The long-running question mark over Groupon’s ownership of Ticket Monster has been resolved. Today the company announced that it is selling a controlling stake in the Korean online shopping platform to a consortium that includes Anchor Equity Partners, KKR and TMON management. The group is taking a 46% of the company for $360 million, valuing Ticket Monster at $782 million, assuming a full vesting of management’s 13% stake. Subject to the closing of the TMON stake, Groupon will also initiate a $300 million share repurchase program.

Groupon says it will continue to retain a fully diluted 41% minority stake in the company that it originally announced it would acquire in November 2013 from LivingSocial for $260 million (with the transaction closing in January 2014). The transaction is expected to close in Q2 of this year, the company says.

A filing with the SEC also notes that the transaction will need approval from the Korean Fair Trade Commission (the “KFTC”). If the deal is not completed by July 31, 2015, it could be subject to a 60-day extension if KFTC approval has not been received.

Groupon says the gain on the sale is expected to be “between $195 million and $205 million on a pre-tax basis and will be recorded at the close of the transaction.” But apart from that, there seems to be wider strategic logic behind the sale.

For Groupon, the sale of the stake is part of its plan to focus on the parts of its business that have been integrated on to a common platform, which today largely means its U.S. and European businesses, thus winding down an operational role in businesses that are too far flung, even will it continues to retain an investment interest.

“As the Korean market developed, it became obvious that TMON would benefit from additional resources and local expertise in its drive to be the leading social commerce company in Korea,” said Groupon CEO Eric Lefkofsky in a statement. “We look forward to watching TMON’s success as a continued large shareholder in the company.” Indeed, the Korean business had been operating at a loss — in 2014, an adjusted EBITDA loss of $8.9 million

From what we have heard, Groupon is also taking a similar approach in India with its operations there, with sources telling us in March that Groupon sold a $20 million stake in the business, which will continue to be operated and grown by current management. There are also reports that Groupon may sell its Breadcrumb point-of-sale business, in what would be a further reigning in of the bigger e-commerce business.

The management’s 13% is a consideration that will vest over time, Groupon tells me, and is based on performance.

“We are extremely excited to work with such world-class partners. KKR and Anchor not only bring global experience in the retail and technology sectors, but they are also experienced local partners with strong business expertise in South Korea,” said Ticket Monster CEO Dan Shin, who is part of the management team in the consortium. “We are thrilled to be working with distinguished partners who share our vision for growth and offer significant pools of capital in support of TMON’s initiatives. With their help and investment, this company will have greater opportunities to attract new customers and expand into new businesses.”

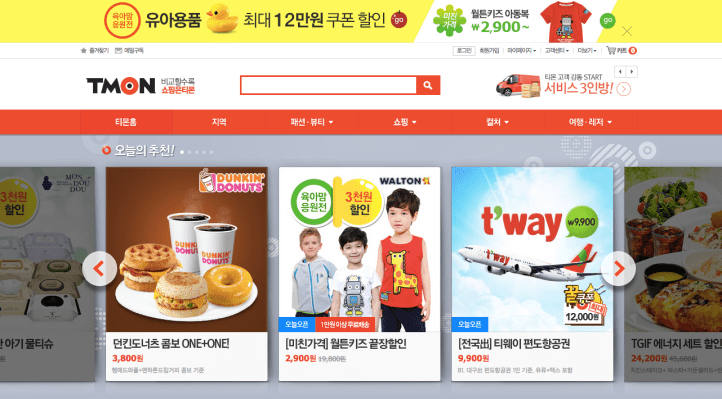

Although Ticket Monster, as its name implies, focused on events when it first launched, today it is a multi-purpose e-commerce platform selling goods, travel services and more. Its mainstay is a mobile business, with its app downloaded more than 9 million times. Some 70% of its revenues come from mobile. It posted $1.3 billion of gross billings in 2014, with revenues just shy of $150 million.

With the sale, Groupon is also adjusting its Q1 and full-year earnings, which are due to be announced on May 5.

Groupon says that Ticket Monster will be treated as a discontinued operation for purposes of financial reporting, effective in the first quarter of 2015.

Because of this and changes in foreign exchange rates, Groupon says it expects Q1 revenues to be between $720 million and $770 million, compared to a previous range of $790 million – $840 million. Groupon says it expects adjusted EBITDA between $58 million and $78 million (old range: $45m-$65m), and non-GAAP earnings per share (from continuing operations) between $0.01 and $0.03 (old range: $0.00-$0.02).

For the full year, Groupon continues to expect adjusted EBITDA of greater than $315 million.

The share repurchase program is on top of the $300 million share repurchase program Groupon is already working through, which has $83 million authorized repurchases remaining as of March 31.