Editor’s note: Matt Oguz is managing director of Palo Alto Venture Science.

Every decision we make from what to wear to whom to hire requires a balance of multiple factors. Sometimes we decide quickly and other times with deliberate consideration. Either way, we do this every day. Picking what to wear, for instance, depends on a number of variables: what we have in the closet, what we’ll be doing that day, what the weather’s like, etc. Often we pick something to wear but later question our judgment. This happens for a number of reasons:

- We haven’t reviewed all of our clothes.

- We haven’t reviewed all aspects of what we’ll be doing.

- When we start that activity we realize there was more to it than what we assumed, such as attending a party where everyone is in a cocktail dress except you because you didn’t know the context of the party.

Selecting a startup to invest in isn’t much different. First, we have a number of alternatives, i.e. our deal flow. We don’t have access to all available deals. Second, we have a limited amount of time to decide and we have other constraints, such as how much cash we have, contingencies, terms, existing portfolio and so forth.

Multi-factor decision analysis, or multi-criteria decision analysis as it’s more commonly known in academia, is an approach that is intended to force hard thinking about the alternatives, contingencies, constraints, etc., to promote good decision-making. It won’t give you the “right” answer, but it will challenge intuition, help structure the problem, provide a sounding board for testing, and combine different perspectives.

People love taking shortcuts when making decisions — smart people more so than others because they believe they are better than others based on their prior accomplishments. This is error No. 1. People also place more emphasis on recent events than the event warrants, such as pouring money into messaging apps after the WhatsApp acquisition. This is error No. 2.

We also anchor our valuations to recent events. Error No. 3: If an IPO is successful, funding to startups goes up. Error No. 4: We value the popular view especially shared among more successful people. Case in point is YC demo days. Error No. 5: We think that what we have available is all that’s available. And finally, when we succeed we take a lot more credit for it than the responsibility we take when we fail. This is error No. 6.

I’m not pointing out these errors to dismiss the intellect of successful people. These errors are like a hammer chipping away from a beautiful chunk of granite leaving you with a small stone. And these errors, aka cognitive biases, are there because of where we are in our evolution. A million years from now we’ll probably decide better. We all suffer from “bounded rationality.”

So let’s dig deeper now. Consider a time when you’re an investor evaluating Facebook. Here’s the scenario:

- Lots of competition. Myspace was already there and big.

- Young and inexperienced team

- Litigation risk

- Questionable monetization

It doesn’t look that compelling, does it? But look at the pros:

- Great product that’s fully built

- Viral growth

- Gargantuan market

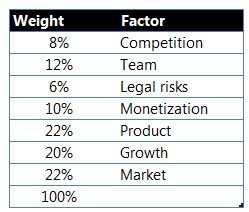

You may say this is hindsight but bear with me. If you decided not to invest in Facebook, the error you’ve made is simply assuming that the four negative parameters carry the same weight as the three positive parameters. You wrote pros and cons and crossed them out; whichever side had more won. This is when multi-factor analysis comes into play and shows its magic. All you had to do was decide which parameter was more important and by how much. One may decide it looks like this:

Consider RingCentral. It’s similar. VoIP is not new. Competition is huge. But it’s got a great team, a good (not yet great) product, great monetization, a big and underserved market segment, etc.

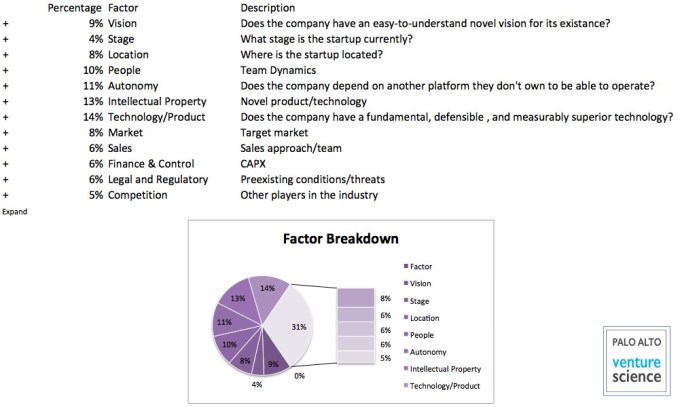

Here’s how you build your multi-factor matrix:

- Identify attributes that are important to you. Do this with your team.

- Take two attributes at a time and determine which one is more important and by how much. Do this for all the attributes and sub-attributes.

- Identify deal-killer (binary) attributes.

The attributes we selected here come from Bell-Mason diagnostics. MCDA takes this a step further and forces the decision-makers to identify how important each attribute is. Naturally, not all attributes have the same level of importance.

To take this a step further, one may decide to run more statistical analysis on attributes and how they impacted startups in the past. The results will help the team understand the importance of each attribute better.

Once you identify the factors and their levels of importance, run each startup in your deal flow through this matrix. Each one will give you a different score. From there, you can calculate your bang for the buck on each alternative. It forces you to avoid biases and look at the problem as a whole, and it builds a framework that takes you from complexity to simplicity.

Multi-factor models have been criticized in the past because they often appear “simplistic.” The simple model does not deny the complexity of the problem. It forces you to distill the key factors in a transparent, easy-to-work-with manner, and this can generate further insights and understanding.

Simon French is a renowned professor of Information and Decision Sciences at the University of Warwick. In his book named “Decision Theory: An Introduction to the Mathematics of Rationality” he states the following:

Decision analysis has been berated because it supposedly applies simplistic ideas to complex problems, usurping decision makers and prescribing choice. Yet I believe it does nothing of this sort. I believe that decision analysis is a very delicate, subtle tool that helps decision makers explore and come to understand their beliefs and preferences in the context of a particular problem. …There is no prescription, only the provision of a framework in which to think and communicate.

We agree with Professor French. The biases described above are quite apparent in the way investors make decisions. We need a disciplined approach to VC investing just like in any other asset class.

Today, we have a lot more data on startups than ever before. We know the cash influx into startups and exits. We know stage-by-stage changes in valuations. It’s worthwhile to study what attributes make or break the startup instead of making blanket heuristic statements such as “most of your investments will fail” or forming valuation correlations such as “x accelerator graduates commend higher valuation.”

Our job as investors is to avoid biases and have a structured approach to how we select startups that creates consistency and translates to newer-generation VCs unlike the models of traditional VCs, which, in our opinion, does not.

Image by Gwoeii/Shutterstock