like Simple, Stash’s bank accounts will be held at a still undisclosed partner bank, while the company instead focuses on building better banking software.

“We’re going to introduce banking in a different way to our clients,” says Krieg of Stash’s banking plans. “There’s the parts of banking that are really important to us: how to help our customers understand their money; understand how they’re spending and saving; and ultimately help our banking clients live better lives.”

The banking service, like other Stash products, will infuse advice and education into the app as Stash learns from the client’s spending and earning patterns.

Unlike traditional investment products, Stash isn’t targeting the wealthy, nor does it have high fees – it charges $1/month for accounts under $5,000 and .25% on those over $5,000, for example. But that raises the question of how or when the company will become profitable.

Krieg, however, is optimistic on this front.

“We’re quickly on track to become a break-even company,” he says, adding that scaling Stash is less challenging than a traditional investment advisory.

“Building a financial services company driven by technology is much different than the incumbent banks and large investment advisors who have a lot of [staff], really high investment, sales’ people salaries, and commissions. We don’t have that here,” Krieg continues. “We can scale and grow this platform without dramatically increasing our costs. And what we’ve found over the last year is that our cost of customer acquisition are dropping as our brand builds and as we grow.”

With the additional funding, Stash aims to continue to develop its products and brand, and double its team of 120 over the course of the year.