Last year, Groupon’s CEO Eric Lefkovsky said that his ambition was to make the e-commerce company’s Goods business more like Costco, not Amazon. Today, the company is launching a new business called Groupon Basics — offering discounts on home goods to compete with warehouse-based bulk-buying clubs — that will bring it one step closer to that idea.

As an expansion of the online e-commerce portal Groupon Goods, Groupon Basics a discounted, bulk shopping service for home goods. Starting with household, personal care and health products, the plan is to expand to canned and packaged groceries in the next few months.

The service is kicking off with around 100 items on offer — things like Gillette razor heads, Dove deodorant, Airborne immune supplement and Pantene shampoo — with discounts generally at 20%-30% off retail prices. The idea is that both Groupon and its customers are getting a discount by virtue of buying items in bulk, not unlike the business model followed by Costco and Wal-Mart-owned Sam’s Club.

“We’re putting the bulk buying power of Groupon to work for our customers, helping them save on serious quantities of the things they buy and use every day –– all from the convenience of their home,” Aaron Cooper, senior vice president of Groupon Goods, said in a statement.

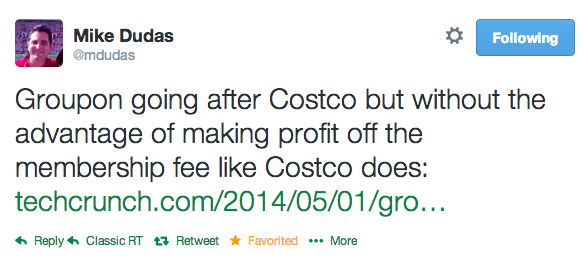

Unlike these two, though, you don’t need a membership to use Basics.

The lack of membership tie-in could have its drawbacks, of course.

To get around the hurdle that some people may not want to shop online, Groupon is also offering free delivery service to orders over $24.99, and it’s also giving people 5% of the total purchase back in “Groupon Bucks,” the site’s loyalty-focused virtual currency. Effectively, since many of the deals are on bulk items, that means that most purchases will be over $25 and qualify for the free shipping option.

The service is launching in the U.S. initially. “We have no plans to expand outside the US at the moment, but this is clearly an obvious next step assuming our customers request it,” Rob Lopez, General Manager, Groupon Basics, tells me.

It makes sense for Groupon to make investments into expanding its Goods service. The division brought in $1.87 billion in revenue in 2013 on total revenues of $2.6 billion. That means it is one of the company’s fastest-growing divisions at the moment. (Goods was up 25% from $1.49 billion in 2012; Groupon overall was up 10% from $2.3 billion in sales in 2012.)

On top of that, direct revenue (from goods purchased by and shipped by Groupon) increased 109% from 2012 to 2013.

It also seems logical in terms of what Groupon has built out already. That includes a distribution center in Hebron, Kentucky, opened in November 2013. In other words, there is already buying power and logistics in place as building blocks.

But putting more investment online is also an interesting complement, perhaps a damning one, to Groupon’s efforts in physical and local commerce. As other efforts from companies like Square have shown, this can be a challenging and tricky business.

Basics, Groupon tells me, has been in beta for less than two months prior to this, and the company has been “very pleased with the initial results.”

There will be limits, though. “We’re not going for the tens of thousands of SKUs play here,” the spokesperson says. “We’re offering our customers a curated selection of inventory.” Indeed, the company’s existing Goods business already has a selection of electronics goods like TVs and tablets so it’s less likely that these will also be added into the Basics mix.

It seems to also link up with a long-held interest that Groupon has had to play more in the FMCG vertical. Back in 2011, it began a pilot with supermarkets to offer Groupons for grocery shoppers, linking up the service with store loyalty cards.