Editor’s Note: Mark Suster is a 2x entrepreneur and VC at Upfront Ventures. Follow his blog at BothSidesoftheTable.

“There’s something going on in L.A.”

It’s the new refrain I hear from investors and even entrepreneurs these days. I hear it right after people decide to come by for a few days to “check out what all the fuss is about.” I hear it when I visit LPs all across the country: “Yeah, I haven’t been out there for a few years but I keep hearing that something is going on there.”

So what is actually going on in L.A.? Is it true that the ecosystem has changed? Has it begun to mature or is it just better marketed than in was, say, five years ago? These are the questions I set out to answer with our master of analysis at Upfront Ventures, Glenn Poppe (who deserves the bulk of the credit for our work).

L.A. By The Numbers

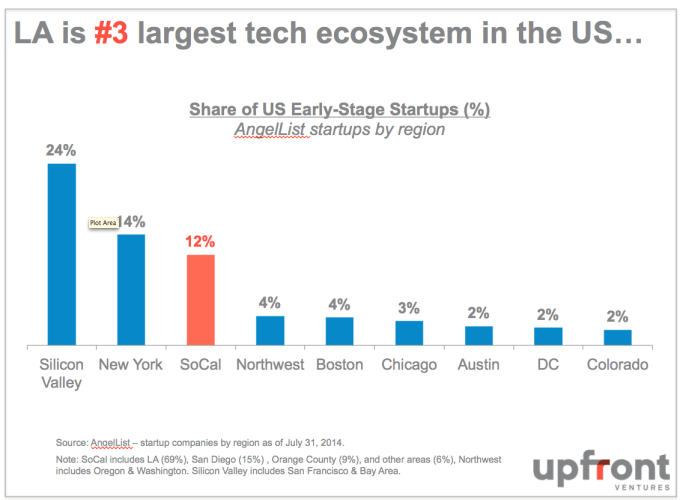

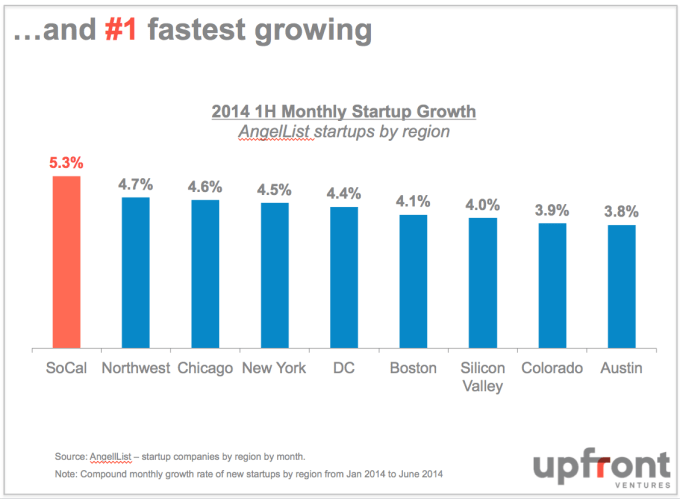

When you peel back the onion, some surprising data presents itself. Let me start with the obvious baseline: Los Angeles is the third-largest technology startup ecosystem in the US. Since our city is the second-largest metropolitan area in the country, this is hardly surprising.

When answering the actual question “Is there something going on in LA?” in 2014, the data seems pretty conclusive. LA has now become the fastest-growing tech startup region by the number of companies being started. And those of us here have noticed this pace accelerating.

I know that many VCs instinctively recognized this, even without the data, because I’ve noticed the frequency of high-profile VCs (from Andreessen Horowitz, Benchmark, KPCB, and Sequoia) recently backing companies in L.A.; or spending time throwing dinners and events. Some very experienced VCs (David Lee, Chris Sacca, Erik Rennala) even relocated to Los Angeles.

In fact, data released in this report by the LA Economic Development Council and the L.A. mayor’s office showed that the city now has more people employed in high-tech jobs (368,500) than any other metro region in the U.S. They’re accounting for 9 percent of all of L.A.’s jobs and 17 percent of total wages (that’s obviously highlighting some other issues that need to be addressed).

