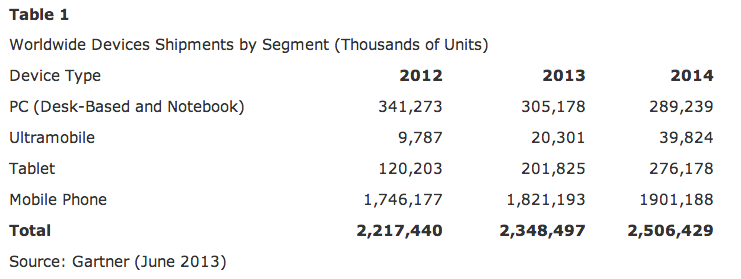

Gartner today has released its latest figures charting its overall predictions for how IT devices — from PCs to mobile handsets — are going to perform this year and in 2014. As in years before, numbers will continue to climb: in 2013, total shipments will rise 5.9% to 2.35 billion, and will rise again in 2014 to 2.5 billion units, driven by portable, often less expensive, but just as powerful mobile devices such as smartphones and tablets. Android will account for just over one-third of all devices this year, and nearly half in 2014. It’s an Android world after all.

But continuing a trend we have been seeing for some time, personal computers — which kicked off the technology love affair for consumers — will not be the hardware reaping the most benefits from that growth. PC shipments will decline this year to 305 million units, Gartner says, before dropping again in 2014 to below 300 million (289 million).

Mobile devices will continue to replace PCs as consumers’ primary computing device, leading with smartphones, which will continue to be the most popular IT device sold. The 1.8 billion units in smartphones that that Gartner estimates will be shipped this year equates to about six times the number of PCs. And while tablets are still far behind both at only 201 million units, they will be growing the fastest, up some 68% on 2012. In comparison, mobile phone growth is 4.3%, actually slower than the overall average of 5.9%. And this is far from being a simple first-world trend or emerging market trend:

“Consumers want anytime-anywhere computing that allows them to consume and create content with ease, but also share and access that content from a different portfolio of products,” writes Carolina Milanesi, research vice president at Gartner. “Mobility is paramount in both mature and emerging markets.”

“Shipments”, as we’ve pointed out before, refers to devices sent to channels for sales. Some analysts use the term interchangeably since these are estimates; and they are an important barometer for how sales are proceeding and users are moving. Indeed, in an example of shipping estimates at work, Gartner notes that the “sharp decline in PC sales recorded in the first quarter was the result in a change in preferences in consumers’ wants and needs, but also an adjustment in the channel to make room for new products hitting the market in the second half of 2013.”

The “ultramobile” group is an odd one and it will be interesting to see how this evolves. This is Gartner’s preferred term for the neither-here-nor-there category of hardware that includes devices like Chromebooks, tablet/PC hybrids and non-traditional “phablets”, and Gartner’s guess is that whatever impact they will have on sales will be to the detriment of tablets rather than PCs or smartphones:

“The increased availability of lower priced basic tablets, plus the value add shifting to software rather than hardware will result in the lifetimes of premium tablets extending as they remain active in the household for longer. We will also see consumer preferences split between basic tablets and ultramobile devices,” writes Ranjit Atwal, research director at Gartner. Specifically, in Q4, he notes that ultrabooks will hit the market built with Windows 8.1, equipped with new Intel processors Bay Trail and Haswell.

In any case, ultramobiles’ impact will be minimal for now. Out of the 2.35 billion devices shipped this year, only 20 million will be ultramobiles.

Perhaps more to the point will be the fact that cheaper smartphones and tablets will see another kind of pressure: the growth of software that will extend the life of these devices, which will mean users will be less inclined to spend money upgrading them.

“The increased availability of lower priced basic tablets, plus the value add shifting to software rather than hardware will result in the lifetimes of premium tablets extending as they remain active in the household for longer,” writes Atwal.

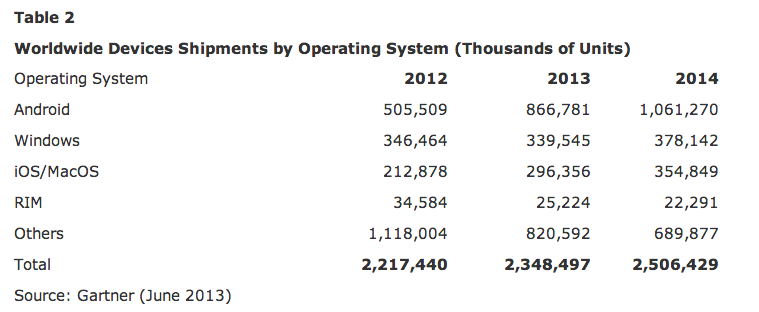

When it comes to platforms, there aren’t many surprises here. Android — which has been dominating the computing industry for a while now with very ubiquitous smartphones running on Google’s OS — will continue to ride that wave. This year there will be 866 million Android units shipped — or roughly one-third of all the devices that will be sent out for sale. Android devices will continue their climb, at a rate faster than that of overall devices. They will hit the billion-unit mark in 2014, with 1.06 billion Android-powered units, equating to just under half of the 2.5 billion devices sold that year.

As you can see from the figures above, Apple is not winning in terms of having the most ubiquitous platform — and it’s not even a close second contender. But interestingly, Gartner points out that it is the most successful at achieving a cross-device ecosystem.

“Although the numbers seem to paint a clear picture of who the winner will be when it comes to operating systems (OS) in the device market, the reality is that today ecosystem owners are challenged in having the same relevance in all segments,” writes Milanesi. “Apple is currently the more homogeneous presence across all device segments, while 90 percent of Android sales are currently in the mobile phone market and 85 percent of Microsoft sales are in the PC market.” What she also didn’t note is that while Samsung is the strongest in smartphones, there are dozens more making Android devices, and in PCs the picture is much the same. This points to how Apple may be better positioned to capitalize on making the best margins not just on their hardware, but also on the services that they lock consumers in to using across all of it.

Samsung, it should be pointed out, is a strong contender in all these categories as well, so it will not be surprising to see it making moves to offer more services that tie in their different devices together. The question remains, though, whether companies like Microsoft and Google who have been so far strongest in software will try to expand that more into hardware. Results so far have been mixed.