Mobile messaging is the hot topic of the year for tech. Canada-based startup Kik, which has largely flown under the radar, is making a big move to win the race in the West after announcing a $38.3 million Series C funding round and its first acquisition.

The fresh influx of capital is led by Valiant Capital Partners, and includes participation from new investors Millennium Technology Value Partners and SV Angel. Existing Kik investors Foundation Capital, RRE Ventures, Spark Capital and Union Square Ventures also put in. This round takes Kik, which claims 185 million registered users, to $70.5 million in funding to date.

Kik CEO and Co-Founder Ted Livingston told me that the round began as a strategic investment opportunity, but things changed when US-based Tango raised $280 million led by Chinese commerce giant Alibaba. The Kik CEO said the company changed its focus and brought on other investors for a full round, but it didn’t feel the need to raise as much as its rival.

“We’re making real revenue, and I’m not even sure we can spend $40 million as it is. We could have raised more to serve our ego, but it would have been a distraction that we don’t want at this point,” he explained.

That’s not quite all. Waterloo-based Kik has acquired GIF messaging app Relay. The startup, which is also based in Canada, claims its 700,000 users sent more than 10 million GIFs on its site per month. Relay for iOS and Android will close on December 15, after which the team will “focus on bringing the best parts of the Relay experience to Kik.”

As part of the undisclosed deal, Relay founders Jon McGee and Joe Rideout will take “key roles” at Kik, which will take the company to around 60 staff.

Three Key Components Of Messaging

Livingston explained that the purchase of Relay is about returning the company’s focus to the core messaging experience following its integration of an in-chat web browser.

“We see three key pillars in messaging: communication, content and commerce. We’ve been very focused on content for a long time. We are close to cracking that and need to return a big part of our attention to the chat experience. [Buying] Relay is one of those strategies,” he commented.

With Facebook Messenger preparing to introduce payments, and Snapchat adding its Snapcash product this week, Kik’s focus on payments makes sense. However, Livingston refused to be drawn on when the company will introduce its own take and what that experience might be like.

Close To Profitable

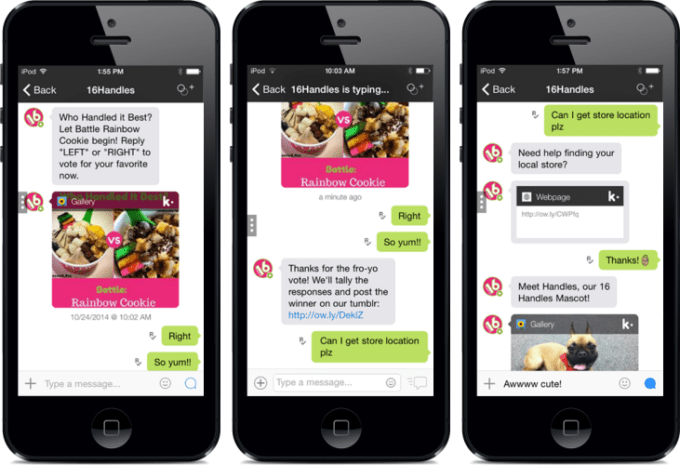

That’s probably because Kik is still ramping up its monetization efforts, after opening up its Promoted Keywords service earlier this month, enabling brands to connect with users on its platform. Livingston said the service is “going well” so far with 25 hand-picked partners signed. Kik has also been quietly monetizing Kik Points, a virtual currency-like initiative that gives users points when they complete certain tasks. Those points can then be exchanged for digital content like stickers.

Brands, content creators and app developers are paying Kik to help drive traffic and interest in their products via Points. There is no set pricing, Livingston said, with each partner charged based on the specifics of their requirements.

These two revenue streams are likely to make Kik profitable “very soon,” according to Livingston. If true, that’s quite remarkable since Kik was founded back in 2009 and it only began trying to make money this summer.

Things appear to be coming together for Kik, which claims 250,000 new users per day and counts over 60 percent of its users in the U.S.. The company claims that 40 percent of Americans aged 13-25 use its iOS and Android app — so Snapchat is logically the company it sees as its closest competitor.

“Things are really coming to a head in the U.S.. It’s Kik vs Snapchat in the race to become the WeChat of the West,” Livingston said, referencing the influential Chinese chat app, which has over 400 million active users and is hugely dominant in China, but a minority player in the U.S..

The Race For The Desktop Web Part Two

Livingston believes that many, older internet users may not see the potential of messaging right now, but the youth audience — which Kik and Snapchat both vie for — is a market that will be hugely influenced by messaging.

But what about Facebook?

“It’s like the web race being played out again,” he said. “Microsoft should have won, but it didn’t. Why was that?”

Livingston believes that Facebook’s desktop legacy is something that hinders it on mobile, even though the company has broken out Messenger into its own app.

“Facebook has a lot of baggage from the offline world. If I want to reach you I know it is Snapchat or Kik, there is no offline or doubt, it’s all online with mobile,” he said.

Messenger isn’t Facebook’s only messaging weapon, of course. Though WhatsApp has over 600 million active users, Livingston doesn’t think its platform is robust enough to compete for the U.S. youth market, and ultimately he believes that will cost it.

“Whatsapp is not designed for commerce and other multimedia. There’s much more control on Kik and Snapchat thanks to the username-based approach. There’s no danger people can find your phone number from playing games or using either app, but with WhatsApp you are bound to your number which can impact privacy,” he added.

In addition to moving into payments, increasing its efforts to lure users and brands, and fortifying its focus on the chat and content experiences, Livingston said Kik may introduce a web version of its service in future. “We want to be on all platforms at some point,” he hinted.