An unexpected consequence of our love of apps is that now there’s just too damn many of them. The app stores are overcrowded, leaving developers desperate for a way to get their games and utilities discovered. That is why the app install ad has become the lifeblood of the mobile platform business.

Big brands aren’t the only ones to suck up to anymore. No one buys a car or Coca-Cola on their phone, at least not yet, so proving the return on investment of mobile ads to these businesses is tough. There is one thing people will instantly plop down a few bucks for on the small screen, though: Apps.

Lured by billions in app install ad spend per quarter and hoping to grow that pie, Facebook, Twitter, and Google have stepped up. But to win those dollars, they have to buddy up to developers.

Facebook and Twitter really have Apple and Google to thank. The critical need for app install ads stems from their negligence around app discovery. The App Store and Google Play provide search engines and Top 10 charts, but little in the way of personalized, social-proofed browsing or discovery. Basically the only way to get a hit app is to score enough downloads to break into the charts, and let the added visibility keep you there. That’s a struggle unless your app is inherently viral, kooky, or great enough to inspire word of mouth, or you win the favor of the app store editors who choose who to feature.

But then there were app install ads.

Rise Of The Install Ad

Ad network app install banner ad on Songza begs people to download a mobile game

Before the big platforms redefined their roadmaps to pry open developers’ wallets, a slew of independent ad networks ruled the space.

AdMob, InMobi, Jumptap and Millennial Media flourished in the early mobile era. These let developers buy ads to promote their apps on mobile websites and other apps, or host them to earn money. The little pop-up banners and interstitials hawking games and shopping portals were inarguably annoying, but they worked to a degree even if they lacked advanced targeting data. Without a sales force or much know-how, developers could monetize their apps by selling ad space or buy growth for their products.

Google saw the potential of mobile advertising and bought the big dog AdMob in 2009 fro $750 million, while Apple acquired Quattro Wireless and launched its own ad network iAd in 2010. Both ran app install ads, but those weren’t their sole focus. It wasn’t until 2012 when the real landslide shift from desktop usage to mobile happened that Facebook wised up.

Mark Zuckerberg’s company was in a bad place. Freshly IPO’d with no revenue on mobile as its users moved there, Facebook’s share price was getting crushed. While it had owned a popular web platform for gaming where it earned a 30% tax on in-app purchases, it didn’t own one on mobile after its HTML5 mobile web platform fizzled out. All the taxes were flowing to Apple’s iOS and Google’s Android stores, even though apps were relying on Facebook’s free social login, friend finding, and sharing features.

What Facebook did have was relationships with developers, deep ad targeting data, and a steady influx of tons of mobile eyeballs.

Facebook’s mobile monetization platform strategy had been a bit far-fetched: Hook developers up with social sharing APIs, and hope users pushed their content from Facebook-connected apps back to the web or mobile News Feed to where Facebook shows ads.

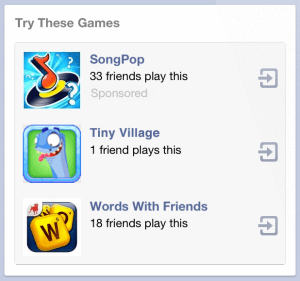

Facebook’s first app install ads were ugly and vague, but proved developers would pay it for downloads

The social network’s relationship with developers had become strained, though, after years of whiplash product and API changes. Even its garishly-named “Operation Developer Love” program to warn app makers of impending changes couldn’t shake the stigma. Viral channels opened and closed, functionality appeared and disappeared, and developers became weary of investing in developing on an unstable platform.

But app install ads let Facebook use its consistent mobile app traffic to turn things around. In August 2012, Facebook announced it would make app install ads its first ad unit not triggered by an action of a friend. By October they were rolling out, and I described Facebook’s strategy as “making a big bet on the app economy…to be the top source of discovery outside of the app stores.”

The ad units looked downright ugly compared to later versions, but early reports from advertisers were positive. Twitter had already seen developers experimenting with ads to drive app installs since at least 2012. With the formal launch of its app install Cards that could be amplified with Promoted Tweet ads in April 2013, it let developers turn a download of their app into the buzz at the global water cooler.

