Battery swapping for electric vehicles might be a little like communism: good in theory, but so far the only place that it has really caught on is China.

Unlike communism, though, battery swapping could usher in freedom for a wide range of people, allowing them to participate in the EV transition in ways that traditional built-in batteries do not. This is why the battery-swapping model keeps being revisited.

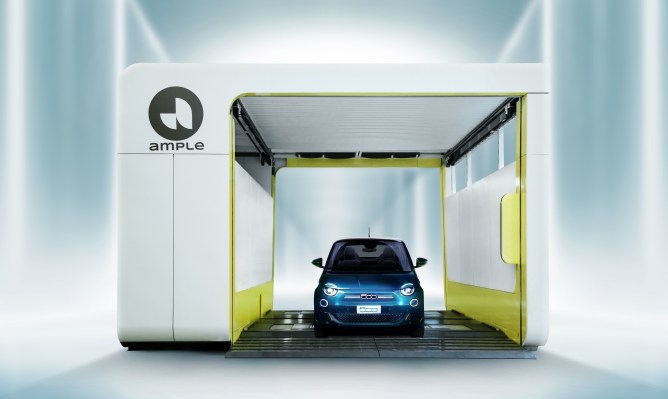

Ample is the latest example. The company announced Thursday it has partnered with Stellantis to roll out its battery-swapping technology in the automaker’s Fiat 500e city car. The two companies will start the first phase in Madrid, where 100 cars in Stellantis’ Free2move car-sharing service will be retrofitted to accept Ample’s modular batteries.

Ample has been able to refine its stations to the point where a swap takes only five minutes, about what it takes to fill up a fossil fuel vehicle. For car owners, the speed at which battery swapping can happen makes the switch to EVs that much easier. For Ample, swapping allows batteries to be recharged more slowly than fast charging, reducing electricity costs and improving the longevity of the cells.

Fleets are an obvious testbed, allowing fleet owners to maximize the uptime of their costly assets. That’s why Ample has targeted fleets first, from car- and ride-sharing customers to trucking companies. But the startup and Stellantis are exploring what battery swapping for private owners might look like.

A private ownership model would likely include a subscription to cover the cost of the battery. That way drivers don’t have to worry about swapping their pristine cells for someone’s used ones. Modules can be tested and replaced or refurbished as needed to keep the standard of service up to par. Swapping costs would be around the cost of electricity.

When many EV drivers hear about battery swapping, they tend to think about how easy road trips would be. No more waiting for unreliable fast chargers to deliver the juice; just swap and go.

The real beneficiaries of battery swapping wouldn’t be road trippers, but apartment dwellers and people who don’t want to (or can’t) shell out for the cost of the battery up front.

“We want anyone around the world, wherever they are, to be able to use an electric car,” Ample founder and CEO Khaled Hassounah said in a press conference.

City dwellers without access to private charging appear to be the ideal candidates for EVs that can swap batteries. The 500e being used in the trial can be swapped at Ample’s stations, but it can also be charged like a regular EV. That’ll prove important should ride-sharing users want to take their steed past the reach of swap stations — and if Ample and Stellantis decide to take this technology to the broader market.

Battery swapping has had the most success in China, where the Communist Party has thrown its weight behind the concept. Automakers Nio and Geely have bought in, working with partners to roll out 24,000 swap stations in the next couple years. (Nearby, Taiwan’s Gogoro has been steadily expanding, though its model applies to two-wheelers, not cars and trucks.) Outside of China, other companies, notably Better Place, have tried and failed.

If Ample and Stellantis decide to take battery swapping to the broader market, they’ll encounter a few other challenges.

For one, the battery-swap hardware will take some space within the vehicle, reducing the amount available for the batteries themselves. Stellantis’ head of energy and charging Ricardo Stamatti-Avila said that the energy density will be “effectively indistinguishable from the original vehicle.” That’s pretty good, but it’s also not “identical.” Customers have proven themselves to be range hogs, and while the hardware will enable faster turnarounds relative to fast charging, it will come with at least some cost to range.

While the economics of battery-swap stations make sense in a densely packed urban space, they may not elsewhere. In cities, with plenty of drivers nearby, the stations are likely to see heavy use, providing Ample with the sort of active customer base that’ll help the site company turn a profit. Farther from the city center, though, those economics start to fray.

We don’t know what that break point is yet. Ample’s value proposition to consumers will only be as good as its network. The fact that the vehicles can charge regularly will help alleviate that concern somewhat, but it also diminishes the speed advantage, which is the main selling point of battery swaps.

It’s possible that battery swapping will stick to fleets. It’s a business model and technology that aligns well with the sorts of duty cycles that fleet vehicles encounter. Is it right for the general public? Perhaps after Ample and Stellantis gain a few years of experience, we’ll have our answer.