Finom, a European challenger bank aimed at SMEs (small and medium-sized enterprises) and freelancers, has raised €50 million ($54 million) in a Series B equity round of funding.

Founded out of the Netherlands in 2019, Finom lets businesses open up an online bank account in minutes and receive an IBAN (international bank account number) to support cross-border transactions. On top of that, customers also receive physical or virtual bank cards, expense management tools, and integration support for accounting software.

In truth, the Dutch startup is one of numerous players in a space that includes the likes of Wise, Qonto, and Revolut, but Finom’s fundraise further highlights the demand for SME financial services in a market that is still substantially dominated by big banks — in recent months we’ve seen challenger banks such as Atom Bank and Monument attract significant investments, while SME lenders such as Iwoca have also closed sizable new funding lines.

“The number one problem [we solve for SMEs] is always unreasonable banking — serving SMEs is considered ‘uninteresting’ for the traditional banks, as compliance risks are high, while lending opportunities are quite limited too, meaning that the product for SMEs is much worse even compared to the digital banks that we use everyday,” Finom co-founder and co-CEO Yakov Novikov told TechCrunch by email. “But at the same time, the level of needs and complexity of SMEs is much higher.”

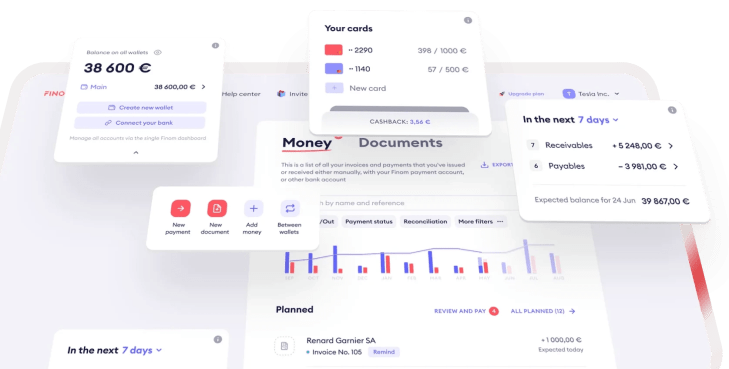

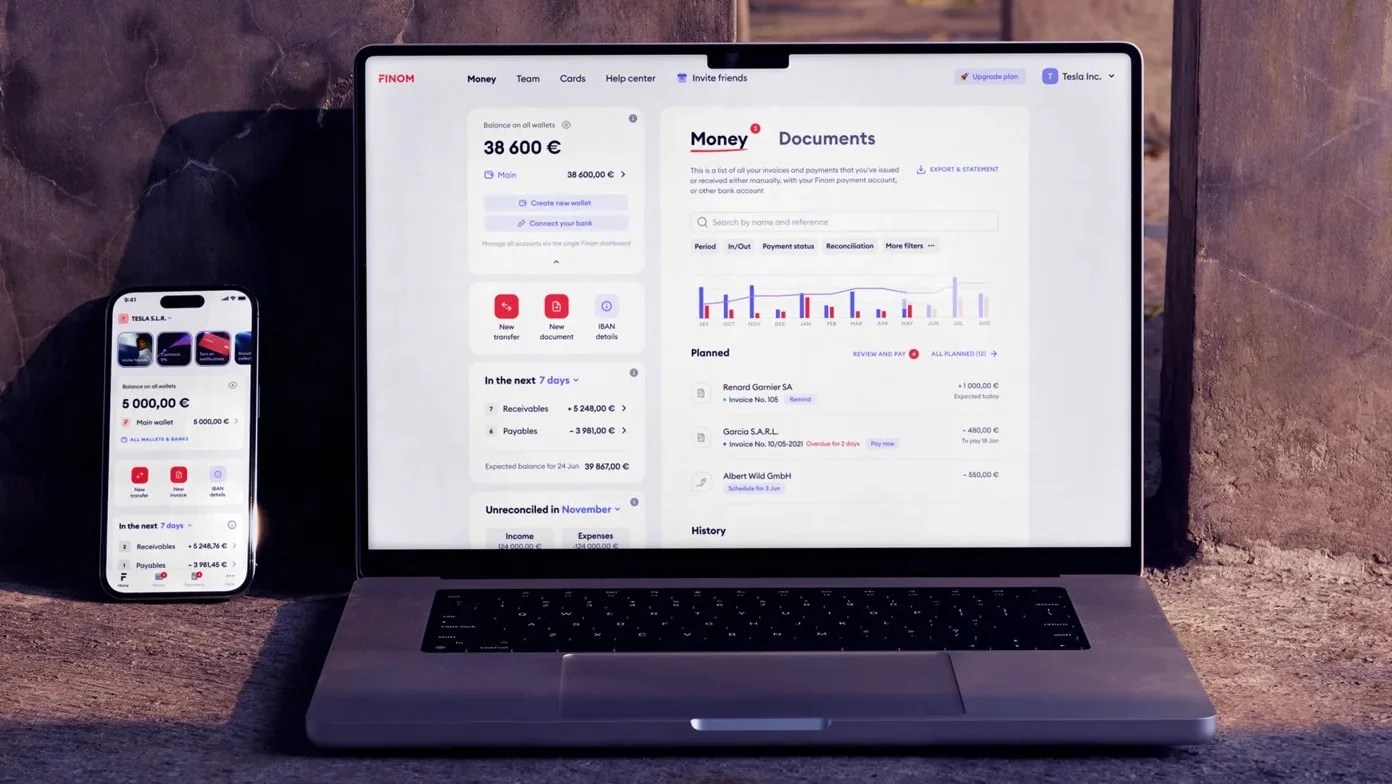

Finom on the web. Image Credits: Finom

Finom touts its core selling point as being a “fully integrated” product spanning banking, payments, invoicing, expense management, accounting, and tangential services such as business registration.

Show me the money

Finom founders, from L to R: Andrey Petrov, Yakov Novikov, Oleg Laguta, Kos Stiskin Image Credits: Finom

Finom had previously raised around €50 million, including a couple of seed tranches in 2020 and a hitherto undisclosed €33 million ($35 million) Series A round it closed in early 2022.

While Finom is generally banded together with other startups challenging the established banking incumbents, it technically isn’t a bank — it holds what is known as an electronic money institution (EMI) license that allows it to offer services similar to what a bank offers, but it can’t offer things like lending. Finom secured its EMI license in its domestic Netherlands market, but this allows it to operate across the entire European Union (EU).

With another €50 million in the bank, the startup is well-financed to gear up its expansion efforts as it looks to target the entire Eurozone by next year. At the time of writing, Finom claims some 85,000 customers in Germany, Spain, France, Italy, and the Netherlands, and while it is technically available across the whole EU, it will begin localization efforts for additional markets in the coming months.

The Series B round was co-led by new investor Northzone and existing investor General Catalyst, which has previously backed the likes of Airbnb, Stripe, and Snap. Other participants in the round include Target Global, Cogito Capital, Entrée Capital, FJLabs, and s16vc.