As crowdfunding sites like Tilt and GoFundMe and lending site Funding Circle raise large rounds to take their businesses to the next level, a startup that sits in the same area of web-based fundraising is trying a new approach. CircleUp, a crowdfunding platform for consumer brands to raise money from accredited investors, has closed a $22 million fund of its own to back a range of brands on the platform.

The Consumer Growth Fund, as it is called, will match investments made on its platform by others — not take the lead on funding itself, in order to avoid conflict with other investors.

The size of the fund nearly matches the amount CircleUp has raised for its own business. To date the company has picked up over $23 million from investors that include Canaan Partners, Google Ventures, Union Square Ventures and Maveron, among others.

While companies like Kickstarter have been known to make occasional investments in startups that are raising money on their platforms, CircleUp’s COO and co-founder Rory Eakin says this $22 million fund is a first — no other crowdfunding marketplace has raised a fund to invest in deals on its own platform before.

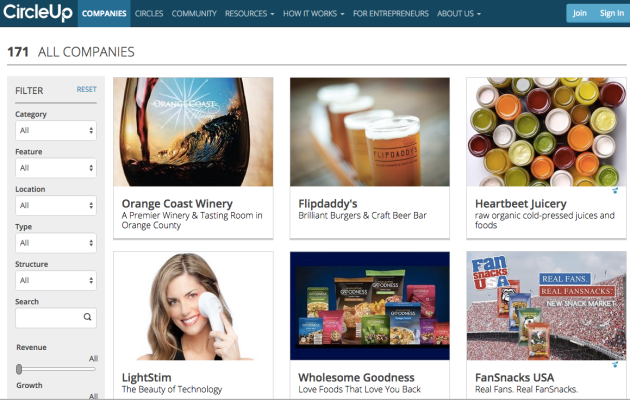

Unlike AngelList, which focuses on tech startups, or Kickstarter or Indiegogo with their mix mainly of hardware and creative projects, CircleUp is used primarily by businesses that are not tech in their focus but are using advances in technology (including CircleUp’s fundraising platform) to grow.

CircleUp taps into a wider trend we’re seeing in the U.S. and other markets. The number of smaller, new brands hitting the market has been blowing up in recent years — propelled by a wave of consumer sentiment away from mass market products and towards more local, organic and less common alternatives. CircleUp estimates that large packaged-goods companies have lost around $4 billion in the U.S. alone in the last year to smaller producers.

Among typical examples and funding sizes on the platform, Bhakti Chai raised $850,000 on CircleUp; and sportswear brand Hylete raised $1.4 million.

Up to now, CircleUp has focused on individual investors backing specific businesses, either on their own or through “Circles,” diversified investment funds introduced on the platform last year that are led by individual investors or organised around a specific theme. These are rolling investment vehicles that appear to work similar to AngelList syndicates.

CircleUp’s existing business has already seen some traction, with 100 businesses collectively raising over $100 million on the platform since 2012, and more individual investments in the last month than in the 15 months before that. (CircleUp is selective about who it permits to raise on its platform, vetting the companies itself before giving a green light.)

On top of funding, it also has built a network of relationships with larger strategic businesses like General Mills, J&J and eBay, which the smaller companies can tap with questions.

The average company has grown 90 percent per year after raising funds, but so far there have been no exits through sales or other liquidity events.

Eakin says that one reason why CircleUp decided to widen its remit to raising a fund is because it had been approached by investors who wanted to get involved in backing businesses on the platform but didn’t have the scope to pursue individual investments themselves.

The fund, which is managed by Jayson Yuan, has about 50 LPs — including consumer product execs like the CEO of Annie’s, John Foraker; former vice chairman of Walmart, Eduardo Castro-Wright; finance professionals like the ex-CEO of the NYSE, Duncan Niederauer; and many family offices.

“These investors can now access an asset class they’ve never reached, without needing to pick and choose the companies themselves,” he says. He adds that the fund was originally intended to be $20 million but was oversubscribed.

Eakin believes that the Growth Fund marks a seminal shift: Crowdfunding is often synonymous with small investors, but the fund points to how it can be appropriated differently, as a “robust online equity marketplace with various products and services for different types of investors.”

Indeed, what’s interesting to consider is that this model could potentially develop as a vehicle for future funding on the site.

Eakin says the company has been approached by several parties already interested in raising another fund to invest across businesses listed on CircleUp. “We are exploring options with more than one right now,” he adds. “Ultimately, our goal is to create a vibrant private capital market that helps more entrepreneurs thrive by giving them the resources they need to grow. Funds managed by experienced consumer and retail investors efficiently managed through the platform fits into that vision in the long-run.”

CircleUp charges a commission of 5 percent to companies that raise capital on its platform, with no other fees. The fund will be run somewhat differently. It will charge the investors and will take both management and performance fees. The terms of these are confidential but Eakin says that they are between two percent and 20 percent.