We’re at the the Computer History Museum in Mountain View, Calif., to see the startups in the Y Combinator Summer 2014 class pitch their wares to investors and the press.

There will be four sessions in total today, and we’ll be writing up a post for each. This is the largest number of startups that YC has ever had as part of its batch, so bear with us!

Here’s the first set of companies presenting on-the-record… We’ll have to wait to talk about a few of the companies, who aren’t ready for their public debut:

Gingko Bioworks: Ginkgo Bioworks is a Boston-based startup that speeds up the process of genetically engineering and growing ingredients. The market for natural ingredients is an estimated $2 billion. The Boston-based biotech company is currently working on a project with DARPA to treat antibiotic-resistant germs, using designer microbes to convert CO2 emissions into fuel and is somehow making yeast smell like roses. They say they’re able to grow ingredients in about 10 days, which reducing the costs of producing these goods by 50 to 90 percent. “This makes it a process that’s more like producing beer,” the company said on-stage. So far, they have nine contracts signed with $4.5 million in development fees and $10 million in annual royalties. The company’s founders have worked together for more than 10 years and they have 15 Ph.D’s and two MIT professors on staff.

TicketLabs: TicketLabs is a platform that provides ways for artists to make more money off their concerts and sell directly to fans. Nearly 3/4 of all their revenue comes from live performances, but most artists don’t have very good insight into who their fans are, because platforms like iTunes and Ticketmaster don’t share fan data with them. TicketLabs hopes to change that by helping artists to sell directly to fans. It’s changing the way users are purchasing tickets: About 50 percent of tickets are both on mobile, and 75 percent are connected through Facebook Connect. The company wants to change the way ticketing works, to capture what is a multi-billion dollar opportunity.

ClearTax: An e-filing service for paying income taxes in India. It makes tax filing significantly easier — instead of filling out a complicated spreadsheet, filers using their software simply upload their W2, and the app automatically prepares all necessary forms. In a few years, the company predicts that 100 million people in India will file their taxes electronically. ClearTax already has a lead on capturing that market, as this year the company processed tax filings for 300,000 individuals, making it the biggest e-file site in India this year. Next year, the company estimates that it will process 1 million tax filings.

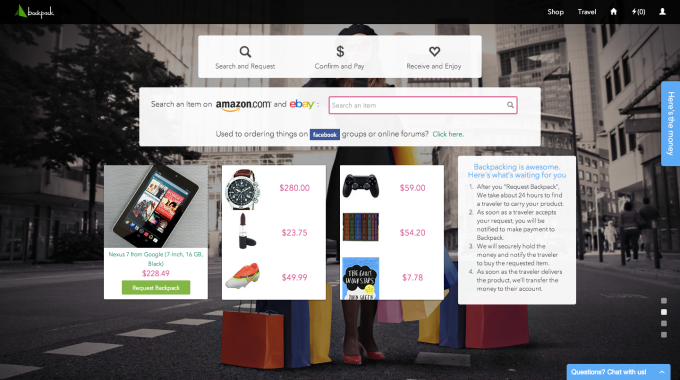

Backpack: Backpack is a company that arbitrages the cost of goods in different countries by using international travelers as a distribution network. For instance, a Macbook might cost $1,099 in the United States and $1,520 in Bangladesh, where Backpack’s founders are from. “They don’t want to pay $400 more,” explained the company’s founders. So Backpack connects shoppers with travelers who are already going on the appropriate route and they’ll carry goods back for a fee. So for that theoretical laptop, travelers can save $300 while the traveler would earn $120. The company says it is already experience 15 percent week-over-week growth and says that this behavior constitutes a $16 billion market alone in China.

Backpack: Backpack is a company that arbitrages the cost of goods in different countries by using international travelers as a distribution network. For instance, a Macbook might cost $1,099 in the United States and $1,520 in Bangladesh, where Backpack’s founders are from. “They don’t want to pay $400 more,” explained the company’s founders. So Backpack connects shoppers with travelers who are already going on the appropriate route and they’ll carry goods back for a fee. So for that theoretical laptop, travelers can save $300 while the traveler would earn $120. The company says it is already experience 15 percent week-over-week growth and says that this behavior constitutes a $16 billion market alone in China.

MTailor: This startup sells men’s custom shirts by measuring you with the camera on your phone. The comapny hopes to change the way that customers buy shirts and makes sure they fit. Since its measurement process is done with machine measurements, it’s able to get a better fit than most tailors. It’s also able to cut out the middleman cost of tailoring those shirts. As such, the same custom shirt that would sell for $125 from a tailor will be shipped to you for $69 instead. MTailor is going after a $10 billion shirt market, but that’s just the start — after that, it hopes to do suits, pants, and other custom-fit clothing for men.

