Ever since Facebook’s $1 billion acquisition of Instagram, the search for the next “Instagram of [insert app category here]” has been on. One area many pundits have focused on in this context is video and according to the latest data from mobile app analytics company Flurry, that’s probably not a bad bet. Video & Photo is now the fastest growing mobile app category across the major mobile platforms. The time spent on photo and video apps per active user increased 89% to 231 minutes per month between October 2011 and March 2012 and a massive 166% since July 2011.

This data is based on Flurry’s analysis of the 180,000 apps that currently use its analytics software on iOS, Android, Windows Phone, BlackBerry and HTML5. Other mobile app categories that, according to Flurry, are currently growing fast are music (72% since October 2011), productivity (66%), social networking (54%) and entertainment (40%).

With the advent of affordable phones with built-in HD video cameras and increased network bandwidth, it does indeed look as if the time is right for social video apps.

Sadly, Flurry doesn’t distinguish between video and photo apps in its report. The fact that active users now spent an average of 231 minutes per month in photo and video apps, however, clearly shows the momentum that apps like Viddy, Socialcam and Color are trying to capitalize on.

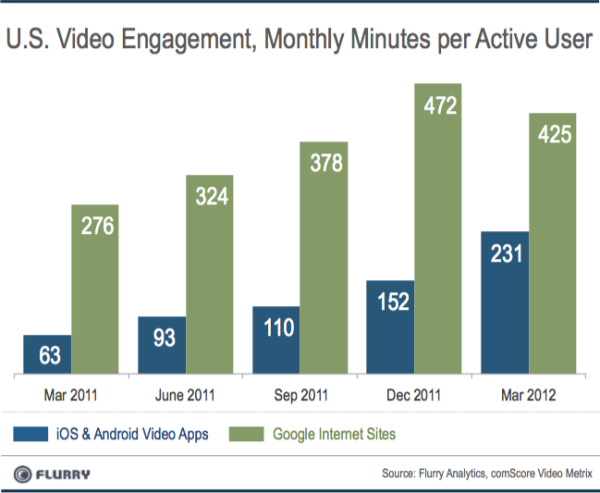

The quick rise of this app category becomes even more impressive when compared to how much time users are spending on Google’s YouTube. According to comScore, Internet users in the U.S. watched an average of 425 minutes of video content per month on Google’s site in March 2012 – a number that was actually down from a record 472 minutes in December 2011.

This data doesn’t quite make a convincing argument that these mobile video and photo apps are cutting into the time that users’ would otherwise spent on YouTube. As Flurry’s Peter Farago rightly argues, though, “the shift in time spent between these two platforms appears to be a signal of disruption.”