They estimate that high-tech work contributes $108.3 billion dollars of regional GDP. What’s perhaps different from other regions is that we have a large indigenous aerospace industry and a big high-tech import/export trade instead of a lot of software companies. But even this is changing.

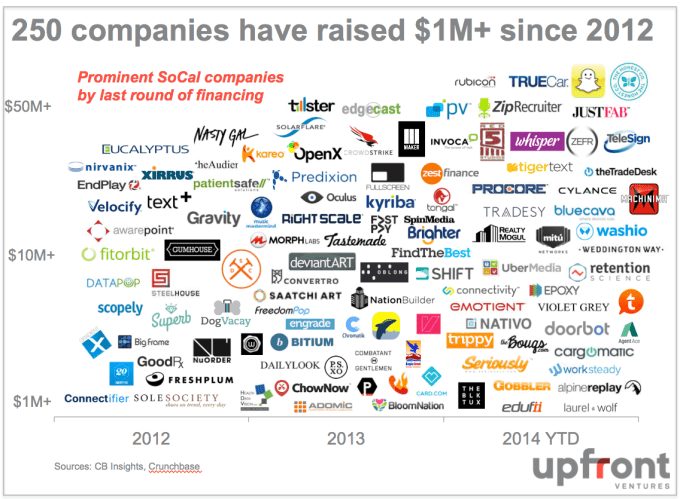

Given how efficient markets are, when a large market like L.A. starts to blossom, it attracts capital pretty quickly. In the last full year for which data is available, L.A. attracted $1.5 billion in venture capital for its technology startups — and 2014 will shatter that figure.

Over the past four years, financing for L.A. tech companies has grown at a 30 percent compounded annual growth rate (CAGR), which is greater four times the U.S. average (at 7 percent).

In the last month alone (not captured in the $1.5 billion 2013 figure), there have been massive financings at Honest Company ($70 million), JustFab ($85 million), ZipRecruiter ($63 million) and whatever figure (lord only knows how much) Snapchat has actually accumulated.

What Has Given Birth to This New Movement in L.A.?

Many people don’t realize that the majority of the monetization of the Internet originated in Los Angeles but was perfected in Silicon Valley.

When my friend, and the father of L.A.’s tech startup community, Bill Gross, first demonstrated his company GoTo.com (renamed Overture) onstage at a TED conference he was actually booed (True story. You can hear many other amazing stories in this 1:1 interview). What was Bill Gross’s heresy that rankled the tech elite? He presented a system where your search results would be ranked based on companies bidding for placement and where merchants would be charged on a “cost per click” basis.

Booed.

So much so that if you read “Googled” you’ll see why Larry and Sergey stated they would never do paid search results. The monetization engine of the Internet that powers its most profitable business was invented and perfected in Los Angeles and is what you now know as Google AdWords. The patents that Overture held became known in small circles as Google’s ‘361 problem. Yahoo acquired Overture for $1.63 billion (Upfront Ventures was an early Overture backer).

Yes, Google won. My point is that historically the ecosystem in L.A. has bred innovations in monetization and technology, but to date hasn’t reached the kind of scale of our major NorCal brethren.

And it wasn’t just Google AdWords that originated in Los Angeles. Google’s AdSense did, too. AdWords, as you likely know, are the paid results you see when you do a Google search. Google AdSense delivers the results you sometimes see on non-search pages that show you ads that are seemingly relevant to the words on the page.

This method was perfected by Gil Elbaz and his team at Applied Semantics in L.A., and in what some have called “the most important acquisition ever made by Google,” the search giant acquired Applied Semantics for $102 million before Google had even IPO’d.

What do Bill Gross and Gil Elbaz have in common that portends well for the future of L.A. tech?

Both graduated from Caltech, one of the most premier science institutions in the U.S. Both are massively funding other L.A. tech companies through what Fred Wilson once defined as “recycled capital.” Both had talented senior executives that are now running (and funding) tech startups in their own right, like Gil’s brother Eytan Elbaz or the countless graduates of Overture. Both Bill Gross and Gil Elbaz are building their next companies in L.A.

