Deezer, the music streaming service based in France that competes with Spotify, is making another move to expand its customer base in the U.S.: it has acquired the assets of Muve music from Cricket, the wireless carrier acquired by AT&T in 2014 for $1.2 billion, and it will now partner with AT&T to sell Deezer music services to Cricket subscribers.

Terms of the deal are not being disclosed, but in an interview, Tyler Goldman, Deezer’s North America CEO, said that it was a “substantial” sum. We understand that it is under $100 million.

This is Deezer’s second acquisition in the U.S. after it acquired podcasting and talk radio network Stitcher in October 2014, and its first deal with a carrier in the country.

The Muve deal is not a straightforward sale: While Deezer will be migrating Muve user data, specifically playlists and songs, the assets that Deezer is acquiring do not automatically include the Muve customer base, which was last estimated to be over 2 million users, all of whom paid for their service as part of their Cricket tariffs.

Instead, Deezer has made an agreement with AT&T to offer Cricket LTE customers 45 free days of Deezer before giving them the option to switch to Deezer subscriptions, which will be billed at $6/month.

Deezer also notes that existing Muve customers can receive up to four months of Cricket for Deezer: All Muve users are eligible for 2 months and customers who also migrate to the new Cricket GSM-based network can receive an additional trial period of up to two months. After the free trial those customers will also be automatically billed just $6/month unless cancelled.

At least initially, this will work out to be less expensive than the Muve bundle, Goldman tells me. Muve was provided at a $45/month all-in package that also included talk minutes, text and web access. Now, those music customers will pay a separate monthly rate of around $35 for their phone services, getting the music, if they choose it, for $6/month on top of that.

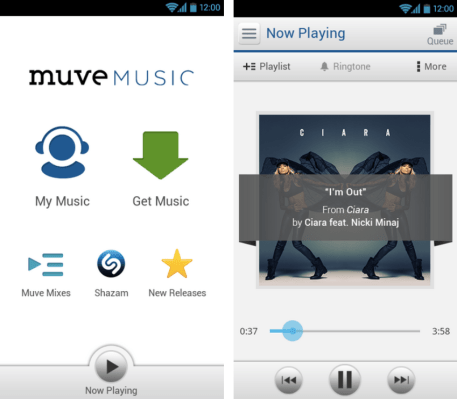

Pricing is not the only difference. Muve worked on a downloaded model, which was unlimited in terms of how much music you could take, but limited in terms of how you could play it — it lived and was confined to only being played via your phone. Deezer, on the other hand, is a streaming service and works across a range of devices including Bose and Sonos audio equipment.

Muve was Android-only, while this opens up the option of the music service being made available to Cricket users of iPhone and Windows Phone devices (if they’re not already opting for another app altogether).

Muve a hit with Cricket’s demographic, but not with AT&T

Muve Music was launched by Cricket in 2011, and it had grown to be one of the more successful premium music offerings, with its 2 million paying users on par with estimates for Spotify’s paid subscribers in the U.S. (Spotify itself has never broken this out. In November 2014 it noted 50 million users overall, 12.5 million paying.)

But in May, after the AT&T acquisition of Cricket’s owner Leap Wireless was completed, Cricket said that it was exploring other music options for its customers. We understand that part of the reason for this was because the carrier didn’t have the appetite to invest in upgrading and maintaining an owned service, and the company seems to confirm as much as well:

“Customers are demanding more compelling services from both their music and wireless providers,” said Jennifer Van Buskirk, president of Cricket Wireless, in a statement. “This agreement illustrates our ongoing commitment to deliver the best value in prepaid wireless and satisfy our customers’ growing need for an unparalleled premium music experience.”

Some speculated that AT&T would expand its existing Beats resale deal to Cricket, but clearly an asset sale to Deezer, which also includes IP and a few product people and an assisted transition to a new product, presented a more useful alternative.

“This is the start of a relationship with AT&T,” Goldman told me.

For Deezer, which has 16 million users total, 6 million of which pay, this will give the company an opportunity to kickstart its U.S. music business.

It only entered the U.S. in September 2014, years after Spotify, Rdio and others have established their brands and footholds in the market. Tying up with a carrier in an exclusive deal, and selling its service to a set of customers that have already proven to be interested in paying for digital music, will help Deezer avoid starting from scratch.

On the other hand, it remains to be seen whether Cricket’s consumers are as interested in paying for a separate music service as they were in a simple service bundle.

One of the reasons that Cricket became so successful was because of that frictionless, all-in, single pricing structure. But now that AT&T has unbundled the music service from the rest of the phone, might users just choose to pay for another service altogether, such as Spotify or Rdio?

Interestingly, pricing may not have been the only reason for Muve’s traction. Another is that Cricket has a strong Latino user base, and the music service was customised to them, both in terms of the app itself (which had a Spanish language option) and the content. This is an area where Goldman says Deezer is well positioned to actually deliver potentially better results than Muve did.

“Muve has a large Latino customer base, and Deezer is large in Central and South America, and we will leverage some of that catalogue in the U.S. now,” he says. Altogether, Deezer is in 180 markets and offers users 35 million songs and 30,000 radio stations.