General Catalyst, one of the largest U.S. venture capital firms, is in talks to acquire an India-focused VC as part of efforts to expand its presence in the fast-growing South Asian startup market, three sources familiar with the matter told TechCrunch.

The deal would allow General Catalyst to tap deeper into India’s vibrant technology scene that has lured over $100 billion in startup investments since 2010. General Catalyst has engaged with Venture Highway in recent months for the deal, according to two sources familiar with the matter. The deal with Venture Highway hasn’t finalized, so things including the target fund could change, the sources cautioned, requesting anonymity as the deliberation is private.

General Catalyst has backed about a dozen and a half startups in India — including fintech giant CRED, used car marketplace Spinny, and healthtech Orange Health — but the venture firm has been looking to significantly expand its presence in the country for more than a year, several people familiar with the matter said.

General Catalyst and Venture Highway did not respond to requests for comment Thursday.

The U.S. firm held conversations with many senior individuals in India last year looking to find an India-based partner, many people familiar with the matter said. At some point last year, it also began evaluating the possibility of acquiring an India-focused fund and use that route to establish a broader presence in the country, the people said.

It’s not the first time a global venture house has explored this route to expand into India. Accel acquired Erasmic, which at the time had a corpus of about $10 million, more than a decade ago, creating Accel India.

General Catalyst, which has over $25 billion in assets under management, plans to invest more than $500 million in India over the next three to four years, another person familiar with the matter said. Its new focus on India follows the firm expanding in Europe last year by agreeing to merge with La Famiglia, an investor in several high-profile early-stage startups including AI firm Mistral.

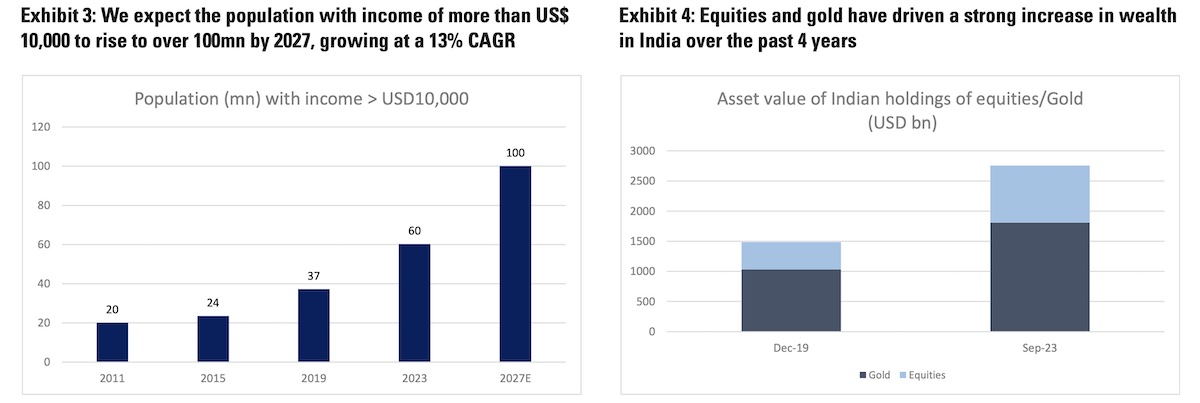

Goldman Sachs’ projection for India. (Image: Goldman Sachs)

Venture Highway — co-founded by Neeraj Arora, who played an instrumental role in Meta acquiring WhatsApp — is a New Delhi-headquartered venture firm that focuses on backing early-stage startups. The firm, the size of whose last fund (its second) was about $80 million, counts Meesho, ShareChat, and Moglix among its portfolio startups. Samir Sood, one of its other partners, recently stepped down. The firm also recently sold some of its stake in Meesho, TechCrunch first reported.

India, one of the world’s largest startup ecosystems, has attracted several heavyweights including Sequoia, Lightspeed, Accel, Tiger Global, SoftBank, and Insight Partners in the past decade and a half. A number of other high-profile venture firms including Coatue Management and QED and Andreessen Horowitz have also backed Indian startups in recent years as they pick young firms attempting to serve the fast growing internet market of over 700 million users.

Investing in India has proven uniquely challenging to many global venture firms that have entered the country or have explored such possibility, a partner at a India-based venture firm said. “India has immense potential but we don’t yet have the level of exits you see in the U.S., nor do we have the size of returns you might find elsewhere,” the investor said, cautioning that venture firms need to make peace with the fact that the time horizon needed for bigger payday is much longer in India.

Yet, globally funds — including asset managers — are increasingly expanding focus on India, whose $4 trillion GDP is expected to double by the end of the decade, according to Morgan Stanley. Invesco, T. Rowe Price, BlackRock, Fidelity and UBS have backed several Indian startups through their mutual funds in the last five years.

“Rather than thinking about average GDP look at how many households in India will make more than $50,000 to $75,000 a year by 2030. Our asset is developers,” Anu Hariharan, founder of VC firm Avra and formerly the head of YC Continuity, posted on X last week.

“India will have ~15 million developers in the next decade making $50,000 to $75,000 a year. For every developer household, there is a financial services household and a healthcare household that will also make $50,000 to $75,000 a year. That equates to ~45 million households (that will make more than $60,000 a year by 2030.) In comparison the UK today has 28 million households making $45,000 a year.”