The growth of tablet sales has been outstripping that of more traditional desktop and laptop personal computers for a while, and now it looks like we are finally approaching the tablet/PC tipping point, where the cheaper, more portable tablet is becoming the de facto PC: 2014 will be the year that tablets account for 50% of all “PCs” shipped globally, according to researchers at Canalys. Leading the charge will be tablets built on Android — which collectively will account for 65% of all tablets shipped (185 million units) with Samsung at the helm. Apple, with its growing line of iPad devices, will remain the single-biggest tablet brand, taking 30% of the market — and, significantly, the most profitable.

Profit, in fact, takes priority for Apple over market share, Canalys argues. “Apple is one of the few companies making money from the tablet boom,” writes Tim Coulling, a senior analyst with Canalys. “Premium products attract high value consumers; for Apple, remaining highly profitable and driving revenue from its entire ecosystem is of greater importance than market share statistics.”

All well and good, but longer term, the company that keeps market share is the one that keeps mindshare. Consider Microsoft, which Canalys predicts will only have about 5% of the tablet market. “To improve its position it must drive app development,” writes Canalys research analyst Pin Chen Tang. Developers tend to go to where the most avid users are.

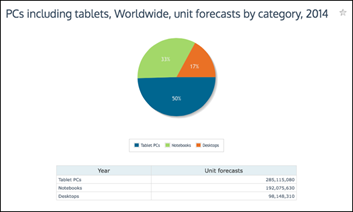

Canalys notes that 50% tablet share in PCs works out to 285 million tablets shipping in 2014. By 2017 that number will rise to 396 million units.

To chart how quickly the market is shifting to tablets, consider that in February 2013, Canalys noted that tablets accounted for only one-third of all personal computers shipped. For all of 2013, Canalys had predicting originally predicted that tablets will account for 37% of all PCs shipped, with some 182.5 million tablets out of a total 493.1 million units, although today it is revising that up to 40%. (I’m sticking to Canalys numbers, by the way, to keep it like-for-like, as other researchers will probably use different data sources and come up with different numbers.)

Given that Apple was an early mover and arguably established the very concept of a tablet market, what has happened to put Android in the lead? For the answer, look to trends in smartphones: Android tablet OEMs will control the market by sheer force of numbers (there are dozens of OEMs building devices on Google’s free Android OS), but also because they are being sold at a number of different price points, thereby tackling many different market segments in the process.

That is having a mixed effect in the PC market. Canalys notes that new tablets like the iPad Air and new iPad mini have helped Apple keep its market share up, and “will strengthen that position in Q4”, in contrast to other vendors who have seen their PC numbers tumble. However, longer term, its market share will decline because of the company’s focus on higher margins with premium-priced products. “Apple’s prioritization of protecting gross margins will see its PC market share continue to decline,” Coulling writes. “Apple’s decline in PC market share is unavoidable when considering its business model.”

This is already happening in some markets. Canalys notes that Samsung overtook Apple in PCs in the EMEA region in Q4 of this year, “and Apple will lose its position to competitors in more markets in the future.” Canalys notes that in Q3 2013 Samsung took a 27% share of all tablet sales. (And note, too, that a recent study released earlier this month from JD Power, the consumer sentiment researchers, put Samsung ahead of Apple in tablets for the first time, with a key focus on price.)

So where is Windows and historic PC king Microsoft in all of this? Canalys believes that Microsoft will account for 5% of the tablet market next year, with its acquisition of Nokia helping to push it closer to turning that market share around by turning the company into “a fully-fledged smart mobile device vendor.” Part of that will be about Microsoft removing some of the fragmentation in its own walled garden. “A critical first step is to address the coexistence of Windows Phone and Windows RT. Having three different operating systems to address the smart device landscape is confusing to both developers and consumers alike,” writes Tang.

If 5% sounds small, consider that in 2012, it took only 2% of shipments. Still, that’s very slow growth — with the question being whether we should consider this strong, oak-like slow growth, or just a general lack of interest in the product.

Longer term, we may be consolidating on a few platforms, but Canalys believes that price competition will cause further fragmentation when it comes to vendors and device makers.

“With the cost and time-to-market advantages afforded by their Chinese supply chain… small-to-micro brand vendors are eating up tablet market share. Vendors such as Nextbook in the United States, and Onda and Teclast in the People’s Republic of China ship more units than some of the major international top tier vendors in their home countries. The rise of small-to-micro brand vendors has proved that there is a demand in for entry-level Android tablets in every country and in every region,” writes Shanghai-based Analyst James Wang.

He believes that brands like Acer, Asus, HP, and Lenovo, with entry-level products at sub-U$150 price points, “have all entered the price war” but will find it hard to compete against smaller, local vendors.

That fragmentation will also spur consolidation. With companies like BlackBerry and Barnes & Noble already rethinking their place in the tablet market, “expect 2014 to bring a flurry of acquisitions, mergers, and failures as PC hardware vendors of all sizes struggle to maintain their desktop and notebook business while attempting to capitalize on a tablet market that will see great volumes driving limited value.”