Glowing Plant: Creates technology for genetically engineering plants. Based on early success racking up more than $500,000 in pre-sales for a glowing plant, the company predicts that it can achieve success in the consumer market by creating living products, like plant-based air filters that don’t require new cartridges every few weeks. Eventually, the company would like to build large facilities for creating plants with industrial uses, including genetically-modified plants that could produce milk or biofuels.

Carlypso: Carlypso is attacking the $400 billion used car market. If you’re a car owner that wants to sell your vehicle, you have two options. You can either sell it to a dealer in less than an hour and earn substantially less for your vehicle or you can engage in the time-consuming process of selling it yourself. Carlypso says this process can take at least 20 hours and the owner opens themselves up to all kinds of spam and unwanted messaging. With Carlypso, a seller enter details the car’s details on Carlypso’s website, and the company advises the seller with a ballpark figure of how much money it could fetch using its own pricing algorithm that takes into account local data from dealerships and successful listings (an extra large pickup truck will fetch a higher price in Texas than in Manhattan, for instance.)

Carlypso: Carlypso is attacking the $400 billion used car market. If you’re a car owner that wants to sell your vehicle, you have two options. You can either sell it to a dealer in less than an hour and earn substantially less for your vehicle or you can engage in the time-consuming process of selling it yourself. Carlypso says this process can take at least 20 hours and the owner opens themselves up to all kinds of spam and unwanted messaging. With Carlypso, a seller enter details the car’s details on Carlypso’s website, and the company advises the seller with a ballpark figure of how much money it could fetch using its own pricing algorithm that takes into account local data from dealerships and successful listings (an extra large pickup truck will fetch a higher price in Texas than in Manhattan, for instance.)

Carlypso then sends an inspector from its nationwide network of certified mechanics to inspect the car, take photos, and attach a “Carlypso device” that tracks the vehicle for when potential buyers come for test drives. Carlypso also formats a “for sale by owner” listing, and helps post it across a number of outlets. From there, the seller continues to use the car as usual. When it’s not in use, the seller parks it in a driveway, or a local parking lot, or down the block, so that interested buyers can check it out or take it for a spin. Carlypso filters through all of the inbound offers, and contacts the seller only when there is one that is deemed reasonable. The seller never needs to meet the person who buys the car. If the car is sold, Carlypso collects a 5 percent “listing fee” that’s capped at $1,500.

Bikanta: Bikanta is using nanodiamonds to redefine medical imaging. Those nanodiamonds act as miniature flashlights that can be used to “shine light” on a number of medical problems, including the detection of cancer. And that’s important because the faster you can detect cancer, the more likely you are to successfully treat it. The technology was developed as part of the founder’s post-doctoral study at the National Institute of Health, and they hold key patents in the field. The company is selling into the $12 billion imaging probe and instrumentation market, and already has letters of intent for $3 million worth of nanodiamonds.

Weave: A professional networking platform that applies the simplicity of Tinder with the traditionally tedious process of making connections. Instead of spamming potential employees or partners with LinkedIn notifications or email, the app gives people a way to quickly determine whether having a conversation with someone is worth their time. The company claims that in fewer than 50 swipes, users can expect to make at least 1 relevant meeting, which takes less than five minutes of use. The company sees its biggest opportunity in the world of recruiting, where $5 billion is spent by recruiters on web recruitment despite the fact that only 20% of people are hired from online postings.

Theorem: Theorem tries to create a unified marketplace for independent brands. The company says that consumer tastes have changed as buyers have shifted from big box retailers to independent, small-batch designers. There are 500,000 independent designers worldwide but no centralized destination for them all. They usually build their own websites or go on Amazon, eBay or Etsy. On Theorem, there’s an interesting twist: The price of each item is up for negotiation. Buying something on Theorem hearkens to the kind of give-and-take that’s been practiced in flea markets and bazaars for centuries, but brought online and into the modern age. The company’s larger vision now is to become the “Priceline for fashion,” bringing the name-your-own-price model to a new type of market, and letting independent brands benefit. Roughly 60 percent of offers presented by shoppers on Theorem are being accepted by merchants at the moment, giving growing independent brands an outlet for selling items to a new customer base, without diluting their carefully-crafted images.

