Debt-management focused Student Loan Hero is ramping up the competition in the “Mint for Student Loans” space, with now 2,000 people on board, $63 million in debt under management, a platform built on proprietary technology (not Yodlee, like some of its nearest competitors), and a little bit of seed funding from Expansion VC.

Just a little bit, though. Previously, the company had funding from Startup Chile, and more recently, from the new ed tech-focused Socratic Labs in New York, which generally puts in around $15,000 to $20,000. In other words, we’re looking at getting-off-the-ground money here, totaling under $100K. However, the company is currently in the process of raising an advisory round, we’re told.

Student Loan Hero competes with services like Tuition.io (formerly Binksty), LoanLook, and to a certain extent, broader debt wranglers like ReadyForZero. The idea is timely, of course, given the trillion dollars in student loan debt, and the chatter in the media that student loans are the “new subprime.”

But like most companies we cover, the idea was first born of personal need. Although co-founder Andrew Josuweit says that when the company first entered Startup Chile, it was focused on another space entirely (app recommendations), it soon shifted to student loan debt because as the problem really resonated with his own experiences. (Also, app recommendations is a crowded space.)

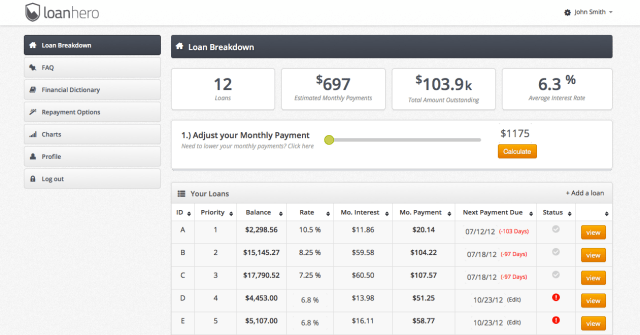

“Ever since I graduated from college in 2009, I’ve been followed by personal loan debt,” says Josuweit. “I graduated with $104,000 in student loans, across 16 loans from four different banks.” To keep up with his payments, due dates, addresses, payment schedules, and more, he put all his loans into an Excel spreadsheet. “My banks and my college weren’t really providing me with financial strategy to get out of debt faster, so in the spreadsheet I was running financial calculations…it was a nightmare, to be honest,” he says.

In March of last year, the concept for Student Loan Hero was finalized, a prototype was done by August, and it debuted as a public beta in October. The service, similar to its competitors, has users entering in their banking and loan credentials to get started. It also asks a series of questions during the sign-up process, in order to determine the programs you may qualify for. Student Loan Hero’s “secret sauce” includes proprietary data scrapers that pull info about your loans from the federal student loan database and SallieMae, for now.

It then helps you identify savings by running an amortization schedule. “Our average user has $52,000 in student loans, and we can save that person over $5,000 if they apply an extra $100 per month,” says Josuweit. It also identifies the various government programs users may be eligible for, he adds, noting that there are over 30 programs for public loans out there. Some people don’t know about other options, too, like consolidation and income-based repayment, or how to deduct the loan’s interest on their taxes.

Long-term, the vision for Student Loan Hero is not all that dissimilar from Mint – that is, once you generate these financial profiles for users, you can then target them with other offers for things like loan refinancing, or other types of loans, like mortgages or auto loans.

The company is currently working as a distributed team of six, with folks in Santiago, New York, San Diego and Toronto. Free sign up is here.