On-demand ride-sharing startup Lyft has been aggressively expanding its service across the U.S. over the last year, but this week could mark its biggest launch and biggest challenge yet. That’s because, for the first time ever, the company is preparing to launch in New York, a region known for its regulatory morass.

On Friday July 11 at 7:00 p.m. ET, Lyft will make its service available to New Yorkers looking to get around in Brooklyn and Queens where taxi service and other forms of transportation are scarce. Lyft president John Zimmer said the focus on the boroughs is meant to help serve an underserved market.

According to the New York City Taxi and Limousine Commission, 95 percent of taxi pickups happen either in Manhattan or at the local airports. There’s only one subway line that runs between the boroughs, and that subway line — the G — is pretty much the worst.

Grabbing a foothold in the place with the least number of transit alternatives makes sense, but that doesn’t mean that Lyft won’t expand to serve Manhattan at some point in the future. It also doesn’t mean that passengers in the boroughs can’t take a Lyft to Manhattan.

To prepare for launch, the company has been working over the last month or so to recruit drivers for the launch, and will have more than 500 ready at the time the service goes live. In terms of wheels on the road, that’s the largest launch in a single market that it’s had, according to Zimmer.

Lyft Faces Stiff Competition

The new service will have to compete with numerous other options that New Yorkers are used to, but its biggest competition will likely come from Uber, which has been operating in New York for more than three years.

Perhaps anticipating the launch of Lyft in the boroughs, the on-demand ride company announced yesterday that it was slashing fares for its UberX service by 20 percent.

To date, Uber’s messaging has always been around how much cheaper its fares are than taxis in various local markets, but it’s clear that it is also trying to squash competition in the ride-sharing space. It also recently cut prices in the Bay Area and Los Angeles by 25 percent each. With more than $1.2 billion in new funding, Uber is clearly using its war chest to push its competitors’ margins to unsustainable levels.

At launch, Lyft rides will have a base fare of $3 per ride with a cost of $2.15 per mile traveled or $0.40 per minute traveled in traffic. That matches UberX’s new fares, but is cheaper than grabbing a taxi, which typically charges $2.50 upon entry and $2.50 per mile or $0.50 for each minute traveling slower than 6 mph.

NYC VS. The Peer-To-Peer Economy

Even if Lyft survives the price war, it will also have to fend off regulators in a market that has not taken kindly to peer-to-peer services that take on incumbent players. More than any other city, New York time and again has proven to be a tough nut for startups to crack.

We’ve seen that with Airbnb, which recently battled the NY attorney general over releasing user data that could show hosts who were running illegal hotel operations. After receiving a subpoena and battling the AG in court, Airbnb succumbed to the request and gave up anonymized user data. It also purged listings put up by “bad actor” hosts who were renting out dozens of units in the city.

New York has been unkind to transportation companies, as well. Lyft and Uber competitor Sidecar launched in Brooklyn early last year, but quickly suspended service and retreated from the market after an administrative court judge ruled against one of the company’s drivers.

Car-sharing service RelayRides also suspended operations in the New York market after receiving a cease-and-desist notice from New York State’s Department of Financial Services (DFS).

Even Uber, which has a longstanding service in the city, ran into problems when it sought to skirt the New York City Taxi and Limousine Commission’s regulations and launch its own UberTAXI service without their blessing.

Uber suspended its New York taxi trial soon after launch, and it took several months for Uber to get back in the regulator’s good graces and get its app back in taxis there.

(It’s probably worth noting that Uber recently hired Ashwini Chhabra — the guy it worked with to get its NY taxi service approved — as its new head of public policy.)

Uber faced resistance in New York City even though it was working with commercially licensed taxi and black car drivers. Lyft, meanwhile, operates a peer-to-peer model with drivers who haven’t gone through the same process. And that could cause some concern at the NY TLC or the NY AG’s office.

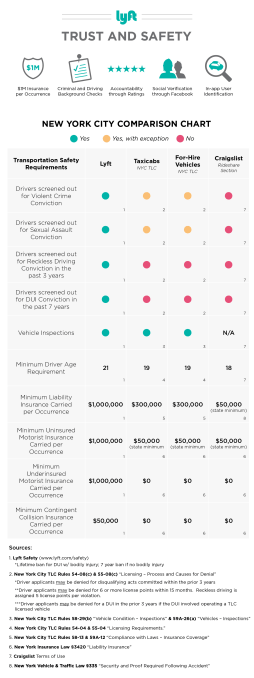

Zimmer says the company has proactively reached out to a number of agencies in New York, touting its work with regulators in other markets. It also has been trying to make the case that its safety standards are well over and above what the TLC requests for taxi and for-hire (black car) drivers.

“We’re now live in 67 cities, and we have worked through every regulatory hurdle that has been thrown at us,” Zimmer said. The insurance coverage Lyft offers is $1 million, compared to a minimum of $300,000 for a taxi. Its minimum driver age is 21, compared to 19 for a taxi. The company also screens for drunk driving and reckless driving, nixing anyone who had violations over the last seven years — something taxis don’t do.

The hope is that Lyft can get regulators in New York to craft a new framework for peer-to-peer rides in the same way that other jurisdictions have. Most notably, Lyft and other ride-sharing startups convinced the California Public Utilities Commission to create a new designation for “Transportation Network Companies,” which they have been trying to convince other state and local governments and regulators to adopt.

It’s unclear whether the folks in New York will be open to new competition from new ride-sharing services. After all, the local taxi lobby is clearly powerful there. What is clear is that Lyft will have a lot of work ahead if it’s going to be successful in one of the largest transportation markets in the country.