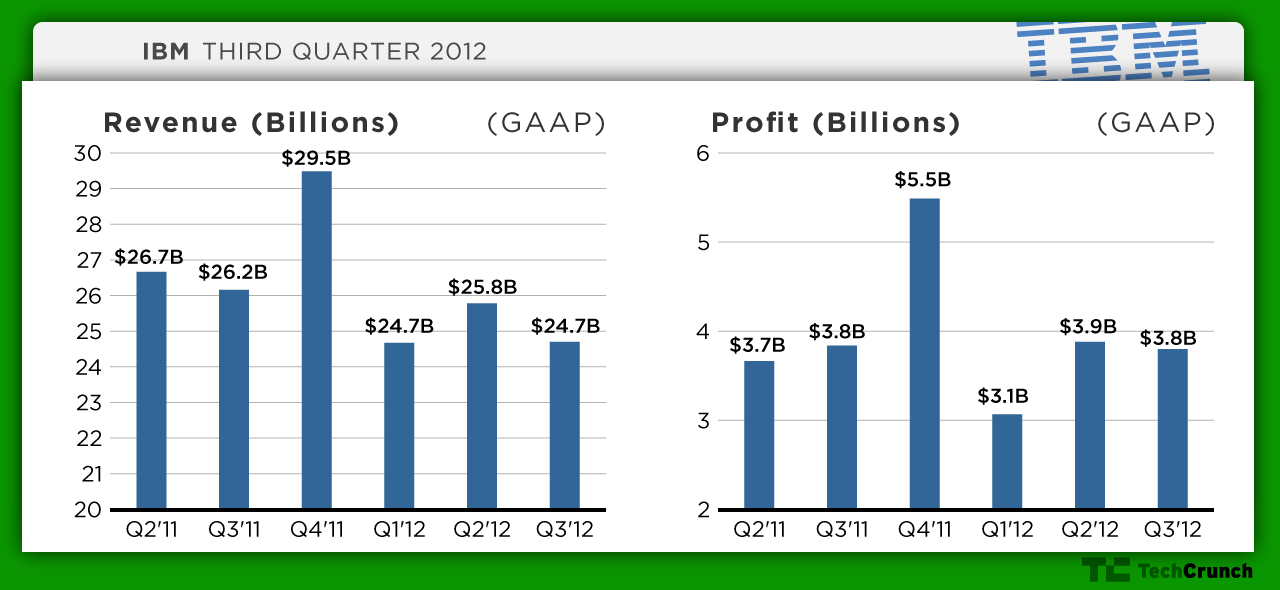

IBM just released its Q3 2012 financials. Big Blue’s GAAP earnings came in at $3.8 billion, up 3% from the last quarter. Non-GAAP earnings were $4.2 billion. Overall, the company reported revenue of $24.7 billion, down from $25.8 billion in Q2.

Ahead of the earnings release, most analyst expected that Big Blue would report robust earnings. The consensus was that earnings per share would increase to around $3.62 (up from last quarter’s $3.51 non-GAAP EPS), but that overall revenue would decline to about $25.4 billion from $25.8 billion last quarter. With $24.7 billion, the company missed the analysts’ expectations.

IBM’s last quarterly earnings were mixed. While revenue was down 3 percent compared to the previous quarter, IBM noted that, after adjusting for currency, it was actually up 1 percent. This time around, the company argued that, after adjusting for currency, its revenue would still have been down 2 percent. Currency fluctuations impacted revenue growth by nearly $1 billion.

IBM’s non-GAAP gross profit margin for Q2 2012 was 47.6 percent. For Q3, the company reported an improved non-GAAP profit margin of 48.1 percent.

The company did not provide any guidance for Q3 in its last earnings release, but it did raise its full-year EPS expectations to at least $15.10 in its last quarterly release.

“In the third quarter, we continued to drive margin, profit and earnings growth through our focus on higher-value businesses, strategic growth initiatives and productivity,” said Ginni Rometty, IBM chairman, president and chief executive officer.

“Looking ahead, we see good opportunity with a strong product lineup heading into this quarter and annuity businesses that provide a solid base of revenue, profit and cash. We are reiterating our full-year 2012 operating earnings per share expectation of at least $15.10.”

IBM’s share price has been rallying lately and the stock just hit a multiyear high earlier this month and is up about 11 percent year to date.

Here are some details for IBM’s various business units:

- Software revenue down 1 percent, up 3 percent adjusting for currency

- Services revenue down 5 percent, flat adjusting for currency

- Services backlog of $138 billion, up 1 percent

- Systems and Technology revenue down 13 percent, down 12 percent adjusting for currency

- Growth markets revenue down 1 percent, up 4 percent adjusting for currency

- Business analytics revenue up 14 percent year to date

- Smarter Planet revenue up more than 20 percent year to date