Some developments for 7digital, the UK-based music platform that powers download and streaming services for the likes of Samsung, HTC, T-Mobile and Pure: it has entered into acquisition talks and a “reverse merger” with UBC Media, a radio program producer, developer of interactive audio technology, and software investor (it’s the largest shareholder in Audioboo, a platform where you can make and share audio recordings). As part of the deal, UBC is providing 7digital with a £1 million ($1.6 million) loan that can be converted into shares in UBC — which is publicly traded in London on the AIM exchange.

On top of that, 7digital is announcing a couple of expansions of its service — confirmation that it is powering a new streaming service from HMV in the UK and Ireland; and a deal with Apple/Intel-backed Imagination Technologies‘ Pure to power a streaming service in the U.S. to complement its Jongo wireless speakers.

Imagination Technologies, in fact, is both a strategic investor in UBC as well as 7digital. It came on as a backer to 7digital as one of the two undisclosed companies in its last $10 million venture round in 2012 (Dolby is the other), with $7 million coming from Imaginational. Ben Drury, CEO at 7digital, claims that having Imagination Technologies as a common investor was more coincidental and convenient than it was a part of the original interest between the two companies.

The news comes amidst a lot of other shifts in the digital music marketplace: among them, Spotify securing a $250 million investment; Rdio laying off employees; Deezer apparently making a stronger move to tackle the U.S.; AOL shutting down more of its own music services; and Turntable pivoting into live events. Taken together, these are all signs of consolidation in the market, with the big fish vying to become stronger, and the smaller among them falling by the wayside.

In that context, 7digital has been something of a minnow. Although it has its own consumer-facing service, it has perhaps more importantly played a role in how other, bigger-name companies have been able to build out digital music plays to compete against the likes of iTunes from Apple. By way of an API, 7digital takes on all the infrastructure management, licensing and reporting for these third parties, which include Samsung’s MusicHub, BlackBerry’s music store, and the Pure Music service. Former partners include Spotify (which used it to power a download service, which it then took in-house and then axed altogether). In total, 7digital says that these wholesale-style services and its own consumer-facing product are growing, with traffic up 225% in the last six months to pass 1 billion requests per month.

Still, given that part of this deal involved a £1 million loan, it’s unclear whether that existing business was providing lucrative enough returns, or at least enough to help the company fuel its next stage of growth. UBC notes that in 2012 7digital’s revenues were £11 million ($18 million), compared to £3 million ($4.9 million) in 2009, making it about four times the size of UBC, with a combined valuation of about £50 million ($80 million). Before today, 7digital in total raised some $18.5 million in venture funding, with other backers including Balderton Capital (formerly Benchmark in Europe) and Sutton Place Managers.

In fact, Drury, who is also a co-founder at 7digital, notes a few reasons for tapping UBC instead of going it alone. First, there is funding: with 7digital founded in 2004, it’s not really playing in startup territory anymore. “We may call ourselves that, or others may call us a startup, but we’ve been around for almost 10 years,” he told me in an interview.

Second, there is speed of execution: “Going on to AIM by way of a reverse takeover of UBC is a way to accelerate our development,” he told me. “This is a faster path.”

Third — and perhaps most interesting for those watching how the digital music space is evolving — is what UBC would bring to 7digital in terms of product. The company owns several patents, it has an extensive catalog of audio archives, and it has infrastructure in place to create original content — “a skillset that could be adapted for the kinds of customers that we work for,” Drury noted.

