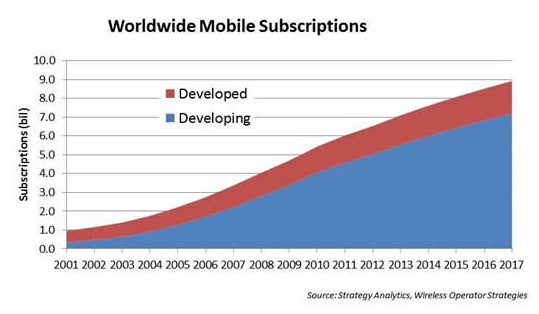

A huge theme of this year’s Mobile World Congress tradeshow, which took place last week, was connecting the “next billions” to the mobile Internet. Looking at the chart above — part of a new report out today by Strategy Analytics — it’s not hard to see why. It’s both a huge opportunity for carriers, mobile makers and app developers, and inevitably an affordability and margins challenge. Analyst Strategy Analytics is forecasting that the worldwide base of mobile subscriptions will rise to 8.9 billion over the next five years — and a massive four out of five of these (80 per cent) will be in developing countries. China and India will account for the bulk of emerging market subscriptions, according to the analyst, but it also expects “rapid growth” in the Middle East and Africa.

As you’d expect, developing countries will also see much higher growth in mobile subscriptions than developed countries. Writing in the report, Worldwide Cellular User Forecasts, 2012-2017, the analyst predicts that subscriptions in developing countries will grow at a compound annual rate of 7.5 per cent — a rate it describes as “substantially faster” than the 2.8 per cent growth that will be seen in developed countries. The analyst name checks Nigeria as a country with a mobile services revenue growth rate that is forecast to be twice the worldwide average — the latter is predicted to be just two per cent through to 2017, according to Strategy Analytics’ figures.

While the majority of devices in developing markets are likely to be basic mobile phones, focused on talk and text, rather than fully featured smartphones, the analyst points to the opportunity created by a growing middle class population in Africa, noting that the African Development Bank estimates more than a third of Africa’s population in 2010 — some 350 million people — could be counted as middle class, up from 220 million in 2000. “Of course there is still a lot of demand for basic products and services, but the growing middle class is starting to demand more extensive data services on a widening range of smartphones, high-end feature phones, and tablets,” said Tom Elliott, Director of Emerging Markets Consulting, in a statement.

Mobile maker Nokia has had some success with a low-end device strategy that has been seeking to blur the line between mobiles and smartphones, such as its Asha line of Series 40 handsets. At MWC, Nokia also announced an $85 feature phone with some smart extras, including the ability to share photos to social networks. Nokia has also focused on lowering the total cost of ownership of these quasi-smart devices, with long battery life and a cloud web browser which compresses data before delivering it to lower browsing costs, to help boost affordability.

Nokia is not the only mobile company focusing on the low-end either. Mozilla’s open web HTML5 Firefox OS, which gained considerable carrier backing at MWC, is also targeting markets with large numbers of people who may not have been able to afford smartphones as yet. The Samsung-backed Tizen OS is another potential low-end contender. Other open source players that are hoping to snatch share at the low-end include Jolla with its Sailfish OS, and Canonical’s Ubuntu. At MWC carrier Bharti Airtel, which operates in India and Africa, called for $30 smartphones to help push down the affordability barrier.

Overall, mobile subscriptions are growing faster than the global population, according to Strategy Analytics. By the beginning of next year it predicts there will be more mobile connections than people in the world.