The battlelines were drawn. Facebook with its in-feed app install ads, Twitter’s promotable app install cards, and Google’s AdMob. Each has its own strength. Facebook knows a lot about who you are, Twitter knows what you talk about and are interested in, and Google deeply understands what you do on the Internet plus had a head start in the market. The next few years would see them turn app install ads from an ATM bolted onto the outside of their business to a full-fledged bank built on the ground-floor of their platform strategies.

Why App Install Ads Work

The web’s decline is dragging the banner ad towards its grave. On mobile, there’s no room for a shotgun approach of riddling the small screen with tiny, low-quality, poorly targeted marketing messages.

Instead, mobile ads are often shown one at a time. That means better targeting goes a long way. This has allowed platforms like Google, Facebook, and Twitter to outcompete the independent ad networks like Millenial Media by combining powerful personal data with native app install ad formats that blend into their content

While many would like to see banners ads die a painful death, app install ads are some of the only banners that can succeed on mobile. That’s because app install ads have two big advantages on mobile compared to traditional brand ads:

- Apps Are Easy To Buy – Most iOS and Android users already have their credit card connected to their operating system’s app store. Users don’t need to clumsily input their payment details anywhere. Apps provide instant gratification since there’s no delay waiting for a physical object to ship, their low price means they can bought as impulse purchases without extra research necessary, and the diversity of apps means they appeal to a very wide demographic.

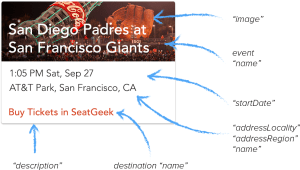

- Installs Are Easy To Track – Conversions for app install ads are straightforward to measure, compared to mobile ads promoting products bought offline. Advertisers demand to see proof of return on investment on their ads to keep spending. This is difficult for traditional brand advertisers on mobile, as it’s difficult to tell if an ad for Honda or Coke actually led to conversions. It’s possible, but even then it’s unclear how much the mobile ads contributed to the purchase decision.But through software development kits (SDKs) and mobile tracking partners, Facebook, Twitter, and Google can all clearly measure when an app install ad leads directly to an actual install. As long as these installs produce users with lifetime values higher than the ad price, they’re ROI positive and developers will keep buying them.

![]()

With the app stores just getting more cluttered, developers began pouring cash into the ad format. By the end of April 2013, I suggested app install ads could become Facebook’s “growing cash calf” and wrote that “While brand advertising was the rock of Facebook’s desktop ads business, app install ads could form the base of the mobile ad business its future depends on.”

When Facebook revealed its earnings for that quarter, it noted that developers, including 40% of the top 100 on iOS and Android, had already bought 25 million installs. The ads contributed “real revenue” to its bottom line said Mark Zuckerberg, and helped total ad revenue from mobile jumped from 23% to 30%. Meanwhile, app install ads had helped Twitter file to IPO with over 65% of ad revenue coming from mobile. By late 2013, the world had proof that app install ads were poised to become a giant business.

PlAdform Strategy

Simply selling ads would have been a missed opportunity, though. Driving installs is so important to developers that, lacking operating systems, Facebook and Twitter built their mobile platform strategies around app ads. The goal: provide high-quality services and tools to developers in order to form relationships that lead to ad buys.

Facebook + Parse

That’s why Facebook bought Parse, a mobile-backend-as-a-service that takes some of the development work out of building and hosting apps. It would form the base of Facebook’s Build-Grow-Monetize strategy.

Essentially, Facebook offers solid, affordable development tools and SDKs for managing and testing apps through Parse, or adding social login and sharing to News Feed. These also aids ad targeting by letting Facebook know who has installed an app with its SDK. Once it has its hooks in, Facebook can then coax these developers to grow by buying its app install ads.

The last part, “monetize,” was a little hazy until recently. The expectation was that thanks to Facebook’s development and growth assistance, apps could make money on their own by hosting ads, virtual goods, or ecommerce. But Facebook wasn’t getting a cut of that until April 2014 when it launched the Facebook Audience Network, an ad network that lets advertisers target ads they buy in third-party apps be targeted using Facebook’s extensive personal data treasure trove. Suddenly, Facebook could pay developers by getting them to host its ads…which very well might be app install ads from other developers.

