Box has a plan to keep growing and it involves building vertical pillars on top of the base Box platform and APIs. To that end, Box announced a new financial services vertical today with a set of tools and technologies geared specifically to firms in the financial services industry.

The company first revealed this vertical approach last Fall at the BoxWorks user conference, dubbing it Box for Industries and announcing three verticals at that time: retail, healthcare and media and entertainment. Financial Services is the latest offering.

CEO Aaron Levie said that this is a project Box has been working toward for some time. “Financial Services companies are at the center of the tension between productivity and innovation and security and compliance,” he said.

Banks and other large financial services entities like insurance companies are under the same pressure to transform and take advantage of cloud and mobile technologies as other industries, but they face a much more difficult challenge because of the intense regulatory pressure they are under with stiff penalties if they fail to stay compliant, Levie explained.

What’s more, financial services, perhaps more than other verticals, require an intense amount of collaboration inside and outside the organization involving substantial amounts of content and intricate regulatory rules around sharing.

Levie believes this is why financial services have been slow to adopt cloud technologies. Box obviously has the content sharing and collaboration pieces down pat, but it was missing some key components that financial services organizations were going to demand before they go with a cloud solution like Box. It recently developed several pieces that fill in these holes.

Perhaps the key component is the Box Enterprise Key Management product it introduced rather quietly earlier this month. This enables customers to encrypt their content and more importantly, control the keys. That puts control of the content firmly in the hands of customers. If law enforcement or government regulators want to see some content as part of an investigation, they can’t force Box as the provider to hand it over because it doesn’t control access, the customer does.

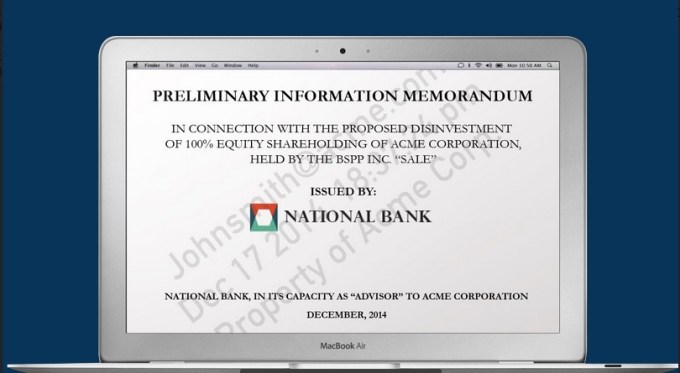

Box also announced some other key pieces today that will make it more attractive to financial services: watermarking and retention management. The former enables firms to add an inline watermark to a range of documents, which helps limit sharing widely by adding a watermark such as ‘Property of XYZ Bank’ built into each page.

The retention management feature, which is being released in Beta, is a key part of traditional content management, and especially important for a highly regulated industry like financial services. It allows companies to define what content to keep and how long to keep to it. This type of granular control over a document lifecycle is essential to an industry like financial services and will help them stay compliant with federal FINRA rules, Levie explained.

Box also announced several partners to help with the implementation including Bloomberg Vault, Capgemini, and Silanis. Each of these partners offers services that can plug into the Box platform or, in the case of Capgemini, help customers plug Box into existing systems inside a financial services company.

“Those relationships are important. Box doesn’t work alone implementing [our product]. We exist within an ecosystem of other players. If you want to integrate into your ERP or equity research system, providers [like Capgemini] will dramatically improve our ability to integrate into these existing systems,” he said.

Levie says that by building the base platform as it has, it allows them to work with customers and partners and address the requirements of a specific industry without having to build industry-specific pieces, or at the very least build pieces that address the needs of a variety of industries. For example, a feature like watermarking will also appeal to legal and entertainment companies.

“When we can meet the needs of a specific industry, that changes the conversation. Similarly after this announcement, this kind of technology allows us to have a differentiated conversation with private equity firms and banks about meeting the needs of the business,” Levie said.

What Box is doing around content, encryption and collaboration is not unlike what Symphony, a startup being funded by a consortium of financial services firms is trying to do. Levie said he’s had conversations with Symphony CEO David Gurle. “We have been chatting with them. Hugely complimentary vision,” Levie said.

Ironically, Box’s approach is not unlike IBM’s. By packaging a combination of products, services, ISVs and consultants, Box is acknowledging that the deeper it goes into the enterprise, the more difficult the challenges become. What remains unclear is if Wall Street will embrace a cloud product like Box, or if it will look to more traditional enterprise vendors for solutions or simply build it themselves. There could ultimately be room for all three approaches, but this is the difficulty Box faces as it builds these vertical tool sets.

Watermarking picture courtesy of Box.