BankSimple, the well-funded startup that’s setting out to build ‘a bank that doesn’t suck’, has some big news today: it’s now allowing its first users into the service. And to mark the occasion, it’s announcing another major change: the company is now just called Simple (and yes, they own Simple.com).

Simple has gotten a lot of pre-launch coverage — it was co-founded by CEO Joshua Reich, CFO Shamir Karkal and CTO Alex Payne, who made a big splash when he announced he was leaving his role as Twitter’s API lead to help start the new banking service. The company has also raised a lot of money for a service that has yet to launch, with a $3.1 million round in September 2010 and another $10 million in August 2011.

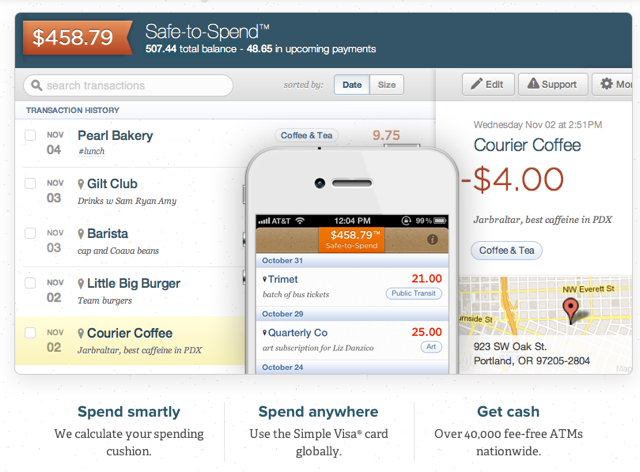

But it wasn’t until this past September that the company posted a video showcasing some of Simple’s early feature set (you’ll find it embedded below). And, as the video shows, Simple has built a user experience that’s much better than other banking services. Simple isn’t a bank itself — it’s working with FDIC-insured banks that will handle your money, as it serves as the more human-friendly frontend.

To be clear, this is still a limited beta. If you go to Simple.com you’ll note that you need an invitation, but it marks the first time that non-employees will be able to use the service.

From the company’s blog post announcing the news:

We’re thrilled to be welcoming our first customers. We want to understand what works for them and what can be improved. We also want to learn how our customers prefer to reach us so that we can intelligently grow our customer relations team. Using this feedback, we’ll rework and revise; the experience we’re launching today will continuously evolve. There is still a tremendous amount to be done, but as of today we are live to our first customers, and that’s a huge milestone for us.

Today is a new beginning for another reason as well: BankSimple is now Simple. Simple is a better representation of what we aspire to. It releases us from the constraints of an industry in desperate need of innovation.

Using Simple, you can make purchases with a Simple Visa® card, pay bills, earn interest, set up and track savings goals, and much more. Simple replaces your bank, but we are not a bank. You use our mobile and web apps and speak with our customer relations team when you have questions. We partner with chartered banks that hold your deposits in FDIC-insured products. They take care of money, we take care of customers, and together we’re delivering a new type of financial experience that’s easier, faster, and friendlier.