Sign of a maturing marketing flattening out, a lack of compelling devices, or a contraction in the economy? Gartner today released figures that note that worldwide sales of mobile phones were actually down by two percent this quarter, to reach a total of 419.1 million units — the first time the market has declined since the second quarter of 2009, the analysts say.

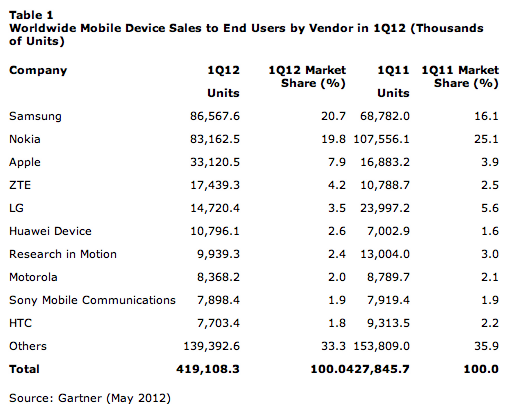

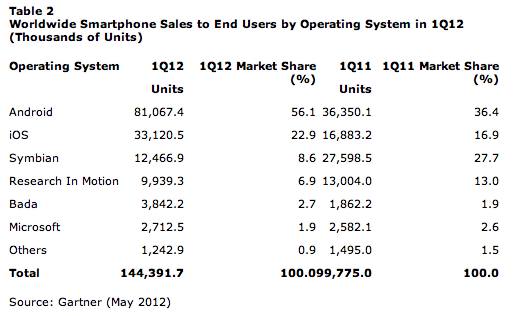

Gartner’s explanation is a slowdown in demand from Asia-Pacific, because of a lack of compelling new devices getting launched in the period: users are simply holding out until something better comes along. Nevertheless, of the vendors that are doing well, Samsung is riding at the top of the list, with 20.7 percent of all mobile sales globally, and among smartphones, it is the only Android vendor to have more than 10 percent market share — with Android now accounting for 56 percent of all smartphone sales in the quarter.

This will be the quarter that people remember as the one when Samsung swapped places with Nokia, with others like Strategy Analytics also showing a similar shift. In Gartner’s calculations of mobile sales, Nokia has now slipped down to second position with 19.8 percent of all mobile sales to Samsung’s 20.7 percent, equivalent to 86.6 million units.

Nokia, Gartner notes, had been in the number-one position since 1998 — but from the looks of its earnings for the last few quarters, it doesn’t appear that Nokia will be regaining the lead any time soon.

(Don’t rule it out yet, though. Nokia just yesterday launched two more low-cost, souped up feature phones that play to the developing markets where it has continued to do alright, despite its market share losses in more advanced countries.)

Among the other trends that Gartner noted, it pointed out that white-box vendors — the long tail of device makers that fill in the “others” category seemed to have been hit the hardest.

It notes that while companies like Nokia may have been selling in less at the retail level, white-box vendors have a supply issue in that they overproduced and now have a build-up of inventory. That will mean very cheap devices will be hitting stores in the next couple of quarters as they try to shift their stock for the next generation of devices. (This by the way was a similar problem Nokia had in Q2 2011, when Gartner suspected this might have made Nokia appear to have a bigger share of sales than it actually had.)

Overall, Samsung and Apple were the only two vendors in the top 1o mobile rankings to have gained market share: the rest all declined, as you can see from the list below.

In smartphones the power of the two is even more pronounced. Samsung and Apple now represent 49.3 percent of all smartphones sold — a sure sign of the consolidation being that a year ago the pair only accounted for 29.3 percent. Nokia’s smartphone share is down to 9.2 percent, Gartner says.

Samsung also managed to wrest the leading smartphone maker crown from Apple this quarter: it sold 38 million units to Apple’s 33 million.

Among Android makers, Samsung is also proving once again that it is the brand to beat: it accounted for 40 percent of all Android smartphone sales. (In that respect, Google’s Motorola buy seems less and less like a device play, or that it can realistically be one.)

But even with Apple in second, its actual growth was hugely impressive, at 96.2 percent over the year. China, Gartner notes, is now Apple’s second-largest market after the U.S. It looks like those sales were 8 million in total: 5 million from Apple’s official sales channges, and another 3 million from “transshipments” from Hong Kong.

More worryingly, RIM sold only 9.9 million units in the quarter and its global mobile share declined down to a mere 2.4 percent (in smartphone-only, that share is 6.9 percent, roughly half of what it was a year ago). BlackBerry 10, its new OS, will hopefully be the knight in shining armor that RIM desperately needs. Also, while Windows Phone actually grew in real terms, with 2.7 million sales in the quarter compared to 2.6 million a year ago, it’s not at all keeping pace with overall growth, and its share is now down to 1.9 percent from 2.6 percent a year ago.

Overall, smartphone sales accounted for just over one-quarter of all mobile sales: they stood at 144.4 million units, out of total mobile sales of 428 million units. That represented growth in smartphone sales of 44.7 percent, Gartner says.

Samsung’s Galaxy S III, the follow up to its best-selling Galaxy S II, was launched only last month and is now gradually getting rolled out worldwide — although it has seen mixed reviews and so it remains to be seen whether it will prove to be a similar blockbuster for the Korean company. In the meantime, we all continue to guess when Apple might release its next iPhone — with many suspecting it will not be until the later half of this year.