Euclid, the new startup from the creators of Urchin, a company Google acquired which then became the basis of Google Analytics, first introduced its offline customer tracking solution – or “Google Analytics for the real world,” as the team calls it – just over a year ago. Today, Euclid is rolling out a new version of its solution called “Euclid Zero,” which is the first time businesses can use its cloud-based software without having to install a hardware sensor device in their stores.

Traditionally, retailers have used everything from basic door clickers to optical solutions like beams above a door or video cameras to track their customers’ comings and goings. But Euclid had a different idea – it could passively detect customers’ smartphones with Wi-Fi enabled and collect their phones’ MAC addresses. Because MAC addresses are unique to each device (although not personally identifiable info), Euclid hashes the MAC address before storing the number on its servers. It also contractually requires that its customers place signage in their stores informing customers of opt-out procedures.

The company’s flagship solution, launched in late 2011, uses preconfigured sensors which are connected to the switch in the network closet. This allows the business to track how many people walk by a store, enter, how long they stay, and more. “We’ve been very focused on providing Google Analytics for the real world, where instead of the clickstream, you get the footstream,” says Euclid CEO Will Smith, whose background in retail complements that of COO Scott Crosby, Urchin co-founder. (Brett Crosby, also an Urchin co-founder, sits on Euclid’s board.)

Today, the company is debuting Euclid Zero, which is being offered in partnership with several wireless access point providers including Aerohive Networks, Aruba Networks, Fortinet, Xirrus, and soon others. Since many retailers already have those devices in their stores, they can now forgo the sensor installation and configuration, and simply switch on the new Euclid feature in their Wi-Fi management console. The Xirrus partnership, in particular, will allow Euclid to go after a new market as well: event venues and conference centers.

Smith says the solution has a big appeal in an era when Amazon is crushing brick-and-mortar retailers left and right. “The big advantage that Amazon has now is data,” he explains. “Data is what allows Amazon to acquire customers cheaply, and make sure they’re engaged and getting through the site seamlessly. We’ve been making the same pitch to offline retailers – ‘we’re going to give you the same tools that Amazon uses to compete with you.'”

When the Palo Alto-based company opened its doors to U.S. testers a little over a year ago, it had primarily been working with retailers in the San Francisco Bay Area, like Philz Coffee, but today it has dozens of national retailers using its software. While it does have some non-obvious locations – like a Western wear retailer with stores in Montana – most of its customers are in San Francisco, L.A., and New York.

That customer list will continue to grow, says Smith, as Euclid brought on Sandra Dolan, a founding team member at competitor ShopperTrack, to help it onboard new businesses. The majority of its customer base includes retailers in the top 100, and it will make additional announcements about customer base in the future, Smith says.

To give a picture of its traction, Smith noted that Euclid has grown from 1 million “events” per day (meaning the Wi-Fi pings it collects) to 3 billion. One smartphone could register multiple pings, however, so that’s not an indication of how many customers have been tracked using Euclid’s solution.

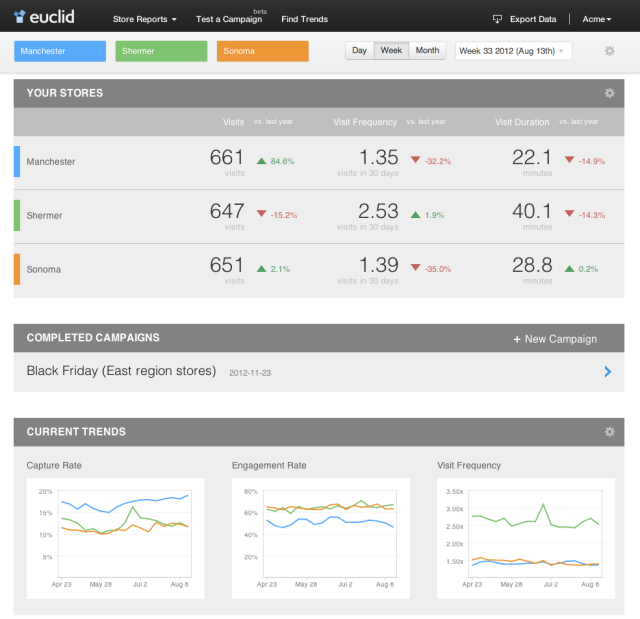

Euclid recently updated its customers’ dashboard, which now allows new views into the data, including bounce rates and ways to see how behaviorally similar groups act. It’s currently working to improve the export process to support integration with retailers’ own business-intelligence solutions as an alternative to having them download a CSV file.

There are other startups, like TechCrunch Disrupt 2011 finalist Prism Skylabs (which recently raised $7.5 million in Series A funding), working to innovate in the retail analytics sector, but Smith argues that his startup offers more relevant data for retailers. “These heatmap companies, these video companies are interesting, but as far as the metrics that drive a retail business, they’re not touching that many of them,” he says.