Amazon, the e-commerce giant that recently added smartphones to its growing mobile empire, is now turning on another element to bring more users and usage into its mobile business. It will now enable carrier billing, so that when people buy paid apps and make in-app purchases through Amazon’s appstore, they can charge that directly to their phone bills.

Working with UK carrier billing company Bango — a relationship that was first announced way back in December 2011 — Bango says the first market to go live is Germany, with Telefonica’s O2, where it will work over the next year to deploy the service on “certain Amazon mobile applications running on Telefonica devices in Germany.”

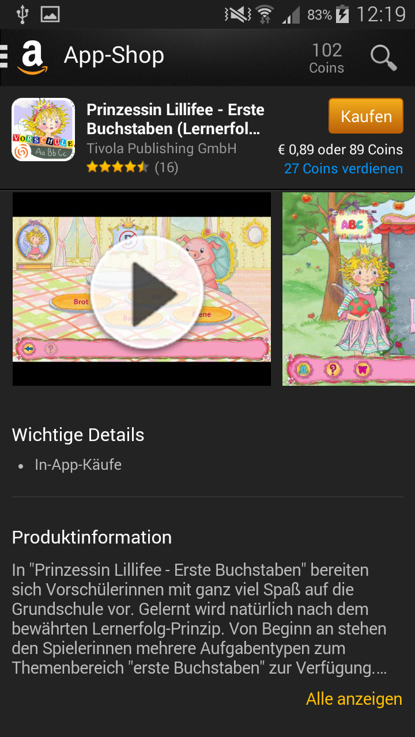

In fact, as of this moment, there is only one device where you can see Amazon’s carrier billing services in action: if you use Amazon services on a Samsung Galaxy Mini that is running on the O2 network in Germany, you can charge app purchases directly to your bill, where the charge is deducted in euros or the euro equivalent of Coins, Amazon’s virtual currency. A screenshot of how it looks is on the right, with a more detailed look of how it appears and is activated in the gallery below.

In fact, as of this moment, there is only one device where you can see Amazon’s carrier billing services in action: if you use Amazon services on a Samsung Galaxy Mini that is running on the O2 network in Germany, you can charge app purchases directly to your bill, where the charge is deducted in euros or the euro equivalent of Coins, Amazon’s virtual currency. A screenshot of how it looks is on the right, with a more detailed look of how it appears and is activated in the gallery below.

Although it’s taken nearly three years to get Amazon’s first carrier billing service out the door, other expansions may not take as long. For one, right now in Germany, to sell its Fire Phone, Amazon has partnered not with O2, but with rival Deutsche Telekom, owner of T-Mobile.

“The Amazon Fire Phone is connected to a contract with Telekom,” Amazon notes on its German Fire Phone page (via Google translation). “This means that the Fire can only be used with a SIM card from Telekom.”

In other words, if you are one of Amazon’s newest phone customers in the country — with a phone and its ties to a carrier being the most optimal environment to use carrier billing — at this moment you won’t be able to use carrier billing. If you are an Android user on the O2 network that has turned on Amazon’s appstore, you will.

Coincidentally, Bango announced a carrier billing interconnection deal with Deutsche Telekom in Germany just last month. It had worked with the carrier in other markets already.

A number of app store operators have already turned on carrier billing services, and Bango is one of a handful of companies (others include Fortumo and Boku) that enables this.

For its part, Bango already works with Facebook, Google Play, BlackBerry, the Windows Phone Store, and Firefox’s Marketplace, as well as directly with content owners to provide carrier billing, integrating with 120 different mobile operators to link up their back-end billing systems to those app stores and apps. Among those, Telefonica is one of Bango’s biggest customers, so it’s no surprise to see O2 being the first to work with Amazon. (O2 is also the reseller of the Fire Phone in other countries like the UK.)

Notably absent in the above list: Apple.

The company has made a killing with its own iTunes billing system, with more than 800 million accounts set up, most with credit card data; and is now gearing up for Apple Pay, its new mobile payments system that will include its own payment button widget that can run in apps.

But neither of these addresses how Apple might better serve users in emerging markets — which today represent the biggest growth opportunity for smartphone makers after more mature markets like the U.S. have been saturated.

In emerging markets around the world, payment card penetration, and often bank account ownership, is a lot lower, so to grow more app business there — and by default your bigger ecosystem as a hardware maker, and of course phone sales — we often see carrier billing get used as a more significant component in the mix.

Unlike an Amazon, iTunes or PayPal account, carrier billing can linked up for customers who take phones on contract, but it can also work with a pre-pay subscription, deducting the charge from your topped-up phone credits. This has been part of the opportunity that Bango and Telefonica have been trying to tackle.

The logic behind enabling carrier billing is twofold: convenience and security.

On the convenience side, the idea is that by offering users the ability to make one-step, small charges to their bills, they are more likely to buy goods when they don’t have to worry about inputting any charging information or thinking about how to pay for what they’re buying. Their phone bill, in effect, becomes like a frictionless new credit line.

On the security side, given the many breaches we have seen around user data and credit card information, the idea is that a billing agreement already exists between a carrier and a user, so none of that kind of information needs to get shared again.

[gallery columns="2" ids="1059119,1059114,1059120,1059121,1059116,1059117,1059115"]