A developer platform for the…sky? That’s the vision of OurSky, a startup founded last year that’s aiming to make space observational data more accessible via a software platform and global telescope network.

The company announced that it closed $9.5 million in seed funding led by Upfront Ventures alongside Oceans Ventures, Venrex Investment Management, Marlinspike Partners and Embedded Ventures, to further accelerate deployment of scopes and the developer platform.

CEO and co-founder Dan Roelker likened OurSky to AWS for developers or the web3 development platform Alchemy: “Alchemy [provided] this platform that was really easy for developers to get the data and process it the way they needed to without standing up their own, in our case, telescope network. That’s really hard to do. Now all that’s abstracted away, and you’re just telling and programming the OurSky platform to get the data, process it the way you want.”

Critically, the startup says it’s a modern and less costly alternative to the status quo, with development tools and open APIs that can be used by companies spanning space situational awareness startups to satellite operators.

OurSky was founded by Roelker and serial technology entrepreneur Alex Hawkinson in October 2022. It almost seems fated: During the pandemic, Roelker and his family moved to an area outside of Washington, D.C., and one of their neighbors turned out to be Hawkinson.

In addition to founding companies, Hawkinson is also an avid amateur astronomer. He and Roelker quickly realized there was a critical need for a developer platform that can access and analyze real-time data on space objects.

The two got to work. Roelker has worked in software his entire career. His resume includes founding a few reverse-engineering hacker groups (which were acquired by the likes of BAE Systems and Raytheon), working as SpaceX’s VP of software engineering from 2015 to 2019 and joining NFT marketplace OpenSea as VP of engineering.

He was at SpaceX during a particularly pivotal time in the company, and his work spanned the Falcon, Falcon Heavy, Dragon and Starship programs.

“When I joined SpaceX, we had just blown up a rocket with CRS-7,” he said. “The next launch was basically the make-or-break launch for SpaceX. […] It was a very exciting time because I was there for four years, and I went through the whole lifecycle. The first launch we had with me at the helm of flight software for Falcon was the first time we landed a rocket.”

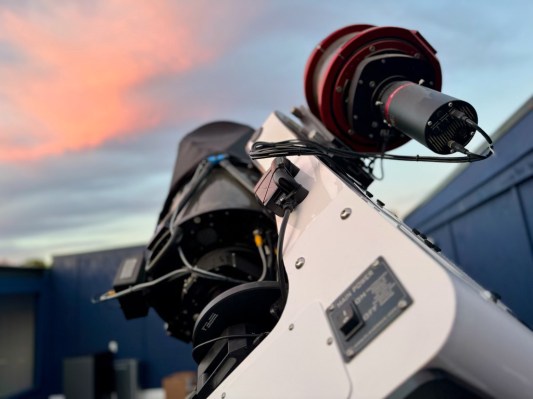

OurSky is tackling different challenges — including building out the world’s largest telescope network. The network has three sources: scopes that OurSky owns and deploys; scopes sourced from the professional amateur community (think people that have extremely capable telescopes that cost hundreds of thousands of dollars); and scopes from the far larger amateur community.

The Los Angeles, California-based startup already has 30 scopes under ownership deployed in nine locations globally, and has onboarded around 35 amateur astronomers on its network. It’s using different incentives to attract amateurs onto the platform — Roelker was very clear that OurSky is not trying to “monetize” the amateur community — and these incentives include free access to otherwise complicated and time-consuming capabilities like image stacking for astrophotographers.

With the new round, OurSky isn’t planning on just buying up a bunch of telescopes — maintenance costs are exorbitant, Roelker said — but instead tying into existing infrastructures to build out a collective network. That way, OurSky isn’t saddled with a bunch of fiddly hardware.

“We are of course going to buy telescopes, and we have, but that’s not going to be the bulk of the money. The bulk of the money is very much around building out the software platform in a way that is going to support all these different needs from research to commercial to defense to the consumer applications for space observation.

The company has grown to 15 people, with the aim of expanding to 20 in around six months. This incremental growth is part of OurSky’s larger strategy to carefully allocate capital in order to keep pace with how the market develops in the next year or two, Roelker said.

“We want to make sure that we’re using this investment wisely with a much further time frame. […] I think the name of the game is, we have to be capital efficient, not just in how we build a network, but really, we’re looking at longer time frames here so we can roll with the market as it evolves over the next year or two. We wanted to make sure we had enough capital to be able to go with that evolution.”