It’s a feedback loop where Facebook helps apps get built until they pay it to grow until they’re big enough that it pays them to help others grow. And it’s a lucrative one. Facebook earned $1.95 billion in Q3 2014 on mobile ads alone, and is suspected that a sizable chunk of that comes from app installs.

Twitter + MoPub

It knew it was the little guy in the fight, with less traffic to its own ad-serving properties than Facebook’s feed or Google’s search pages plus AdMob. It also watched Facebook IPO, only to have its share price battered due to a lack of mobile ad revenue. So in October 2013 just before its IPO, Twitter wisely ponied up $350 million in stock to acquire MoPub, a leading ad exchange that let developers get the most install bang for their buck across top ad networks with units spread across other mobile sites and apps.

To make an irresistible pitch to developers and win the hearts of Wall Street during its IPO, it needed MoPub’s reach. Twitter went on to acquire TapCommerce to boost its app re-engagement ad targeting prowess eight months later.

But it wasn’t until October 2014 that Twitter’s strategy came into focus at its Flight conference when it launched Fabric. It’s a suite of developer tools that includes Crashlytics for squashing bugs, enhanced login and tweet composer options for upping an app’s organic virality, a quick way to build login via phone number called Digits, and MoPub for making money by hosting ads.

What Twitter cunningly leaves out is the with each Fabric tool a dev uses, they get closer to Twitter and are probably more likely to buy its app install ads. And just this week, Twitter announced it would start tracking all the apps on a user’s phone to improve the targeting of its ads, and its app install ads that will get the most benefit. First off, you won’t see ads for apps you already have, and it could know to show you travel or sports app ads because those are the kinds of apps you already have.

Along with more traditional brand ads, app install ads helped Twitter bring in 75% of its ad revenue from mobile for a whopping $272 million in Q3 2014. Now that its plot to endear developers is revving up, expect app install ads to be an even bigger part of its revenues next quarter.

Google + AdMob

All the while, it appeared Google was resting on its laurels, satisfied to enjoy the gains from its prescient acquisition of AdMob. But it finally saw how hard others were chasing the market, and invested more resources. It had less reason to rush than Facebook and Twitter, as its ownership of Android gives it a steady income from taxes on in-app purchases. While they scrambled, Google calmly kept improving AdMob’s targeting and conversion tracking.

All the while, it appeared Google was resting on its laurels, satisfied to enjoy the gains from its prescient acquisition of AdMob. But it finally saw how hard others were chasing the market, and invested more resources. It had less reason to rush than Facebook and Twitter, as its ownership of Android gives it a steady income from taxes on in-app purchases. While they scrambled, Google calmly kept improving AdMob’s targeting and conversion tracking.

By April 2014, Google was ready to wrestle for the limelight, launching enhanced app install ads on AdMob that leverage the giant’s data on what apps people download, use, and spend money in. Beyond installs, it would join Facebook and Twitter in offering app re-engagement ads built on deeplinks that get users back into apps they’ve already downloaded, and straight to relevant purchase pages like HotelTonight listings for a city they just arrived in.

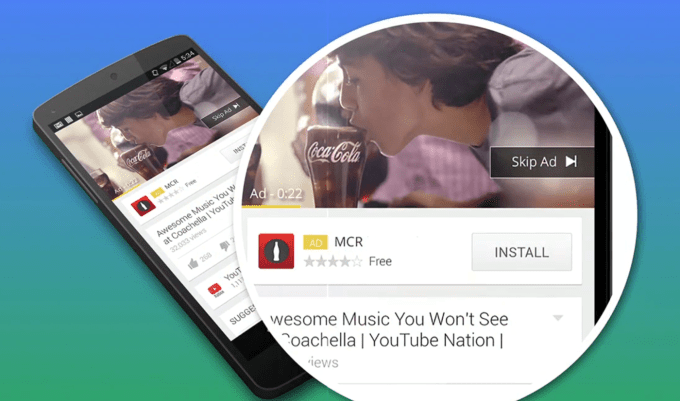

After a messy year for Google+ spent working on its login platform for third-party apps, Google finally brought its app install ads to mobile search and YouTube in August. That’s a full two years after Facebook put them in its mobile feed.

