On the heels of Farfetch raising $86 million last month, another fashion commerce startup out of London has picked up a significant round of funding. Lyst, a site that lets people shop across 11,500 different online stores using a single check-out, has picked up $40 million in a Series C round of funding.

Investors in this round, which brings the total raised by Lyst to $60 million since being founded in 2011, include strategic backers Group Arnault (the controlling shareholder of LVMH), as well as previous investors Accel, Balderton, 14W and DFJ Esprit, and an unnamed New York hedge fund.

While Farfetch’s Series E in March vaulted it into the so-called “unicorn” club with a valuation of $1 billion, Lyst cares little for disclosing where it stands on this front.

“We never disclose valuation,” founder and CEO Chris Morton says. “I don’t think it’s healthy for my team to obsess over. I recognise the industry is all about chasing unicorn status these days but we don’t want to be part of that conversation.”

All the same, the company has seen a big boost in its business in the last year. Total sales to date stand at $150 million compared to $40 million 12 months ago. Lyst also claims in that time it has generated “hundreds of millions” in sales for the stores and designers that sell on the site, with its international customer base (150+ countries) on average spending $400 per order.

There are a number of “aggregating” sites online that effectively let users browse styles from different designers and different stores — Farfetch, Shoptiques, and Pinterest being a few. Lyst is different from these in a couple of different ways.

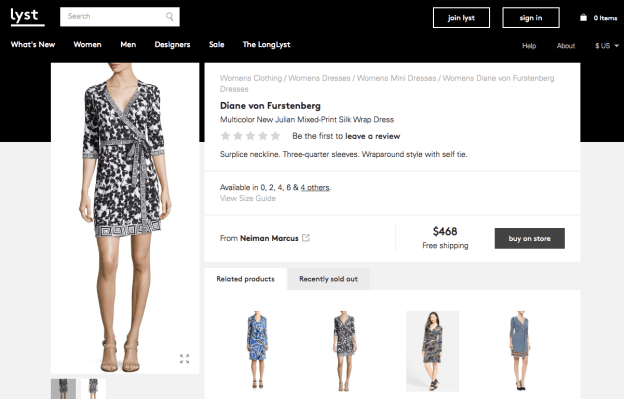

First is the sheer size of the pool of online stores and designers that it aggregates — currently over 11,500, with brands including Acne, Alexander McQueen, Barney’s, Burberry, J.Crew, Topshop and Valentino among them.

Second is the singular focus on fashion in its aggregation push, a focus that potentially will attract much more active and less casual browsers.

Third is the shopping experience itself: Lyst uses a lot of algorithms to personalise the experience for visitors, suggesting new items to you based on previous purchases, with a real-time ability to show you what is actually in stock and where.

Lastly, the single shopping cart helps make the whole experience particularly seamless. Morton claims that the universal cart increases sales conversions by as much as five-fold.

What Lyst has in common with other aggregation sites is that it’s solving one of the big pain points in online shopping: for people looking for a specific item, it can be very time consuming to have to visit different shops’ sites looking for the exact size and color you may want, and to compare prices.

While Lyst is currently restricting its scope to clothes and other fashion items, there is actually a case to be made for extending the technology to cover other kinds of items, too, such as furniture from specific brands that might be sold in more than one place.

While Lyst has in the past started to dip its toes into physical commerce (working with PayPal on its Beacon rollout for example to let in-store browsers buy items online if the stock in one place is not available) it looks like right now the focus will be on global expansion and adding more commerce sources to add to its universal shopping cart.

That is smart, considering that Lyst makes its revenues on affiliate and referral percentages, ultimately the business model is one of economies of scale.