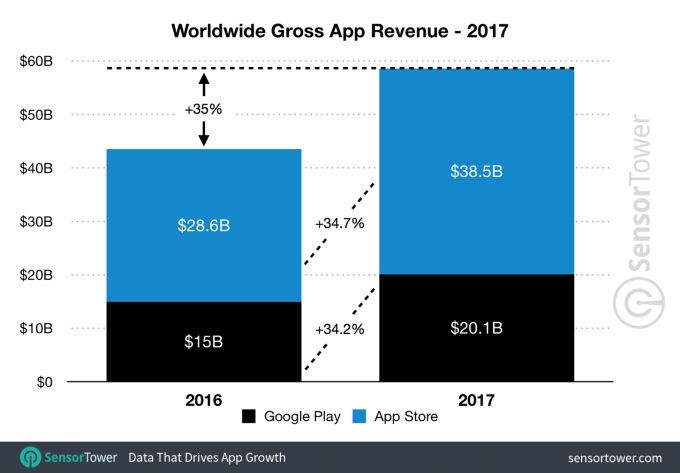

Global app revenue climbed 35 percent in 2017 to reach nearly $60 billion, according to a new report today from app intelligence firm Sensor Tower, which measured paid apps, subscriptions, and in-app purchases across both Apple’s App Store and Google Play. However, Apple is the one pulling in the most revenue, the report found – at nearly double that of Google Play.

Specifically, Sensor Tower pegged App Store revenue at $38.5 billion last year, compared with an estimated $20.1 billion spent on Google Play. That’s 34.7 percent growth over 2016 for the App Store, compared with 34.2 percent growth for Google Play.

Combined, the two app marketplaces total $58.7 billion in 2017, up around 35 percent from 2016’s total of $43.5 billion.

Sensor Tower’s numbers are in alignment with Apple’s own figures, announced yesterday. Apple on Thursday said it had a record-breaking holiday season on the App Store with over a billion in revenue, and noted that iOS developers had earned $26.5 billion in 2017 – an over 30 percent increase from the year prior.

$26.5 billion is the money paid out to developers – after Apple’s 30 percent cut. Sensor Tower’s report looks at estimated gross spending before Apple’s cut, and its findings fall within 1 percent of the actual figure.

Some of the increased revenue is likely due to mobile’s growth in emerging markets, as well as Apple’s newer support for in-app subscriptions. But Apple didn’t offer a breakdown as to how the revenue was generated or where. Instead it attempted to tie the growth to things like the App Store’s big makeover and the new crop of AR apps, like Pokémon Go. Certainly these things helped, but at this scale it’s more about the boom in developing markets, like China and India, that’s contributing to the climb.

China, for example, overtook the U.S. in App Store revenue back in 2016; and App Annie more recently attributed Q3 2017’s record app revenue and downloads to several emerging markets, including China, India as well as other Southeast Asian nations, particularly Vietnam and Indonesia.

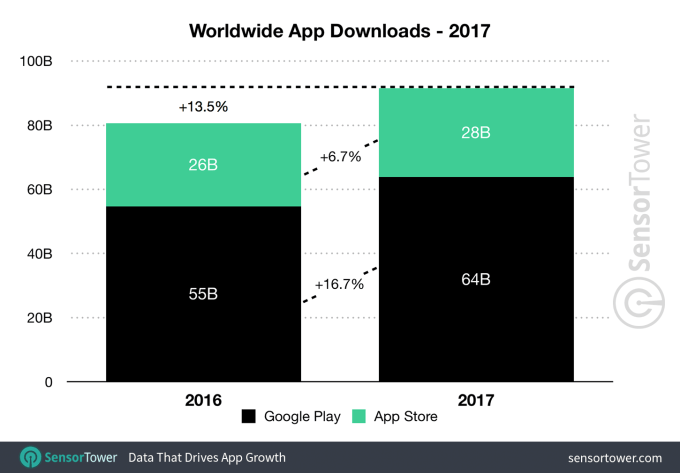

Related to emerging markets’ impact on the app stores, first-time app installs across both the App Store and Google Play were also up. The report found that global first-time app installs grew to 91.5 billion in 2017, up around 13.5 percent from the estimated 80.7 billion in 2016.

While multiple studies have found that a majority of U.S. consumers today download zero apps per month on average, this growth rate points to the fact that there’s a lot of potential for new downloads in these emerging markets.

This can also be seen in Sensor Tower’s data. It found the growth rate of Google Play app downloads was much larger than the App Store’s, at 16.7 percent versus 6.7 percent, respectively. This is because Android has a higher rate of adoption in developing markets.

In total, Google Play saw 64 billion first-time installs to the App Store’s 28 billion.

[gallery ids="1583147,1583146"]

The report finally delved into mobile gaming revenue, which increased 30 percent year-over-year to an estimated $48.3 billion – or nearly 82 percent of all app revenue. Game downloads were more popular on Google Play, which accounted for 27.2 billion (77%) of the estimated 35.5 billion downloads.

More details are here on Sensor Tower’s site.