Cash-based payments platform PayNearMe has raised additional financing, the company announced today, in a Series D round led by August Capital with participation from other existing investors including Khosla Ventures, Maveron, and True Ventures. The news comes alongside the launch of the company’s latest product, PayNearMe Express, a self-serve platform that lets any business sign up to accept cash payments from PayNearMe customers.

PayNearMe, which was once known by the name “Kwedit,” focuses on bringing an alternative payment mechanism to under-banked and unbanked here in the U.S. The company works with business partners both online and off, which provide consumers with a payment slip which they can either print out or access on their mobile phone. The slip has a scannable barcode or numerical code, which merchants scan or key in at point-of-sale to accept the cash payment. For example, some utility companies use PayNearMe to allow their customers to pay their bills in cash at 7-Eleven convenience stores. Through a recent partnership with property management software maker AppFolio, tenants can pay their rent at 7-Eleven or ACE Cash Express stores.

Currently, PayNearMe customers can make payments at 7,000 7-Eleven stores or 1,600 Ace Cash Express stores, and in the first half of this year, the company will add two more major retailers which will “significantly increase the size of its footprint,” says PayNearMe CEO, Danny Shader. He can’t reveal which stores yet, but one is a big nationwide chain while the other is an important regional chain.

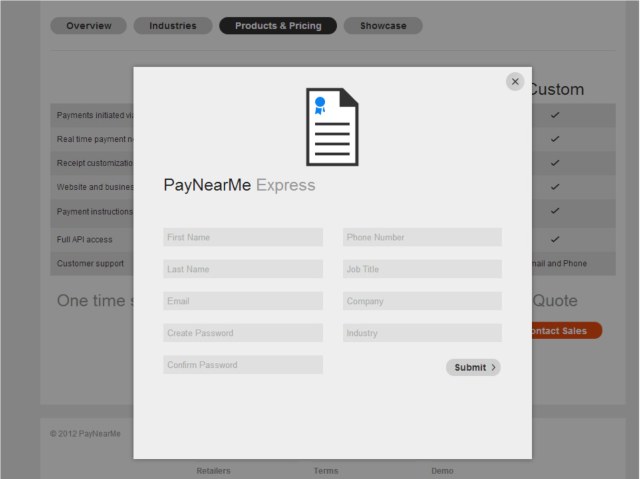

Starting today, PayNearMe is bringing that same type of system of cash-based remote payments to other interested business partners, through the self-serve system. Initially, PayNearMe Express is targeted towards property managers, lending companies, educational providers (including daycares), and collection agencies.

Shader says that PayNearMe’s volume has tripled year-over-year from 2011 to 2012, but the limitations on growth have to do with the technical integrations PayNearMe requires. “The ‘a-ha’ we had was that if we could get I.T. out of this entirely, then there’s an incredible number of merchants that would take advantage of the system,” says Shader. With Express, merchants can get set up without any I.T. assistance. “We can go from addressing hundreds of companies around the country to tens of thousands,” he adds. “It’s the democratization of cash acceptance for remote businesses.”

For merchant partners accepting the cash, like 7-Eleven, the benefit to using the system isn’t just the commission paid on the transaction (an undisclosed fee that varies by business type), but also the increased foot traffic to their stores. Meanwhile, for the businesses integrating with the system – the lenders, property managers, etc. – it gives them an alternative to having to touch cash or money orders, which Shader says they hate. “If you miskey the amount,” he explains, “there’s no trace on it. If I paid you with a check and you credited the amount, I could show you the cancelled check. But if you entered the wrong amount or you credited the wrong account [with cash or a money order, e.g.], we’ve got a conflict and there’s no way to resolve it,” he says. “Cash is a security risk.”

Now that the self-serve platform is in place, Shader says the company’s next focus will be to bring its system to other smaller merchants, specifically online stores, like those merchants using Shopify or Yahoo Stores, for example. In fact, he notes that the team had started out thinking about doing a widget, which is what initially led them to create the more robusts Express Platform in the first place. The company will likely just launch an additional template for online merchants, which will be available in the Express platform as another menu choice in the near future.

Update: The original version of this post had the number of 7-Eleven and ACE Cash Express stores incorrect. We’ve updated to address the error.