India is facing a quandary in enforcing long-delayed rules to curb the dominance of PhonePe and Google Pay in the country’s ubiquitous UPI payments network, which processes over 10 billion transactions monthly.

The National Payments Corporation of India (NPCI), a special unit of the Indian central bank, wants to limit the market share of individual companies in the popular Unified Payments Interface (UPI) system to 30%, a long-delayed effort to curb the dominance of Walmart-backed PhonePe and Alphabet’s Google Pay, which together control over 83% of the growing payments market. However, with rival Paytm now struggling after strict regulatory action, the NPCI faces an acute challenge in bringing down the commanding share of the leading duopoly: It doesn’t know how to.

The NPCI officials believe there is a technical barrier to achieving the goal and have sought industry players in recent quarters for ideas, two sources familiar with the situation said. The NPCI, which delayed enforcing the rules to 2024, declined to comment Tuesday.

Its dilemma has come into focus again after a parliamentary panel asked New Delhi last week to support domestic fintech firms to counter the dominance of PhonePe and Google Pay. The recommendation came after the central bank directed Paytm to stop several operations at Paytm Payments Bank, the associate entity that processes transactions for the financial services group.

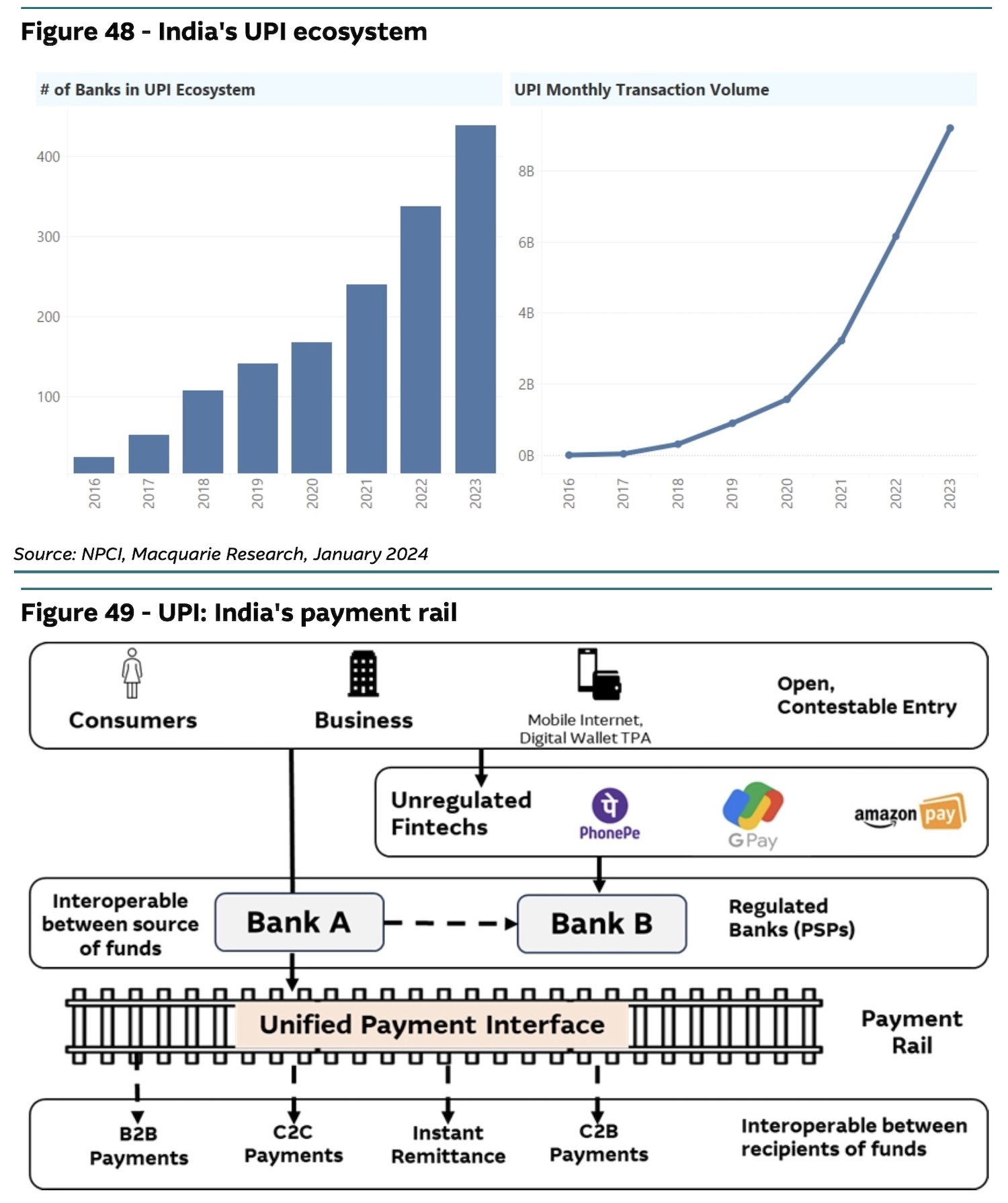

India’s real-time digital payments system, UPI, has radically transformed the country’s payments landscape since its launch in 2016. The UPI network features about 500 banks, 70 million merchants and a monthly transaction volume exceeding 10 billion.

The NPCI originally proposed (PDF) a check on the market share to mitigate risks on the system and to “smoothen out all the transactions in the UPI ecosystem.” At the time of the proposal, PhonePe and Google Pay commanded under 80% of the UPI market.

Image Credits: Macquarie

Brokerage firm Macquarie on Tuesday dramatically cut its 12-month price target on Paytm over concerns that its lending partners and its customers may leave the platform. Macquarie, whose price target implies a valuation of $2.1 billion for Paytm (taking into account that Paytm has a $1 billion in cash balance), said the Noida-headquartered firm is “fighting for its survival.”

Paytm’s further loss of market share would benefit the top two, industry executives cautioned. Citing official data, the parliamentary panel said PhonePe had 47% and Google Pay 36% market share during October through November 2023.

Industry executives said the only way for PhonePe and Google Pay to comply with the 30% cap is to stop adding new users. In the meantime, PhonePe continues to spend on marketing to acquire more share.

India’s central bank, in the meantime, is beginning to hint that perhaps a few players commanding the UPI market share isn’t really a problem. The RBI Deputy Governor Rabi Shankar said at a press conference last week that the central bank has no concerns about UPI apps becoming too big, and how big someone becomes is for the “market to decide.”

“The market forces have to play out such that this percentage is more evenly divided. We will not be interfering in the market process to ensure the 30% cap that in any case is an NPCI requirement.”