The media and advertising giant WPP is taking a big step into e-commerce and how it can use it to leverage its other digital investments: today it has announced that it is investing $7 million into the grocery comparison shopping site mySupermarket, part of a $10 million round that also includes participation from existing investors Greylock and Pitango.

WPP says that it plans to use the investment to help extend its digital portfolio, and specifically help in the marketing and other services that it offers to is customers in packaged goods — the FMCG segment is one of the most important in WPP’s client base. The deal will see WPP become a minority shareholder in Dolphin Software, the company that makes mySupermarket.

The investment announced today takes the total amount invested in mySupermarket up to $23.4 million.

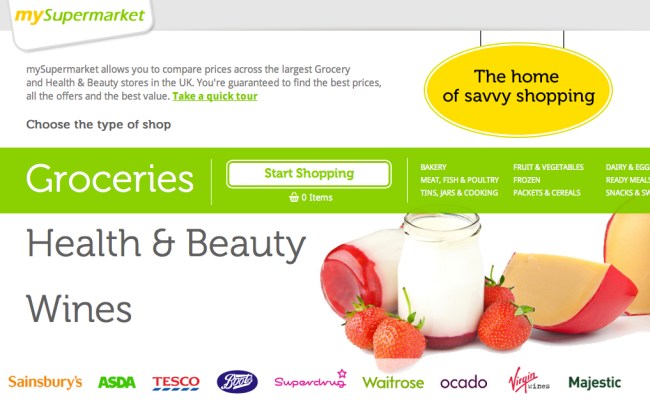

mySupermarket, which has offices in London, New York, Tel Aviv and Tokyo, has been in business since 2006, with its service focusing on letting consumers compare a product, or a whole cart of groceries, across a range of retailers to see which offers the cheaper price, and it offers a compelling and disruptive service that falls squarely in favor of the consumer:

In the UK, the range of stores covered by mySupermarket includes nine major retailers — Tesco, Asda, Waitrose, Ocado, Sainsburys, Boots, Superdrug, Majestic and Virgin Wines. It lets users not only check the prices for goods across these places, but then allows them to quickly swap their products over to the cheapest retailer to buy them.

mySupermarket says that it trawls about 30,000 special offers every week and lets customers cut their bill by up to 20 percent. It says it has 2 million monthly unique users in the UK with sales growing 100 percent year-on-year.

Bloch also notes that while the company “had term sheets from VCs” for this round, the company decided that WPP was a better strategic fit in terms of how the business wanted to develop. “WPP provides more domain expertise and their breadth of relationship is unparalleled in both the data and advertising worlds,” Bloch said.

You can see how this will work with WPP: it currently makes just over a quarter of its revenues from digital — $4.8 billion out of a total of $16 billion in 2011 — but is always looking for ways to increase that share, as part of its strategy to be making 40 percent of revenues from digital in the next five years. Here they can help their clients develop offers for their products, as part of larger digital marketing campaigns, and then help connect those offers directly with consumers.

It will also help the company pick up an enormous amount of consumer data, helpful for future campaigns.

The two biggest digital divisions at the moment for WPP are Wunderman and OgilvyOne, with revenues of over $950 million and over $900 million respectively — these might be the agencies that we will see working most closely with mySupermarket in future.