Last quarter, based on funding and M&A data we collect in CrunchBase, we signaled that we were cautiously optimistic about the rebound of the tech sector. Q2 trends were no worse than Q1 09: venture financings were up 20% and mergers & acquisitions held steady (excluding Oracle’s acquisition of Sun Microsystems) in comparison to Q1.

With another quarter of data under our belts, we’re feeling even better about the health of technology startups. The number of new startups, venture fundings and M&A are all on the rise. In addition to decent stats, there are lots of new tech products launching across diverse categories, coming from companies both great and small. The Layoff Tracker and Deadpool have quieted down in our sector. In short, we’re feeling like there’s a more rational and focused market for startups and tech.

Strategic M&A Is Back: 3x Q2 Levels

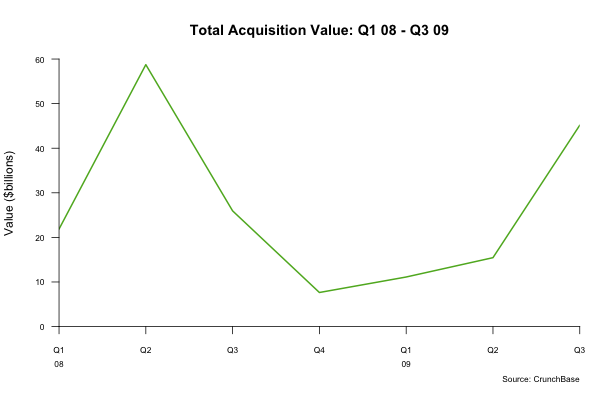

One of the strongest signals of the quarter was the resumption of activity in mergers and acquisitions. The acquisition market really rebounded in Q3 09 to over $45 billion from 231 deals, 3x greater than Q2’s $15 billion. We haven’t seen M&A activity at this level since Q2 08, which recorded 275 deals totaling $59 billion.

Why? Large internet and media companies have faced significant R&D budget cuts in the last year, but they recognize that they need to grow to remain competitive. The weakness in the overall economy and the pullback in venture investing dragged down exit valuations. At more rational prices, large companies see acquisitions as a good use of cash. And the target acquisitions have slashed their own cost structures over the last year and proven they can grow through the downturn, making them even more attractive.

Most encouraging, acquirers are adding strategically to their businesses (Amazon-Zappos, Facebook-Friendfeed, Google-On2, Yahoo!-Xoopit, VMWare-Springsource, RIM-Torch Mobile, Intuit-Mint, etc.) Some acquirers are returning to the market with multiple strategic deals (Adobe, EMC, IBM, Thomson Reuters, Yahoo!, Google, etc.) Deal making was well distributed across business segments (consumer web, retail, mobile, advertising, enterprise, biotech, cleantech)

Deal-making was highly targeted during the quarter. For example, there wasn’t a big rumor mill about deals being shopped to multiple target acquirers. Instead, it appears that many individual deals came together for the right strategic reasons at rational prices and were executed promptly. In many cases, leading acquirers appear to be making preemptive moves for attractive assets, so they don’t risk competitors taking the deals or paying up as valuations rise in the future.

Q3 Venture Financing Is Up 17.5%

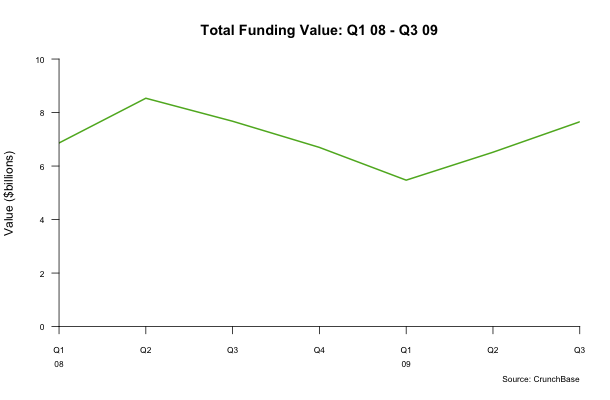

Venture investments increased 17.5% to $7.7 billion in Q3 09, from $6.5 billion in Q2. Q3 09 data is on par with the numbers from Q3 08, with 645 deals. The most recent peak period was Q2 08, which had 859 deals totaling $8.5 billion. The most recent trough was Q1 09, which had 609 deals totaling $5.5 billion.

Along with the increase in venture financing, the quantity of deals financed was up 11.4% quarter-to-quarter. The number of financings is also on par with the number of deals from a year ago.

Q3 New StartUps Up 25%

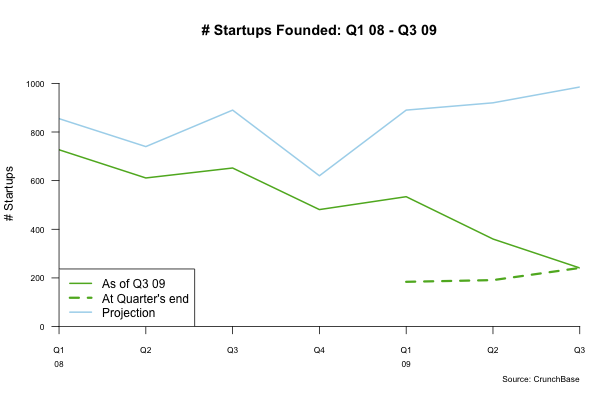

CrunchBase estimates that 985 startups were founded in Q3 09, up 25% from Q2. This is based on 241 actual records submitted for Q3 vs 191 for Q2, and extrapolated for delays in startup self-reporting of data. We expect the rise is a bit seasonal and partly attributable to the growth of incubators and fall launch conferences, such as TechCrunch50, where large numbers of startups launch at once.

The full 40-page third-quarter TechCrunch Trends report (including 30 interactive excel exhibits and 59 PDF graphics) is available for $295 as a download here.

This quarter, we added a leaderboard of the 25 most active venture capital firms for Q3, including deal breakouts by round and business sector. If you’re looking for funding, the tables in this report might help you narrow your search.

Trends Table of Contents here.

Data Pack Excel Exhibit List here.

Trends Report Graphics List here.

BUY the Q3 2009 TechCrunch Trends report with Data & Graphics Pack

$295

BUY the Q3 2009 TechCrunch Trends Data & Graphics Pack Only

$149

BUY the Annual Subscription Bundle (2008 Year In Review, plus the Q1-3 2009 Reports)

$595

Of course, you’re also welcome to grab the data free of charge through our CrunchBase open API. CrunchBase is the largest, free directory of statistical information about startups and technology businesses. We track over 24,500 companies (including 8,700 financings and 2,300 acquisitions), 40,400 people and 3,200 financial organizations.

Check out TechCrunch Trends, our newest TechCrunch-family blog, covering, yup, the latest technology trends sourced through CrunchBase. Daniel Levine and other TechCrunch staff will be adding cool new trends there on a regular basis.