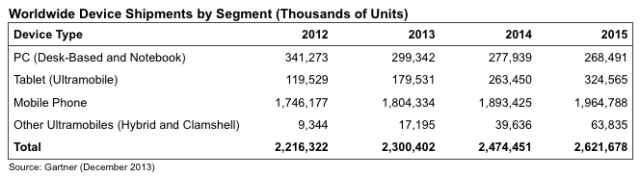

As the worlds of communication and technology increasingly become mobile-first, the traditional desktop PC continues to go the way of the dodo bird. The analysts at Gartner are today publishing their annual devices forecast, and they project 2014 to be another banner year for mobile — and its biggest player, Android. There will be 2.5 billion PCs, tablets and mobile handsets shipped this year. Of those, 1.9 billion will be mobile handsets, and 1.1 billion devices will be Android-based. Meanwhile, shipments of “ultramobiles” (tablets of all sizes) will for the first time this year outnumber those of PCs.

While PC shipments will decline 278 million units in 2014, ultramobiles — Gartner’s preferred term for those devices like Samsung’s Galaxy Note but also tablets — will rise to break the 300 million unit mark (combining tablet shipments of 263 million and shipments of “other ultramobiles” of 40 million units).

Overall, the 2.5 billion figure represents a rise of 7.6% for device shipments compared to 2013 (which had growth of half that rate, 3.8%), with the recovery engine being fuelled entirely by mobile devices: ultramobile shipments will go up by 54% this year; mobile phones 5%; but PCs will decline by 7%.

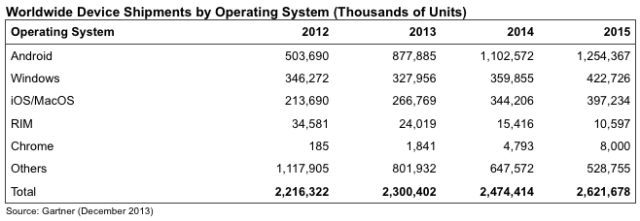

To give some context of Android’s rise — and of what role “mobile” plays in the device landscape — Google’s OS in 2014 will account for nearly 45% of all device shipments. In 2013, it was 38%. In 2015, Gartner projects it will be nearly 48%. The tipping point is nigh, and if you’ve ever wanted proof of how Google is today’s Microsoft, this is one starting point.

The same kind of domination is being played out in terms of the installed base. Among existing device owners, Android clocked 1.9 billion devices in use in 2013, while Apple had 682 million across both iOS and Mac, according to principal analyst Annette Zimmerman.

Looking at the installed base is important for a number of reasons: it indicates which device makers and platforms have the most dominant ecosystems. And this, in turn, will have a knock-on effect not only in terms of where developers will put their resources, but also where consumers making repeat purchases are likely to put their money.

Returning customers and brand/platform loyalty become ever more essential in saturated markets.

Gartner does not break out specific manufacturers, but Ranjit Atwal, a research director at Gartner, confirmed to me what you may have already guessed: just as Android dominates mobile, Samsung dominates Android.

That could, he believes, lead the company closer to developing its own, customized operating system, similar to what Amazon has done with its Fire OS. (Indeed, Samsung’s recent developer’s conference, with new SDKs for its different range of devices, seems to point in this direction, too.) The thinking here is that Samsung will want to control its own destiny better than it can do as a Google partner. That will include creating its own app experience, and its own ways of monetising that experience.

Further down the league table, Apple is getting closer to Windows in overall shipments, although Microsoft’s OS (which includes both Windows and Windows Phone) edges it out with 360 million units to Apple’s 344 million devices, or 14% of all devices shipped.)

Interestingly, Apple timed a release charting sales on its App Store to come out today. It notes that the company made $10 billion in app sales in 2013, with $15 billion paid out to developers to date since the App Store went live — meaning that developers have made $5 billion off apps in the App Store in the last six months.

The subtext seems to be that even if it’s in third place in terms of operating system shipments, it’s still the one bringing in money — an apt point considering Samsung’s less-than-encouraging profit guidance issued just yesterday. (It’s also a way of Apple making some noise during CES week.)

In terms of geography, Atwal tells me that China is continuing to set the pace for what is being bought and for how much — yes, this is partly because China is bigger, but it’s also because it encompasses two larger purchasing trends in consumer electronics: high-end, early adopting, big spenders; and those consumers who are significantly more price-sensitive but no less tech-crazy than their wealthier counterparts.

He says that in China, while smartphones continue to be sold in vast quantities, as the high end gets ever more saturated, we’re seeing an ever-greater emphasis on low-priced devices (think $100 and lower) for later adopters. That is being played out also in developing countries: by 2017, over 75% of Android’s volumes will come from emerging markets, says Gartner. Meanwhile, the segment of the market in China that has become saturated in terms of smartphone adoption is moving on to buying a lot more tablets and other ultramobiles.

But what Gartner is not putting into its forecast, in a way, is possibly more interesting than what is there.

There are no wearables or cars, or smart TVs — three other device categories that are becoming increasingly “smart” and being built on the same kinds of platforms that dominate more established categories like handsets, PCs and tablets — and if you take something like CES as a yardstick these newer categories are the ones making some of the loudest noise right now.

As a mark of their rising importance, Atwal tells me that these categories are likely to become part of Gartner’s overall device mix later this year.

Image: Flickr