Shopping and comparison engine Decide.com, which offers suggestions as to not just what to buy but also when, is announcing today that it has raised $8 million in Series C funding, in a round led by Vulcan Capital. Also participating were existing investors, Maveron and Madrona Venture Group.

As a part of the new funding, Steve Hall from Vulcan Capital is joining Decide.com’s board. The company also recently added another board member as well: Dawn Lepore, former CEO of Drugstore.com.

With the additional financing, Decide.com has raised $17 million in total outside funding to date.

The company first emerged back in June 2011, after operating for two years in stealth, while raising $8.5 million from Maveron, Madrona, and other angel investors.

Unlike other shopping search or comparison sites, what made Decide.com unique was its proprietary technology for tracking when an item’s price has dropped to the point that it’s worth buying. The technology is similar to what the founding team (Oren Etzioni, Mike Fridgen) had done with Farecast, the airline ticket price predictions engine later acquired by Microsoft for $115 million. As with Farecast, Decide.com’s algorithms accounted for a number of signals – including product release cycles, historical trends, company announcements, news and rumors published by the media, and more – in order to make its price predictions.

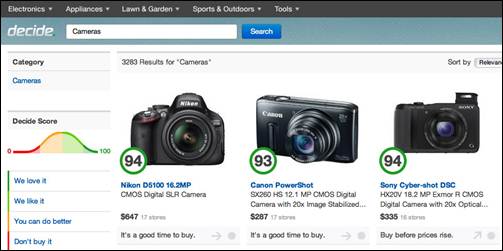

Decide.com initially began by targeting consumer electronics, but later expanded into other product categories. Today the company covers 150 product categories across Electronics, Appliances, and Home & Garden. CEO Mike Fridgen says that the plan is to increase product coverage by 10 times in the weeks ahead, including moves into Baby & Kids, Jewelry, and Toys.

In addition to its predictions, Decide.com also added price guarantees for select items, as a way for the company to stand behind its predictive algorithms’ accuracy – if the price drops, Decide pays consumers. When this service launched in April of last year, only a handful of price guarantees were offered, but Fridgen says this has now been scaled to “hundreds of thousands of products daily.”

The service also expanded further into the “what to buy” part of the equation last summer, to provide product ratings based on millions of user and expert reviews using technology that normalizes across sources and removes bias from reviews.

At present, Decide.com’s database is filled with 230 terabytes of data, including 25 billion price predictions. Though Decide.com is more useful for doing serious research from the desktop, its complementary mobile apps have been downloaded over 250,000 times.

In October, the company said it had provided over 10 million users with “when to buy” predictions since its public debut, which it calculated to be around $127 million in savings. Today, that number has grown to $200 million.

The company isn’t discussing revenue, but Fridgen would say that, thanks to the launch of its subscription deals service last fall ($5/month for the “when to buy” recommendations), it has beat its internal forecast for paid members for Q4 2012.

With the additional funding, the plan is to grow the current team of 30 by 10 over the course of the year, and expand further into data mining and mobile in particular, on the product side.