Unicorns are like buses for Hong Kong. After living in the shadow of other cities and waiting around for its first, it now has (almost) two billion-dollar companies within months… and in the same space.

GoGoVan became the country’s first unicorn in September following a merger deal with China-based 58 Suyun, and now Lalamove — another Hong Kong company specializing in logistics on-demand in China and other parts of Asia — has snagged $100 million in new financing at a valuation that is just shy of the $1 billion mark.

Both Lalamove and GoGoVan both offer transportation and logistics services on-demand, very much in the same style that Uber works for passengers.

Typically aimed at business users, the services allow goods to be transported from A to B via trucks, vans, motorbikes using a smartphone app that connects them with vehicle owners. Uber tried that itself — and in Hong Kong, too — but its ‘Uber Cargo’ service was shuttered less than two years after its launch.

Lalamove founder and CEO Shing Chow estimates the logistics market in China alone is worth $1.7 trillion a year, so it isn’t surprising that Uber was among those to take a look. But the once-bustling field of contenders has whittled itself down over the years as realities of business kicked in.

“There were probably 200-300 competitors when we started [in 2013],” Lalamove’s head of international Blake Larson told TechCrunch in an interview. “Now, for what we’re doing, there’s a very small group.”

That’s primarily because this isn’t really a consumer service despite inevitable comparisons to Uber. Or, at least, consumers alone aren’t enough to turn the service into a business. Instead, there is a reliance on business users — and particularly SMEs — who are a very different audience. As Larson previously explained, business customers are driven by reliability and service quality more than short-term incentives like low prices funded by fare subsidies.

Lalamove divides its business between a China unit and an overseas arm that covers Hong Kong, Taiwan and parts of Southeast Asia. Overall, the business is in 100 cities and it has accrued some 15 million registered users with a network of more than two million drivers.

Larson claimed “a bunch” of cities are already profitable which shows investors that the business — which isn’t yet net profitable as a whole — is a sustainable one. That’s a point Uber and others in the consumer ride-hailing space are still grappling with.

This new funding for four-year-old Lalamove is actually somewhat unexpected since the company raised a (then-largest) round of $30 million in January when Larson told TechCrunch that it didn’t need to raise again.

Not quite famous last words. He did add a caveat in January that the company might still take more money and, indeed, as is often the case with startups that start to really show promise, interest was inbound.

“When you really need money, nobody has it for you, but when you don’t need it you get offers,” the Hong Kong-based American exec joked.

Lead investor ShunWei Capital, a growth stage fund headed by Xiaomi CEO Lei Jun, came knocking, and “several” existing backers including Xiang He Capital and MindWorks Ventures doubled down and joined the round. Larson said the financing was two-times over-subscribed, which he again attributes to solid financials giving investors confidence.

As for the valuation, he said it was just shy of the billion-dollar mark when talks first began a few months ago but, where discussions to start now, it would be at over $1 billion. In other words, becoming a unicorn or reaching this highly coveted valuation wasn’t a target.

“We didn’t want it to become a distraction,” Larson said.

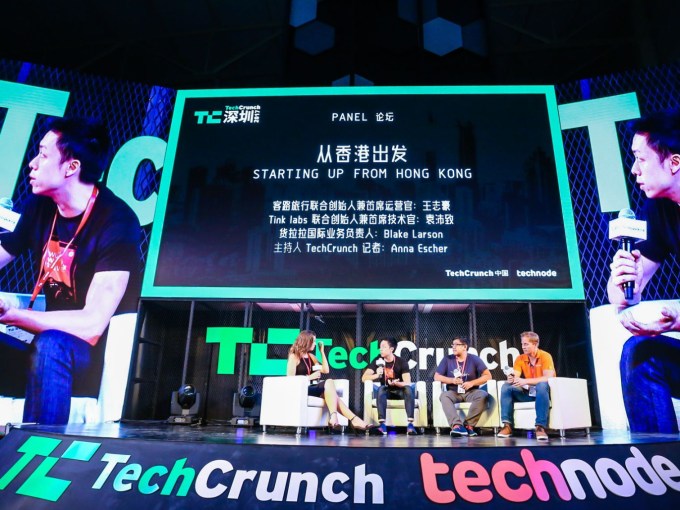

Larson [seated far right] was a speaker at the inaugural TechCrunch China event in Shenzhen this summer

On to more tangible topics, Lalamove plans to spent the capital continuing its growth. Larson said that headcount in Hong Kong, its international HQ, is set to double to 200 staff. The Chinese business will “at least” match that growth if not exceed it, he said, in order to execute on an ambitious plan to expand total reach from 110 cities to 200-250.

Beyond reaching more parts of China, the plan is to go deeper in existing markets — which means move into places like Malaysia and Indonesia in Southeast Asia — rather than head to new places such as India, East Asia or beyond Asia itself. That’s contrary to GoGoVan, which said in September that it plans to raise upwards of $200 million to expand to new continents.

Larson said Lalamove takes inspiration from companies like Grab and GoJek which have gone beyond capital cities in markets like Southeast Asia to service tens of cities in countries like Indonesia, Vietnam and Thailand, to name but three examples. He added that it would take a major strategic partnership or opportunity to expands to parts of the world like Africa, Latin America, etc.

For its growth beyond China, Lalamove is counting on the fact that Southeast Asia, which Larson said already “competes with Chinese cities based on order numbers,” will scale and raise its revenue for the business.

The Lalamove head of international had previously discussed the likelihood of an IPO, potentially in Hong Kong, before 2020. This funding doesn’t change that plan, he explained, but he played it down as something that it is some way in the distance.

“[An IPO] is totally plausible,” he said. “We’re making sure we are IPO-ready as a company [but] we don’t have any impetus to do it immediately or at any fixed time. We won’t commit to anything but definitely see it as a viable option.”