There’s also no denying the role that Richard Rosenblatt has played in building the L.A. tech ecosystem. He built and sold iMall in Internet 1.0 for $565 million to Excite. He led and sold Myspace to Fox for $650 million. He built and IPO’d Demand Media. And while none has had the lasting power of the much bigger NorCal successes, I imagine his next moves will continue to be closely watched. And the younger L.A. entrepreneurs, who count Rosenblatt as a mentor, may leave an even more lasting impact.

But the “monetization heart of the Internet” doesn’t stop at Overture or Applied Semantics. Over the past decade we’ve had high-profile exits at many companies that pioneered monetization techniques now used across the web, including Commission Junction, Value Click, ShopZilla, Price Grabber and LowerMyBills along with a newer breed including Invoca, Burstly, Shift, Retention Science and so forth. Many of the early winners sold for over half a billion dollars.

Success begets success. The rewards reaped by those who came in the 90’s have 15 years later created new seed capital, blossoming new entrepreneurs and an ecosystem of experienced operators that nourished L.A. 1.0 and are cultivating L.A. 2.0.

But Is This Really That Surprising?

All of this success raises the question whether the flourishing of Los Angeles is just emblematic of the long tech boom we’ve seen nationally. Of course it is — to some extent.

But this time there really is something happening in L.A. It’s different. More substantive. Lasting. Structural. This time we won’t stop at a half a billion, but we seem destined to create the kind of tent-pole successes that have brought lasting change to markets like Seattle.

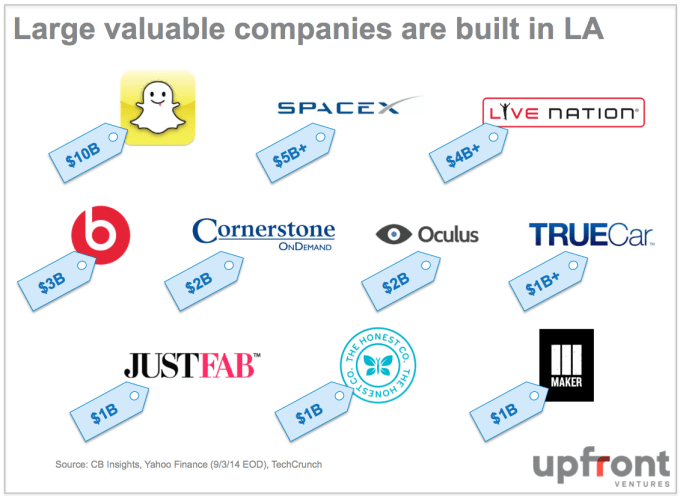

Of course most of you know SnapChat, Tinder and Whisper. And many people (who wouldn’t be wrong) immediately associate the success of Los Angeles under the SoLoMo banner (Social, Local, Mobile). But they forget that we have 2 relatively recent IPOs that are substantive companies: TrueCar (Upfront backed) and Cornerstone OnDemand. We don’t seem to get credit as a community for SpaceX or recognition as one of the fastest growing communities for commerce: Honest Company and JustFab. You probably know that Disney recently paid nearly $1 billion to acquire Maker Studios (Upfront backed) and that’s just the first inning for online video companies hatching out of LA.

If you throw in Oculus into the mix along with TrueCar, Rubicon, Burstly, Beats and others, L.A. tech has seen more than $8 billion in exits in 2014 alone. As Adam Sandler would say, “not too shabby.”

L.A. 2.0: This time it really is different.