Parenthoods: This startup is reinventing the way that parents connect with each other and find the resources they need. It’s a common struggle for today’s parents, because they are either stuck on web discussion forums or listservs which don’t serve them well. Parenthoods, by contrast, offers a mobile app to help a new generation of parents that are increasingly on the go. The app is pseudo-anonymous and local, and is already seeing 25 percent of parents who sign up interacting with it eevry single day.

Unwind Me: A service for scheduling spa-style massages at home. The company describes itself as “Homejoy for massage and wellness,” letting users book a massage in minutes with a licensed therapist, who will bring everything necessary to your home. The company has been operating in San Francisco for seven months, and in that time it has seen some evidence that making it easier for massage therapists and customers to connect, more massages are done overall: customers have more sessions over time than the industry average, and massage therapists working with the service make 2-3 times the industry average.

Vizera Labs: Vizera has some cool technology that uses projection mapping for designer showrooms. Their software can change the color and patterns projected on furniture so that buyers can see what chairs or couches would look like with certain kinds of fabric. This enables showrooms to be much more space-efficient and smaller. The company says that showrooms make up 28 percent of all retail revenue and are part of a $1.3 trillion market.

Checkr: This startup wants to change the manual process of doing background checks for a new generation of employers. With a growing number of companies hiring contractors for on-demand services, it’s a huge and growing market. Already, it’s doing background checks for companies like Instacart, Homejoy, and DoorDash, and has gone from 0-$40,000 in revenue in just one month. It’s seeking to build the trust layer of the Internet, with an API for background checks that could, over time, lower the cost of doing them.

LivBlends: Livblends wants to revolutionize the smoothie market by bringing fresh smoothies directly to your door. ““There’s an enormous shift toward food that isn’t killing us” joked co-founder of LivBlends, Elise Polezel. The startup has received a healthy growth of 30% week over week and says it plans to take on the $10 billion dollar smoothie marketplace against companies like Odwalla. Polezel says this type of food is dead and Livblends delivers live, fresh mixes instead. The company has made inroads delivering freshly blended mixes to several San Francisco startups. It counts Twitter, Box and others among customers now receiving its smoothie mixes on a daily basis. Polezel and her co-founder, MIT engineering grad Matthew Udomphol also plan to release a Keurig-like smoothie maker that removes the messy cleanup of most juicers later this year.

WalkSource: Billing itself as “an exchange for overbooked hotels,” Walksource has built a network that connects hotels together and allows them to see who has room availability in the same geographical area. Just like airlines, hotels frequently overbook with the assumption that some customers will cancel their bookings at the last minute. But unlike airlines, most hotels don’t have a software system for finding overbooked customers somewhere else to go. Hotels that are overbooked for a night must “walk” customers when they check in — call around to other neighboring hotels in walking distance to see who still has an available room. According to the startup, the demand for this service has been huge: In the six months since WalkSource’s beta launch, the company has gotten 43 percent of all San Francisco Bay Area hotels to sign up for its service. That’s more than 200 hotels in 33 different cities. WalkSource charges $200 per hotel per month for its service. In the future, the company says that it can also take its knowledge of last minute available hotel rooms and sell the information to companies like Hotel Tonight and Priceline.

San Francisco Open Exchange: San Francisco Open Exchange is a trading platform for Bitcoin that helps buyers find the cheapest prices between various exchanges. The company says that 90 percent of all Bitcoin trades are done in U.S. dollars even though the most popular exchanges like Bitstamp and BTC-e are based outside of the U.S. because of domestic banking regulations. The company has grown to $50,000 in weekly volume and is aiming for the broader Bitcoin trading market, where $3 billion worth of Bitcoin was exchanged last year. The company’s two founders, Akbar Thobhani and George Melika, have built at least four trading platforms between them.

Greentoe: This startup offers a name-your-own price marketplace for products — think of it as “Priceline for products.” The price you see on a retailer’s website often isn’t the lowest price it is willing to sell something for. That’s because manufacturers keep retailers from publicly displaying the lowest price. By helping customers name their own price, Greentoe has already generated more than $1 million in revenue, and it has a return customer rate of 34 percent. By remaining independent of retailers and manufacturers, Greentoe can provide the lowest price available.

Zen99: A service offering tax and insurance assistance for independent contractors.The company notes that independent contractors make up 40% of the work force and that their segment of the labor force is growing two times faster than the labor market overall. As with Intuit’s Mint, the company is able to offer its service to contractors for free by making its money as an insurance broker, collecting a small percentage when its users take its advice when buying insurance.

Colleen Taylor, Ryan Lawler, Kim-Mai Cutler, Sarah Buhr, and Kyle Russell all contributed reporting.