As 2023 comes to a close, a critical cohort of tech companies has regained the value it lost after the summer rally, potentially setting the stage for a stronger IPO cycle in early 2024 than some may anticipate. Cloud stocks are back, y’all!

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Let’s do a quick recap to refresh our memories.

Earlier this year, we saw three companies go public in quick succession: Arm’s, Instacart’s and Klaviyo‘s IPOs represented a liquidity peak, but they failed to inspire other tech companies to a rush toward the public market.

The three companies had pretty good IPOs, too, but they mostly failed to make the sort of splash some had hoped for. Arm’s stock has performed well compared to its IPO price (trading at $71.30 per share today, up from its $51 list price), but Klaviyo and Instacart haven’t fared as well. Klaviyo’s shares are trading 24 cents above its IPO price, while Instacart’s stock is trading at about $5 less than its listing price this morning.

The three companies had pretty good IPOs, too, but they mostly failed to make the sort of splash some had hoped for. Arm’s stock has performed well compared to its IPO price (trading at $71.30 per share today, up from its $51 list price), but Klaviyo and Instacart haven’t fared as well. Klaviyo’s shares are trading 24 cents above its IPO price, while Instacart’s stock is trading at about $5 less than its listing price this morning.

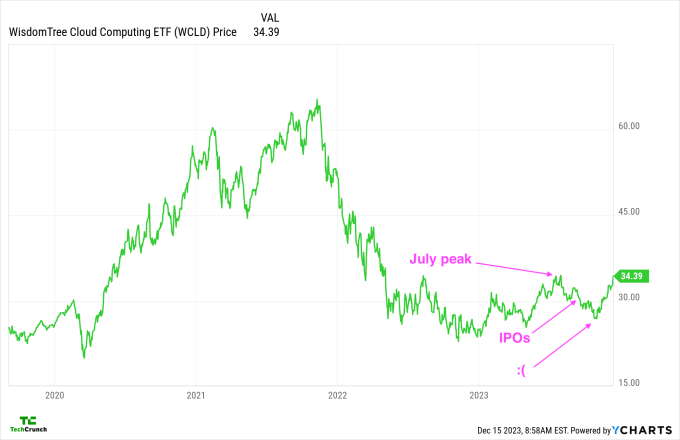

But it was not these less-than-blistering IPOs that scuttled the IPO market. No, the stock market itself moved lower, shutting fast the IPO window. Here’s a chart showing the performance of a basket of cloud stocks (software, cloud, enterprise and AI companies) that TechCrunch+ closely tracks (messily annotated by yours truly):

Image Credits: YCharts

This ETF (exchange-traded fund) we’re looking at tracks the performance of the Bessemer cloud index that this column has long used as a point of reference. Basically, cloud valuations peaked this year in July; then Arm, Klaviyo and Instacart filed for their IPOs in August, and they went public in September. Subsequently, cloud stocks declined, which made it unpalatable for other companies to try their own luck at the public markets.

Astute readers will have noted that the index pictured above has rallied following the decline in September. Indeed, cloud stocks are back to trading around their prior highs this week, which is also about the highest levels this index has reached since April 2022. We are witnessing a material recovery in real time, folks.

There’s reason to believe this rally will continue. Interest rates in the critical U.S. market appear to have peaked and could come down a bit in the new year. What’s more, some software companies are showing signs that their growth stories are not yet over. Yes, pockets of weakness remain, but the vibes in tech today feel much better than they did just a few months ago.

For late-stage startups and unicorns hungry to finally go public, this is all very good news. For yours truly, ever hungry for S-1 filings, this counts as a late but very welcome holiday present.

None of this means that tech companies will be able to go public at the valuations they desire. Instead, it merely indicates that the IPO window may inch open again. We’re still a ways away from ye olde boome tymes, but who doesn’t want to end the year with some good news?