From Infrastructure to Applications – The Three C’s

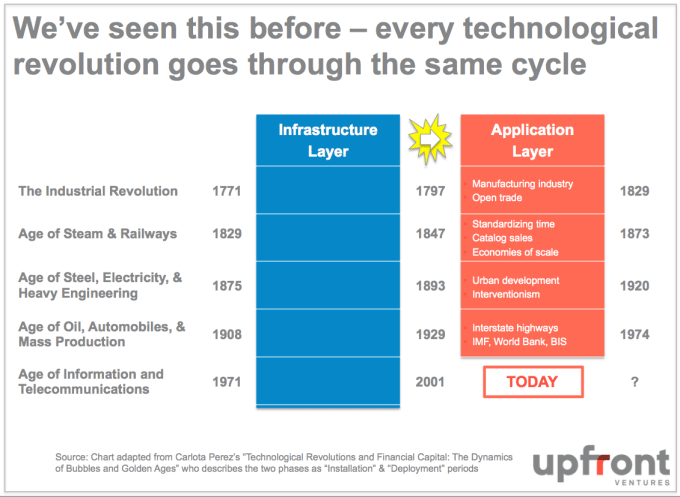

In order to contextualize the opportunity that exists for the Internet outside of Silicon Valley, take inspiration from the history of technology evolution across many markets throughout history. In her well-regarded book “Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages” Carlota Perez outlines the history of many of our great leaps forward in innovation.

Each followed a predictable path of building out infrastructure followed by a bubble then a crash followed by a more rapid deployment of the technology throughout industry and society. No less than Fred Wilson has credited Carlota’s work with having a major influence on his investment strategy at USV.

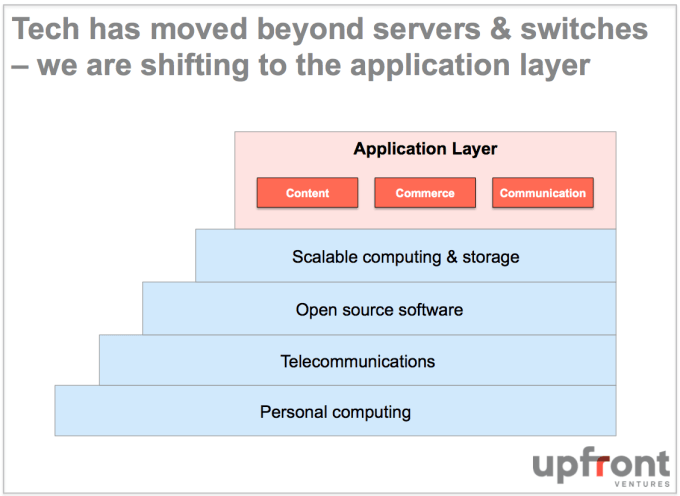

In order to have the great companies we now know today (Uber, DropBox, Airbnb, Snapchat, Twitter, Facebook and so forth) we first needed the “Internet rails” beneath us. We needed routers, switches, databases, caching software, load balancers, application servers, browsers, compression algorithms, streaming technology, low-cost storage, management consoles, programming libraries and on and on. We saw booms and bubbles in both telecom infrastructure and Internet infrastructure and now, of course, those two things are largely the same.

Once the railways are built most countries (except the U.S.) start to build better versions of their infrastructure. So you get high-speed railways in Japan, Germany, China, France — and now even connecting France and the U.K. So I’m not arguing that the “infrastructure building” phase of the Internet is over – to the contrary. We see big data storage solutions and processing platforms. We see improvements in wireless transmission and in real-time programming languages.

But.

With the foundation laid, the application layer is having its moment. It’s no surprise to see billion dollar companies like Honest Company and JustFab in L.A. We are the largest textile and apparel center in the country and now we have a way to reach billions of people in this globally connected Internet. Deflationary Economics now favors us.

Is it any surprise to see Zulily in Seattle, Wayfair in Boston, ExactTarget in Indianapolis, TrueCar in Los Angeles, Groupon in Chicago or BuzzFeed in NYC? I think it’s the era of the application.

And our belief is that consumer applications that ride on this Internet infrastructure layer fall into just three buckets we call “the three C’s”: content, commerce and communications. These are industries ripe to succeed in LA and NYC. These are industries that start to open up new commercial zones like Cincinnati (home to P&G/Kroger) and Chicago.

Content. It should be intuitive to most that L.A. is well-suited to take on the world of content meets tech as we’ve seen with Maker Studios, Fullscreen, AwesomenessTV and Big Frame. With all of those companies gobbled up the market is now focused on the next generation startups like Tastemade, MiTu Network, StyleHaul and so forth. We believe there is no denying that the future virtual reality (VR) world will be stimulated in LA where you have the great 3d special effects companies, content creators and movie studios.