Though Google’s mobile search traffic keeps it far in first place for total mobile ad share, its piece of the pie is expected to shrink while Facebook’s grows. eMarketer believes Google will fall to 44.6% of mobile ad market share by the end of 2014 from above 50% two years ago, while it projects Facebook will grow to 20.4% from a mere 5.4% in 2012, and Twitter is expected to grow from 2.25% in 2013 to 2.64% in 2014. That’s why Google’s CFO said on its recent earnings call that “Our focus [is] on helping developers generate app downloads.”

Where’s Apple?

Beyond its iAd ad network, Apple’s largely been silent regarding the app install ad business even though it’s a huge reason it exists. Mainstream iPhone users rely on Apple’s top charts and editors’ picks to discover apps. Despite acquiring app discovery site Chomp in 2012, the experience of digging great apps out the million in the store hasn’t gotten much better.

If developers don’t have the clout or virality to get on the charts, they have to buy their way there. That’s led some to like Hunter Walk to wonder if Apple could barge into the market with app install ads on the App Store itself or elsewhere on iPhones and iPads. iOS 8 can offer location-based recommendations for apps other people nearby frequently download, such as the Starbucks app when you’re in one the cafes. It’s sensible to assume it could sell these recommendation slots.

For now, though, it seems dead-focused on its high-margin hardware business, ceding the opportunity to the other platforms.

Deciding A Winner

With the app store overpopulation problem getting worse at an accelerating pace, app install ads will only grow in importance. They could take on new forms, though.

As apps evolve to be more vivid, so might their ads. Facebook is deeply investing in video advertising with its recent acquisition of LiveRail. It could combine LiveRail’s video ad inventory across the web with its targeting and developer connections to sell video app install ads that really show how fun or useful an app can be.

Developers are also experimenting with Twitter’s Vine video sharing social network. They get Vine creators with huge followings to make sketches about their apps or name-drop them by commissioning the stars through content monetization networks like Niche [Disclosure: Niche was founded by my cousin Darren Lachtman]. Some devs then pay again to promote tweets containing the Vines that shill their apps.

Developers are also experimenting with Twitter’s Vine video sharing social network. They get Vine creators with huge followings to make sketches about their apps or name-drop them by commissioning the stars through content monetization networks like Niche [Disclosure: Niche was founded by my cousin Darren Lachtman]. Some devs then pay again to promote tweets containing the Vines that shill their apps.

Contextual home screens that replace Android’s default launcher app navigation and folders with dynamic suggestions of apps you might need at the moment could also host app install ads. Popular home screen Everything.me already sells its app recommendation slots. There are also pre-install deals with carriers and manufacturers where devs might pay upfront or a cut of future earnings to have their app come with a phone.

[Update: After app install ads, it will be the rise of the app engagement ads. Overtly promotional push notifications are banned on iOS, and they risk getting an app’s lifeline muted if annoyed users turn off push. Ads can be the only way to get someone to open an app buried in a back screen folder.

Sophisticated retargeting by adtech startups like URX and Nanigans will help developers pull dormant existing users back into apps, or trigger whales to make purchases. These ads could remind people to check out the new clothing line in a fashion app, buy access to extra game levels, or check out must-see content that could rope them back into a social network.

Sophisticated retargeting by adtech startups like URX and Nanigans will help developers pull dormant existing users back into apps, or trigger whales to make purchases. These ads could remind people to check out the new clothing line in a fashion app, buy access to extra game levels, or check out must-see content that could rope them back into a social network.

As more brands and businesses make the shift to mobile and start building userbases for their apps, partly through install ads, they’ll look to squeeze more lifetime value out of their initial investments with reengagement ads.]

Ultimately, it is the balance sheet that will decide the winner of the app ad war, though is likely to be more of an ongoing turf war than one with an uncontested conqueror. Which platform has the best targeting and ad formats that can deliver the best conversion rates at scale and can prove the highest lifetime value per user for the lowest ad prices?

If either Facebook, Twitter, or Google can supply the highest return for app ad spend, developers will come running. And not only will the victor get the spoils as developers thrust open their wallets, they’ll become the gate-keeper to success in the new app economy.