Intuit’s Mint has one less competitor now. Adaptu, a Portland-based startup that positioned its mobile wallet as an alternative to Mint, is closing its doors. The company announced the change via its website and in emails to its subscriber base. According to the company, the decision was made because Adaptu didn’t want to have to transition away from its free model in order to remain in business.

The company is now working with users to transition them off the platform before its final shutdown on February 20, 2013. Users are receiving both emails and mobile alerts, and Adaptu has updated its main website, as well as its social media channels with the message about the closure. Support teams are staffing the support@ email address, too, in order to answer users’ questions before the final shuttering.

Things at the company started to look questionable when co-founder Mark Brundage left for Salesforce in May 2012 where he now serves as “Director of Customer Success.”

In addition, Adaptu owner StanCorp Financial Group has been in a bit of financial trouble itself lately, reports OregonLive. The insurer announced last month it would cut 100 positions company-wide, as it struggled to grow earnings. The article also noted that Adaptu only saw 2,000 uniques per month to its website (per Compete data).

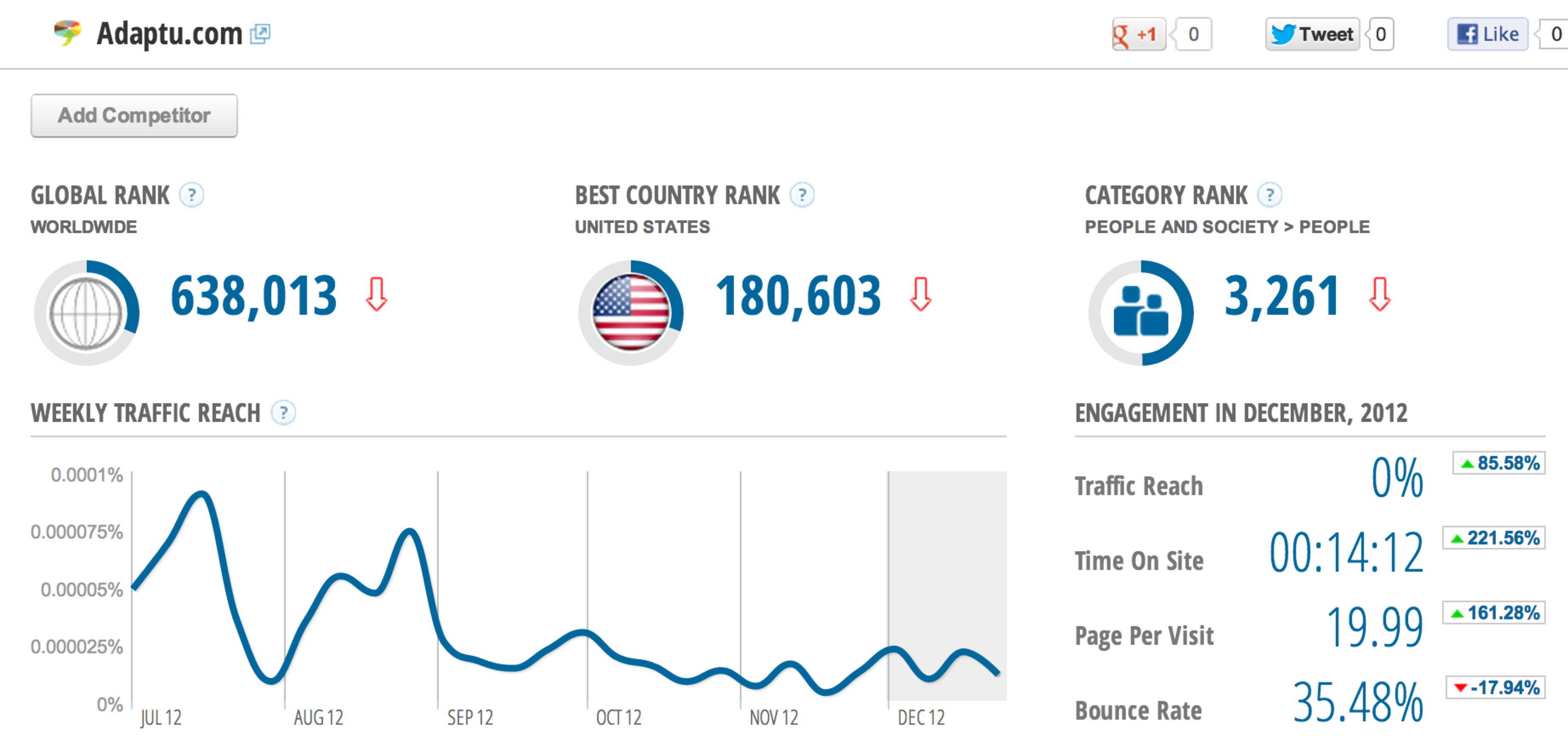

Checking with SimilarWeb, it’s clear the company was on the decline over the past year:

The service competes not only with Mint, but also with LearnVest and HelloWallet, all of which the company recommends to its users in the online FAQ about the closure. While Adaptu can’t help users transition data itself, it is offering a CSV export option for transactions. User accounts and other data will be deleted from company servers on 2/20/13, the FAQ notes.

Startups fail all the time, but Adaptu was not exactly a bootstrapped effort. Rather it was a subsidiary of a larger entity, which makes its closure a bit more unique. The product was a decent-enough Mint competitor, but its mobile wallet functionality didn’t seem to offer users a compelling enough reason to switch. Personal finance, despite its huge importance in our everyday lives, isn’t something that can easily attract massive numbers of users. And for a breakout hit to occur, we need more than an incrementally improved version of Mint (if you can even argue Adaptu was that). We need a groundbreaking new way to manage and track our money. You know, like Mint was when it first debuted.

Full text from the website, excluding the FAQ, reads:

Adaptu was launched as a free service to help people gain better control over their financial lives. Over the past few years, we have been humbled by our customers’ enthusiasm for the content and tools we provide on adaptu.com as well as our mobile apps. Instead of expanding the service in ways that would have required a transition away from a free model, we have decided that the time is right to discontinue the Adaptu service.

UPDATE: Adaptu would not reveal the number of employees at the time of the service’s closure, but all are receiving “job placement assistance,” a spokesperson says, “either within The Standard or externally, as well as a separation package that includes severance pay and other benefits.” A LinkedIn search shows 17 employees, however.