We are hearing from bankers underwriting Facebook’s initial public offering, that it will IPO at a $70 billion to $90 billion valuation, or $27-$35 a share. The reason for the valuation dropping below its speculated $100 billion mark is the sequential quarter-over-quarter revenue decline going into the first quarter that it revealed in its recent S-1 amendment. While that’s still going to be a landmark valuation for a consumer Internet company, it could be a bit disappointing for some.

“If y/y rev growth had accelerated, we could be talking LinkedIn multiples. Plus LinkedIn has expanding margins, which Facebook doesn’t,” said a source. (Just for reference, LinkedIn trades at a price-earnings ratio of 913. If Facebook debuted at a $100 billion valuation, that would be 100x its trailing net income.)

The Wall Street Journal also reported that Facebook will debut at an $85 billion to $95 billion valuation, but we have our own independent sources who have confirmed this price range.

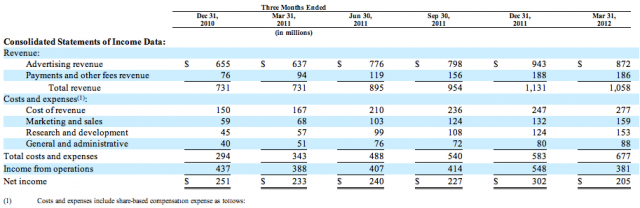

Investors are a little concerned that Facebook is too aggressively priced considering its growth trajectory. Google didn’t have its first quarter-over-quarter revenue decline until late 2008 going into early 2009. That’s when it had about a $20 billion annual revenue run rate. Facebook is still at one-fourth of that, on a 12-month trailing basis. The company made $1.058 billion in revenue in the first quarter of 2012. That was up 44.7 percent from the first quarter a year earlier, but down 6.5 percent from the fourth quarter.

What’s the reason for the decline in quarterly revenue? Part of it is seasonal.

Facebook is coming off of a holiday quarter, and the company is more susceptible to seasonal swings, because it’s a brand-advertising platform rather than a search-oriented one. Operating margins are also declining over time, given the company’s increasing headcount and share-based compensation expenses. Facebook made $381 million in operating income (or 36 percent of its $1.06 billion in revenue) in the first quarter of this year. That’s down from $388 million in operating income (or 53 percent of its $731 million in revenue) from a year ago.

Still, bankers want to see revenue growth skyrocket to command a greater than $100 billion pricing. And they haven’t.

The expected sub-$100 billion valuation could spur CEO Mark Zuckerberg to play a bigger role in the pre-IPO roadshow. No one knows the company and its long-term vision better than him.

A week ago he was expected to skip much of the roadshow to focus on product development, but sources told AllThingsD on Tuesday that Zuckerberg is expected at key roadshow meetings. With today’s news, he may take a bigger role, rather than having COO Sheryl Sandberg and CFO David Ebersman lead the charge.