Commerce: What is less known is just how important LA is as a commerce hub. Around $400 billion of imports & exports pass through the L.A. ports each year, which set the national high-water mark in 2012. Thirty-six percent of all apparel jobs in the U.S. are in Los Angeles. And L.A. is the largest retail & trade employment metropolitan zone in the country. It’s not accident we have so many great startups targeting commerce including Tradesy, DailyLook, NastyGal, Honest Co and JustFab just to name a few.

Communications: Of course comms companies are springing up globally including WhatsApp, Line, KakaoTalk, WeChat and the dominant platforms of Facebook & Twitter. But there’s no denying that we have more than our fair share of great startups in this space that have emerged recently including Snapchat, Tinder, Whisper and textPlus (which while much smaller still has millions of monthly active users – Upfront is an investor).

Stuff you may not know about LA?

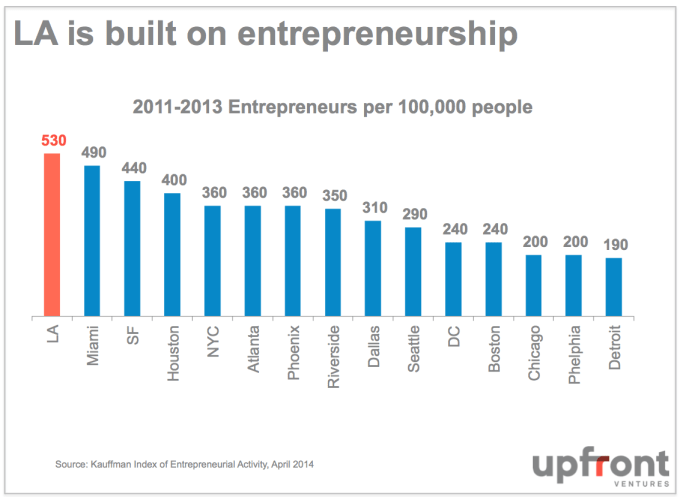

It’s probably worth pointing out that LA is a town built upon entrepreneurship even if not always underpinned by technology. We’re a land for people who left their stable East Coast homes in search of opportunity and a chance to start fresh. LA has more entrepreneurs as a percentage of its population than anywhere else in the country.

Intuitively, most people know that L.A. is also the heart of creative capital. L.A. is the largest metropolitan area in the U.S. for people employed in art, design and media and the local creative economy of L.A. generates more than $140 billion in economic output – more than the GDP of many countries. In fact, 1 in 7, or nearly 15 percent, Angelinos are employed in a creative field.

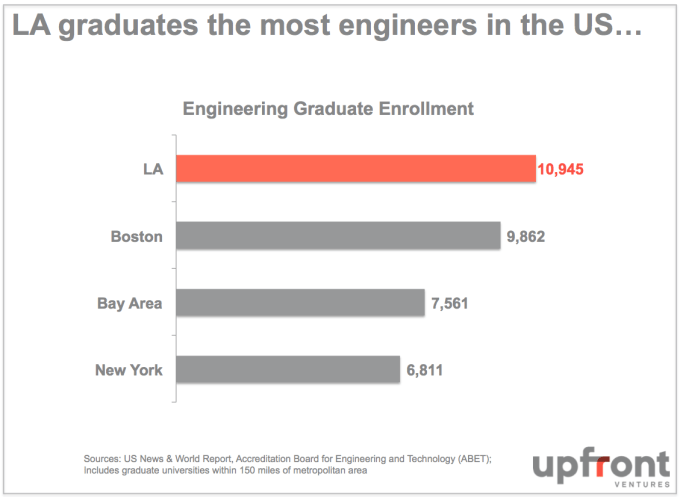

But what about tech talent?