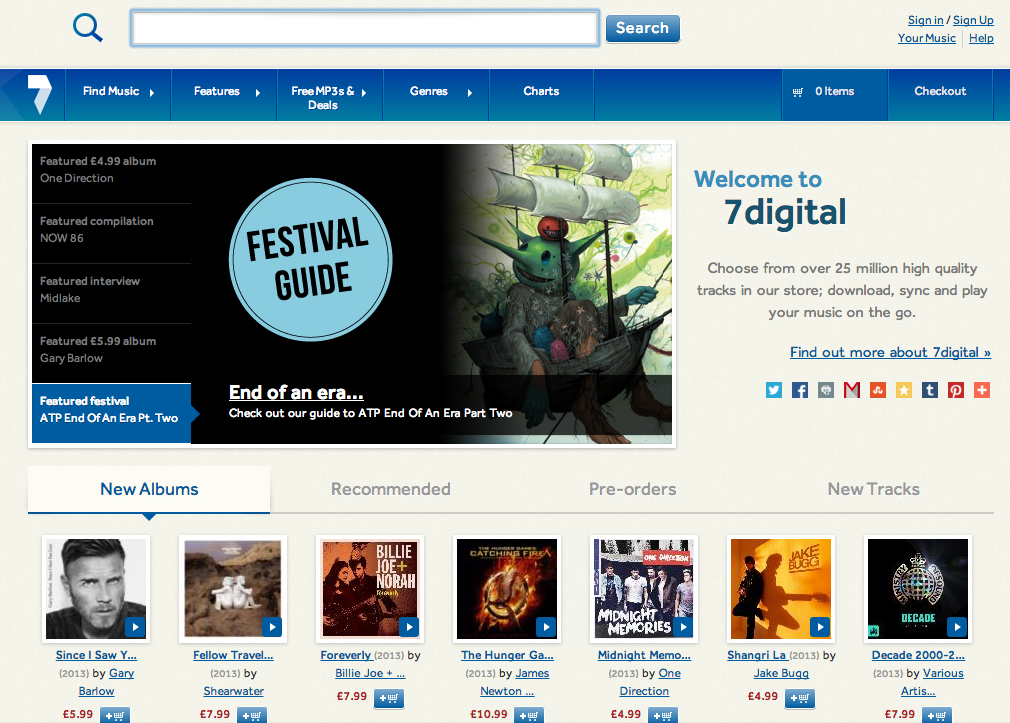

What could that mean? Right now, he says, the buzzword in digital music is “curation” and how to whittle down and shape the huge mass of music that customers have at the tips of their fingers but without much shape about what to listen to next. (Yes, the old water, water everywhere conundrum.) It sounds like what 7digital might be looking to do is help produce original content, or at least services that help point users to more tailored listening experiences that cut through the 7digital catalog.

His example: UBC currently produces a show for BBC Radio, called “Pick of the Pops,” which picks a year and then runs through music from it. “Imagine that strong editorial role being adapted for the on-demand age,” he told me. Along with that will come an evolution of the streaming music business model to offer more targeted “microsubscriptions” around particular genres or even playlists — not unlike the vision that Deezer is also eyeing up, creating deals that cut up the typical $10/month, all-you-can-eat offerings.

“Our platform and partnership roster has been growing steadily over time and we see continued interest in music globally, across online radio, subscription streaming, and downloads. We will continue to develop and scale the platform, and to innovate with new products and features,” Ben Drury, CEO of 7digital, noted in a statement. “Radio, in particular, is an area where we see a lot of future opportunities, and we are thrilled that our new strategic investor and partner, UBC, shares this vision.”

UBC says that the deal will play into a wider strategy that it has to develop more digital services around audio content, with the interactive media market offering “the best opportunity for growth as so-called ’connected’ devices became more important for the consumption of content.”

UBC and 7digital’s non-legally binding Letter Of Intent says that the two will outline terms of a potential acquisition of 7digital by UBC by no later than December 16, 2013, “with a view to entering into a definitive sale and purchase agreement by 30 April 2014.”

UBC says the new publicly-listed company would combine its existing UBC assets, its investment in Audioboo, and 7digital, with 7digital’s Drury would become the CEO and UBC’s CEO Simon Cole taking on the role of chairman. Customers would include the BBC and Yahoo (two of UBC’s current clients) and Samsung and HTC (two of 7digital’s), with business operations in 42 countries and covering 5 million registered users and services pre-loaded on 60 million mobile devices. “In content terms, the new company will have an archive of thousands of hours of entertainment programming, producing 1,200 hours of new material a year and have a licensed catalogue of 25 million music tracks and audiobooks,” UBC notes.

Updated throughout with comments from 7digital CEO Ben Drury.