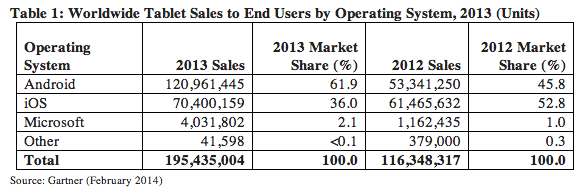

A new tipping point in the world of tablets: today the analysts at Gartner have released their tablet sales numbers for 2013, and Android has topped the list for the most popular platform for the first time, outselling Apple’s range of iPad tablets nearly twofold. Of the 195 million tablets sold in 2013, Android took nearly 62% of sales on 121 million tablets, while Apple sold 70 million iPad tablets for a 36% share.

In comparison, last year, Apple led the tablet category with nearly 53% of sales on 61 million units, compared to Android at nearly 46% with 53 million tablets sold.

What’s fuelling sales these days? “Low-end, smaller screen” tablets, along with first-time buyers, Gartner says. Ironically, one of the companies that had pioneered that form factor and targeted newbies, Amazon, isn’t faring so well.

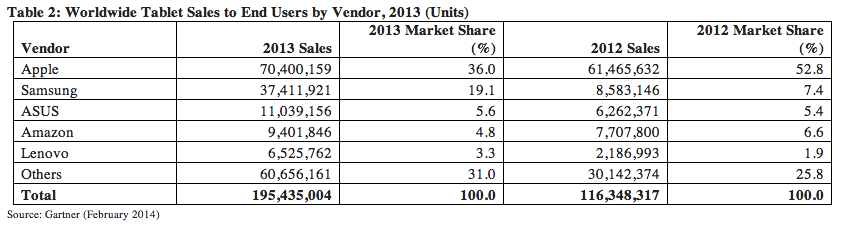

Interestingly, while many saw Amazon and its cut-price Kindle Fire as disruptors in the tablet space when the e-commerce giant first entered the market in 2011, it looks like the company has lost some steam. Sales were up by some 2 million to 9 million, but its overall market share declined to 4.8% from 6.6% in 2012. (And Gartner is not alone here; IDC noted similar declines for Amazon in quarterly sales earlier this year.)

Price and size alone will not do it in the future, it seems. Gartner believes that this may signal a turn towards more features, even on less expensive devices.

“In 2013, tablets became a mainstream phenomenon, with a vast choice of Android-based tablets being within the budget of mainstream consumers while still offering adequate specifications,” writes research director Roberta Cozza. “As the Android tablet market becomes highly commoditised, in 2014, it will be critical for vendors to focus on device experience and meaningful technology and ecosystem value — beyond just hardware and cost — to ensure brand loyalty and improved margins.”

Going further into specific vendors and brands, Apple continues to lead tablet sales overall with 36% of all sales on that 70 million figure. Samsung, as expected, is using its bigger range of Galaxy tablets to catch up swiftly, with 37 million tablets sold for a 19% share — a huge leap considering that a year ago, for 2012, it only had 7% share compared to Apple’s 53%.

Among platforms, distant third Microsoft took a modest 2.1% share of total purchases, on sales that grew nearly threefold to 4 million, with Gartner noting that its ecosystem “still failed to capture major consumers’ interest on tablets.”

“To compete, Microsoft needs to create compelling ecosystem proposition for consumers and developers across all mobile devices, as tablets and smartphones become key devices for delivering applications and services to users beyond the PC,” writes Cozza. However, the updates announced last week during MWC, which will see more of Microsoft’s traditional PC tweaks restored to the tablet form factor, seems almost a move counter to this.

The challenge for Apple, Gartner seems to imply, will be to compete with lower-cost tablet makers and a consumer market that seems to care less and less about brands as it grows and takes in users so are more price-sensitive. “Apple’s tablets remain strong in the higher end of the market and, Apple’s approach will continue to force vendors to compete with full ecosystem offerings, even in the smaller-screen market as the iPad mini sees a greater share”, writes Cozza.

Emerging markets, Gartner notes, saw growth of 145%, compared to only 31% in mature markets.

Among other tablet vendors, ASUS and Lenovo were the only two others to sell enough volume to break out from the “others” category. (That latter group, incidentally, doubled sales to 60 million and grew market share to 31% — a sign of how, despite concentration among certain vendors, there is still a lot of fragmentation afoot.)

Among other tablet vendors, ASUS and Lenovo were the only two others to sell enough volume to break out from the “others” category. (That latter group, incidentally, doubled sales to 60 million and grew market share to 31% — a sign of how, despite concentration among certain vendors, there is still a lot of fragmentation afoot.)

Lenovo, Gartner notes, grew 198%, interestingly on the strength of the Yoga hybrid model and also sales of Windows tablets. While analyst Isabelle Durand notes that “establishing a strong brand with consumers outside China, which is especially important in the tablet market, remains a key challenge” for Lenovo, it will be interesting to see how it incorporates and leverages its new Motorola acquisition to achieve that. Indeed, given that Motorola has by far the strongest brand recognition in the U.S., that may even have been part of the strategy for acquiring the company in the first place.

As for ASUS, its success in the tablet category is tied to its bigger position in the “ultramobile” segment, according to Gartner. Ultramobiles, which saw sales of 216 million units in 2013 includes hybrids, clamshells and other form factors including tablets. Tablets account for the vast majority of ultramobiles at 90% of all sales but other ultramobile devices offer extra usability advantages such as easier-to-use keyboards for those doing a lot of typing. As you can imagine, the rise of the ultramobile has dovetailed with the decline of the PC.

“Although there were few models available last year, the hybrid form factor was the fastest growing category in 2013,” writes Cozza. ASUS, she notes, was the leader in the hybrid ultramobile segment in 2013, on the back of sales of its Transformer Book T100.