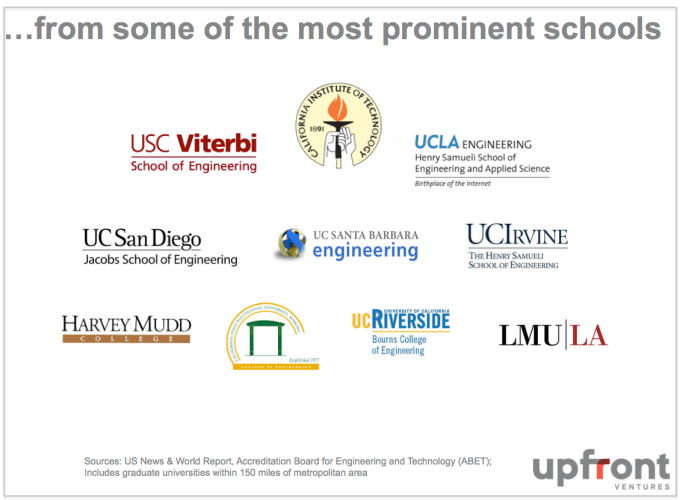

Yeah, we got that, too. It may surprise you to learn that L.A. graduates more engineers than anywhere else in the country. We also have more grad student enrollments each year in computer sciences than anywhere else in the country. So we produce them with deep knowledge and en masse.

Of course many of these graduates have been employed for years in the video and music industries and a larger amount have even been pulled into aerospace and defense over the past 30 years. As a result, we have a large number of locally employed engineers with video experience that will fuel the next boom of the Internet (Americans watch 5.3 hours of television per day – and much of this video is now moving online).

Equally important is that we are now a rich source of hardware expertise and innovation that is increasingly becoming important as the hardware markets boom.

While our best Internet software engineers have historically been exported on a net basis to the Bay Area, I’m sensing that trend reversing. Companies like Snapchat have been able to import large volumes of Stanford grads lured to creating a next-gen Internet powerhouse in Venice, Calif., GQ magazine just dubbed it “the coolest block in America.”).

You may also be surprised to know that not only does LA graduate more engineers than anywhere else in America but we also have more top 25 engineering programs than anywhere else in America with nationally acclaimed programs at Caltech, UCSD, USC, UCLA and Harvey Mudd.

The Road Ahead

The infrastructure phase of the Internet is over. It will still attract investments as it improves in terms of quality, speed and reach; but the application layer will rise in its import. The three C’s will ride on the tracks that have been laid for us and L.A. has shown itself to be a prominent player in this application phase.

We have the engineers who are graduating from top engineering schools; we now have second- and third-time entrepreneurs fueled by recycled capital and mentors who have built startups to successful outcomes and have seen scale; and we have our emerging tentpole companies like SnapChat, Oculus, TrueCar along with large investments and teams from Google, Facebook and Microsoft.

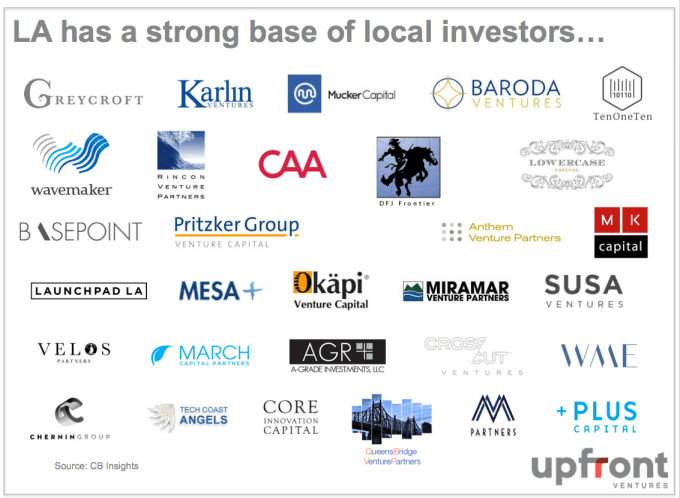

I also surveyed the list of local VCs and while we are slim on total available local capital I also realized just how many new funds were created over the past decade and how much more modern the skills are of this generation of local VCs are than those of the past.

With the founders, the funds, the application layer of the Internet, the attractiveness of Los Angeles in terms of cost-of-living and climate I think it’s fair to say that our moment in the sun has just begun.