What happens when you feed a few thousand pitch decks to an AI, analyze them all, and figure out what the most common problems are for founders trying to raise early-stage funding? Well, I decided to find out.

A while back, I built a tool that would automatically analyze a pitch deck and give you feedback. A couple of months and a few thousand analyzed decks later, I have built up quite the library of insights for what most founders are getting right — and wrong — in their pitch decks.

Of course, this is a tool aimed at founders who aren’t sure if their deck is any good. The sad truth is, though, usually their hunch is right. About 54% of decks have a “low” likelihood of raising funding. In this context, that means founders made fundamental mistakes in putting their decks together (e.g., they forgot a team slide or didn’t explain what they will do with the money).

Overall, only 6% of the decks analyzed by the AI tool include all the information the AI robot is looking for. That’s not great, honestly.

5 things most founders get right

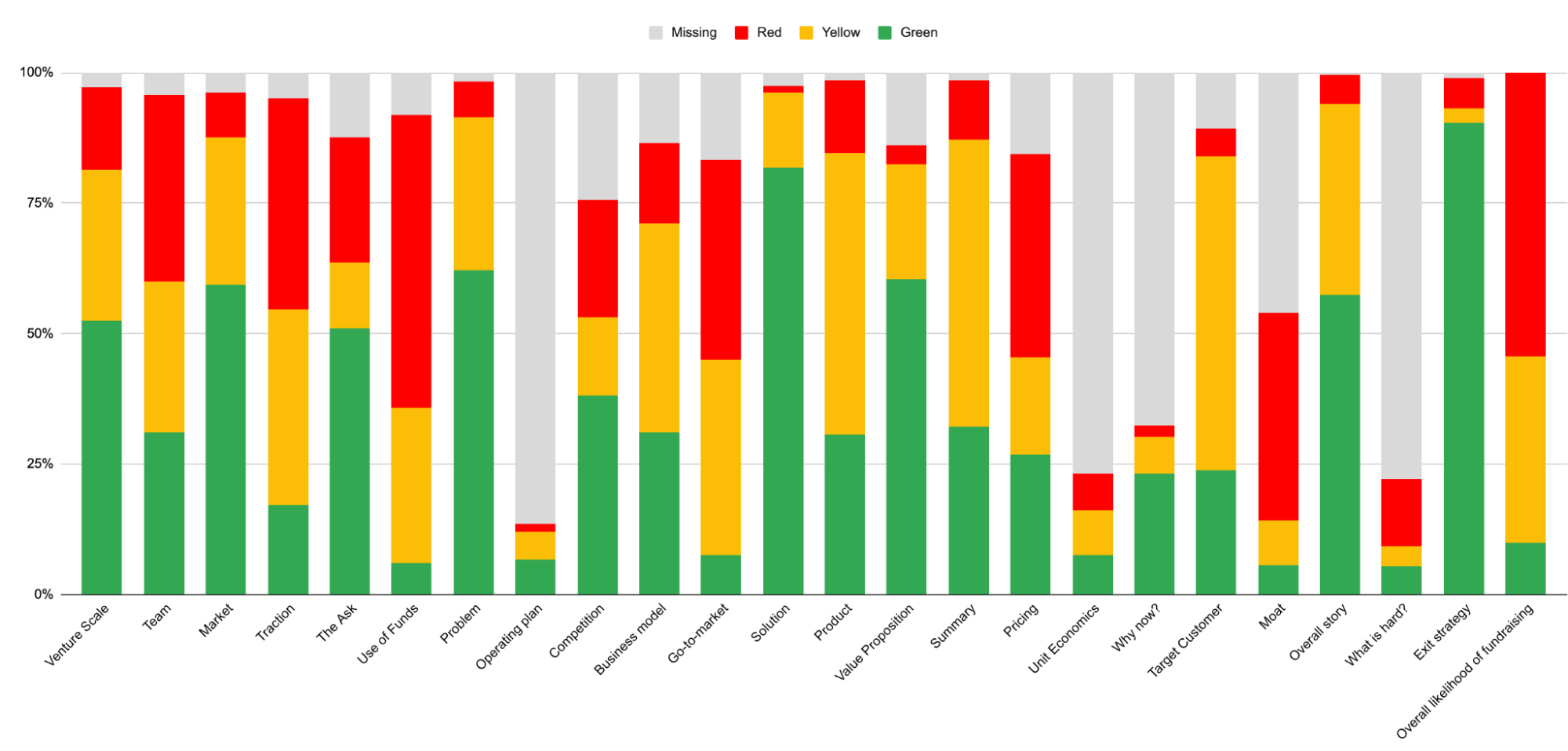

Red means: ‘Fundraising would be very hard without resolving this.’ Yellow means: ‘There is an issue, that can probably be fixed with a better story or by adding / amending available information.’ Green means go. And grey means ‘this is missing from the deck’ The exception is exit strategy: Green means it’s absent (because that’s a good thing), and ‘overall likelihood of fundraising’ is an overall calculation that uses weighted scoring from the other categories. Image Credits: Haje Jan Kamps / TechCrunch

- About 90% of founders don’t include an exit strategy in their slide deck. That’s a good thing, because it’s not often that an exit slide will help you raise money.

