In case you thought paying $7 to $10 to trade a stock in the US was bad, it costs $65 in Australia. So now that its zero-fee stock trading app is thriving stateside with hundreds of thousands of users, Robinhood is planning to go international, starting in Australia. A $50 million Series B cash infusion from NEA will fuel that expansion, as well as hiring and development of Robinhood’s first monetization feature.

“Bringing the largest VC firm in history into the round is very confidence-inspiring for customers”, co-founder Vlad Tenev tells me. With 25% being first time traders, Robinhood’s users have transacted over $500 million on the app to save $12 million in fees to date.

Stock Trades For All

Robinhood is swiftly fulfilling its mission to steal commission charges from online brokerages for the rich, and give access to the stock market to the poor. The company was founded in 2013 by Stanford grads Tenev and Baiju Bhatt [Disclosure: Tenev and Bhatt are friends of mine from college] after they’d tried their luck building algorithmic trading and investment bank software startups.

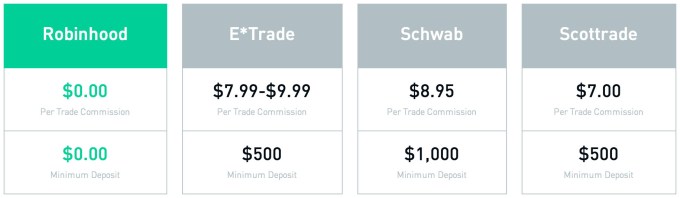

Together, they developed the Robinhood iOS app where you can track stock performance and trade with no commission, rather than paying $7 to $10 to online brokerages like E*Trade or Scottrade. Those fees aren’t hard to swallow for rich people investing tens or hundreds of thousands of dollars. But they make it tough to win at the stock market because if you’re only investing small amounts, the cost might be more than your upswing. Removing the fees removes the barriers to trading for younger, poorer people who might not have traded stocks before.

Robinhood raised a $3 million seed from Index Ventures and Andreessen Horowitz in late 2013. Once it’d received clearance from the SEC and locked down security, Robinhood opened a waitlist in February 2014, and by September when it raised a $13 million Series A led by Index, it had a half million people wanting in. The app began rolling out in beta in December, launched publicly in March, and already has an Apple Watch interface.

Here’s a demo of the Robinhood app:

Raising Money To Move Money

Now Robinhood is looking overseas thanks to the $50 million round led by NEA and joined by Vaizra Investments plus existing investors Index Ventures, Social Leverage, & Ribbit Capital. The round brings Robinhood’s total funding to date to $66 million as NEA’s Kittu Kolluri joins the Board alongside Index’s Jan Hammer, plus founders Bhatt and Tenev. That much cash in the bank assures users that Robinhood won’t disappear.

The money will help Robinhood grow its team of 30 engineers and designers, release an Android version, and expand internationally. Tenev tells me “At a high level, our mission has always been to make awesome investing services universally accessible. Internationally it’s much worse”, due to even higher fees.

So today Robinhood opens waitlist signups for Australian citizens, choosing the country for its high interest, English-speaking population, and relatively simple regulatory framework. Once admitted to the app, Australians will be able to trade U.S. stocks and ETFs for free, rather than paying the $65 that’s customary in the country.

Canada and the UK are two other places showing the strongest demand for Robinhood, and Tenev tells me the company plans to go country by country to roll out globally. Tenev relays that eventually “we’ll also investigate integrating with local market centers and banks” so that users could trade on their nation’s own stock markets.

Software Is Eating Brick-And-Mortar

Unlike old school brick-and-mortar competitors, Robinhood can rapidly scale abroad since it doesn’t have to open physical stores. It’s those costly establishments that force E*Trade and Scottrade to charge so much in fees.

Instead, Robinhood plans to earn money thanks to the volume of trades on its app, and some bonus features for serious investors. It’s currently testing the ability to trade on margin, so users can buy stocks with money from those they just sold but that won’t clear into their account for a few days. Tenev says Robinhood is charging a 3.5% fee to trade on margin in a private beta of the feature, but that rate could change when margin trading rolls out to everyone.

Robinhood founders Baiju Bhatt (left) and Vlad Tenev (right)

Robinhood’s rapid rise to $66 million in funding in under two years underscores the potential for consumer software to demolish old brick-and-mortar businesses. Rather than spending money on property, utilities, and staff for retail locations, a few mobile engineers can offer the same product for much cheaper. Viral traffic instead of Super Bowl commercials. Premium features for power users instead of taxing everyone.

If I was invested in the old online stock trading companies, I’d call my broker right now and tell him to sell, because people aren’t going to pay to place trades anymore. There’s an app for that.