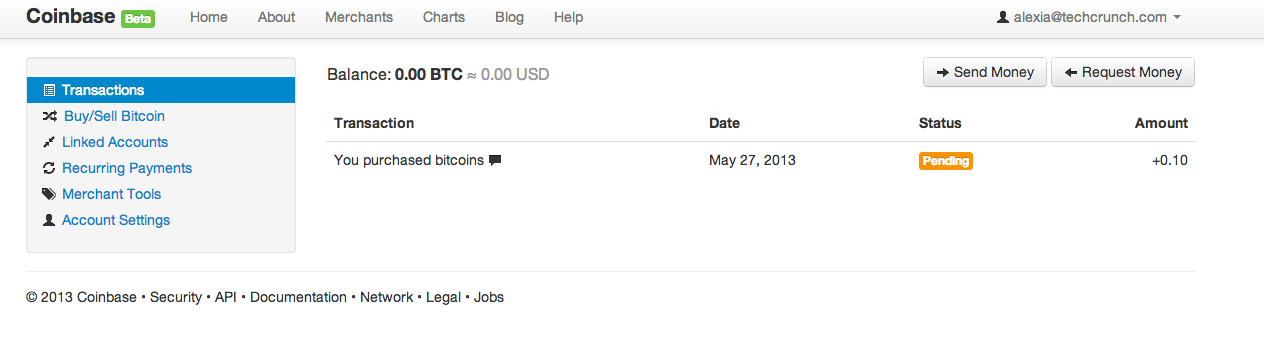

Because why do anything other than try out hot technologies on Memorial Day, I just bought some Bitcoin. I might finally play Dots and maybe 3D-print an ear later this afternoon.

I would not have bought my .1 ($13.17) in Bitcoin if it weren’t for a startup called Coinbase, which is “one of the places that looked less sketchy,” according to TechCrunch editor and Bitcoin bug John Biggs. “It’s one of the ones I would tell my Mom to use,” Biggs insisted. Indeed, if your mom knows how to link a bank account to a Fidelity or Charles Schwab account and buy mutual funds, buying Bitcoin through Coinbase is a similar deal. Just input her account and routing number, verify a couple of small transactions and your mom will be one step closer to Silk Road.

As a Bitcoin wallet, an exchange and a merchant payment-processing system, Coinbase is one of the most, if not the most, “legit,” user-friendly Bitcoin startups out there, a position it solidified by raising $5 million from Twitter investor Fred Wilson among others — the largest investment to date in a Bitcoin startup. It took Wilson over two years to find a Bitcoin startup that had what it took: a solid team, product and plan. And Coinbase’s founders have a pretty legit pedigree — with Brian Armstrong and Fred Ehrsam having spent time at Airbnb and Goldman Sachs, respectively.

In addition to investor interest, the startup is beginning to see some traction. In January, it launched its Bitcoin-to-US-dollars exchange feature, and saw $1 million converted in and out of Bitcoin. In February it saw $2.5 million, and this April the startup saw $15 million — figures inevitably increasing with the rise in the Bitcoin exchange rate. Armstrong holds that the company, which takes a 1 percent transaction fee from all conversions, is growing 15 percent week-over-week in terms of transaction volume, revenue and users signing up. “Coinbase is becoming the most trustworthy consumer brand in Bitcoin,” investor Bobby Goodlatte told me.

Any abstracted currency –gold, fiat money, Klout — has value because the collective believes it has value, unlike, let’s say, food, which is a resource that actually has inherent value that you can trade currency for. Like a lot of things in life, currency is like the Emperor’s New Clothes: As long as we all believe that a Starbucks latte is worth $3.50 in San Francisco it continues to be. The trick is now convincing people it is also worth 0.03 BTC.

As to when that will happen, the jury’s still out. Will people lose trust in a string of random digits? Will Bitcoin be the Friendster to Ripple’s Facebook? How big a business can you build taking a 1 percent transaction fee off conversions of a currency with a $2 billion market cap?

And, most importantly, when will it be easy to buy a Bitcoffee at Coupa Cafe in Palo Alto? When I called Coupa today to ask, the first person I spoke to had no clue. Apparently I have to “Send Money” using Coinbase to Coupa’s wallet. Which I can’t do via the Coinbase iOS app.

Max Wright, author of the Bitcoin Revolution, estimates that Bitcoin will go mainstream — i.e. where multiple vendors in the vast majority of niches accept Bitcoin as payment — in the next 24-36 months. Okay. “Bitcoin’s advantages over traditional banking and credit systems are undeniable. Bitcoin has zero transaction costs, which is a huge advantage over our existing credit card, pay-on-line paradigm that incurs fees of 2-5 percent on every transaction.”

A16z partner and OpenCoin investor Chris Dixon, who called the digital currency “the red pill” at TechCrunch Disrupt NY, was more circumspect as to an exact date of Bitcoin mass adoption. “These things are incredibly hard to predict. Bitcoin could flame out altogether. The key to going mainstream is for technologists and entrepreneurs to build out the infrastructure to make Bitcoin easier to use, easier to integrate, more reliable, more trustworthy, etc. This means both back-end technologies and merchant/consumer-facing services. From what I can tell, this is beginning to happen. ”

As to what Armstrong, who pays his employees in Bitcoin, tells skeptics, “In our mind, it’s just low fees. If you can reduce fees it means more money in consumers’ pockets, and that means more money in small business owners’ pockets.”