- 82% of founders have a good “solution” slide, outlining roughly how the startups wants to tackle the problem it has identified.

- 62% of decks have a solid problem slide, where the team outlines what the problem is and why it is worth solving.

- 60% of the decks analyzed had a decent value proposition, explaining how and why the product is delivering value to its customers.

- 59% of the decks explain what the market opportunity is. In other words: How the company sees that the market might be big enough to sustain venture capital scale returns.

Of course, not everything is awesome, and founders more often than not mess up and miss a whole bunch of important information. Here are the five most common issues:

5 most common mistakes in pitch decks

- A whopping 56% of founders don’t have a decent “use of funds” part of the story present in their deck. The most common issues were that founders were not using milestones as their forcing functions for why they are raising funds, or they just broke it down as percentages, which doesn’t give investors the information they need to know whether they are about to make a great investment or a terrible one.

- Close to half (40%) of decks don’t tell a great traction story, either because they’re missing it altogether (oof!) or because they are leaning into vanity metrics (ugh!). If you don’t have revenue yet, you can still come up with a compelling traction story.

- A slightly smaller 39% of analyzed decks don’t explain how a company is defensible. In other words: If your startup comes up with a halfway decent idea, why couldn’t an incumbent or a better-funded startup in your space come along and crush you? Patents, trade secrets or other unfair advantages count toward this metric. Investors care about a solid moat, because they know that it’s a strong indicator of a possible future exit — if a company is well-defended, an incumbent may need to buy it in order to stay competitive.

- Continuing, 38% of decks don’t have a clear go-to-market strategy. All startups need one, and the number of founders who do a hand-wavy “I guess we get some influencers and then go viral?” is, frankly, ridiculous. On top of that, 17% of founders missed out on the go-to-market altogether.

- Finally, 36% of founders get the team slide wrong, which is unfathomably embarrassing. Especially for early-stage startups, your team slide is the pinnacle of your unfair advantage. Do not do this!

5 most common storytelling problems in pitch decks

The AI tool flags things as “yellow” if it believes there’s an issue with the storytelling in a deck. The information might be there or there might be a problem within it, but it probably wouldn’t be a dealbreaker. A few categories stood out here:

- Some 60% of founders didn’t have a clear enough target customer. That’s unfortunate, because even if your customer base is “every person with a cell phone in the U.S.,” you need a beachhead market: Who are you going after first, and how will you reach them? Customer segmentation is crucial, and explaining to your investors that you know where your customers are coming from is ridiculously important.

- Just over half (55%) of the decks analyzed failed at the very first or last hurdle: Not having a strong introduction or closing slide. Last impressions matter, and a great summary and opening slide can help set the stage for the whole conversation. If you’ve got the rest of the deck right, the opening and closing should be the easiest part of the whole deck, so there’s really no excuse to not get it right.

- A similar portion (54%) of analyzed pitch decks don’t have a clear enough story around the product. Some have way too many slides, while others don’t clearly identify how much of their product is still a dream, and how much has actually been built to date. Giving a clear indication of product progress with photos, screenshots or a demo goes a long way.

- Some 40% of pitch decks that I ran through my AI tool do a pretty awful job of explaining the business model. That’s not great. If you need help, remember to keep it simple and stick to just the one business model.

- Finally, 30% of decks that we looked at included a “use of funds” section but told the story in such a haphazard way that it wound up being pretty confusing. I’ve covered “use of funds” above, but, look, you’re raising money for a particular reason. All you have to do is share that reason, and you’re golden. This part shouldn’t be hard.

5 most commonly missed pieces of information in pitch decks

There is some information that founders miss out significantly more often than other data:

- An incredible 86% of founders don’t include an operating plan — a simplified version of your financials that also includes your product and customer milestones for the next 12 to 18 months. It’s basically an easier-to-discuss version of your business financials. It’s a great tool for talking through your company in numbers. Guess what investors love? That’s right: Numbers.

- More than three-quarters, or 78%, of founders don’t really touch on the hard problem their company is trying to solve. This is kind of a subset of the “defensibility” conversation above, but I fear a lot of founders are failing at this because what they are creating is, unfortunately, way too easy to replicate.

- More than two-thirds, or 68%, of the decks the AI looked at didn’t anchor the company in time with a “why now” part of the story. This doesn’t necessarily have to be a separate slide, but somewhere in your story, it should become clear that the time is right for this startup: Why 10 years ago was too soon and why 10 years from now will be too late.

- A worrying 24% of decks didn’t include competitive analysis. That’s wild to me, since if you don’t have competitors (or at least competitive alternatives), you essentially don’t have a business.

- Finally, 16% of founders didn’t include pricing information for their products. That’s a fail. Yes, there are industries that are not particularly price-sensitive, but for the vast majority of industries, markets and segments, a pricing model is crucial. For some decks, it makes sense to include that as part of the business model slide, but for many startups, having a clear pricing strategy communicated as part of the deck is a solid idea.

I know that I sound like a broken record at times here, but I really want your company to raise a lot of money. Avoid the above mistakes!