AI technologies will help make startups leaner and more cost-effective, according to a recent report from Battery Ventures. In turn, Battery anticipates that lower-burn startups will be worth more provided that their growth rates remain attractive.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

It’s an interesting thesis. When we consider AI from the startup perspective, we tend to think about what AI-powered software startups will themselves build. By flipping the question from what will AI software do for startups, Battery can see a future in which startups are worth a greater multiple of their revenues. That could make more nascent tech companies venture-backable, full-stop, and existing startups more likely to be able to grow into prior valuation marks.

At issue is the value of software revenue. The repricing of tech shares in the comedown from 2021’s market excess is a well-trod story at this point, as is the perspective that startups should burn less than they once did when money was cheaper and more plentiful.

At issue is the value of software revenue. The repricing of tech shares in the comedown from 2021’s market excess is a well-trod story at this point, as is the perspective that startups should burn less than they once did when money was cheaper and more plentiful.

But what good is a profitable startup if it fails to grow quickly? Little, it seems. So what venture investors would like more than anything — founders, too — is a world in which each dollar of revenue that their startups generate is worth more. That situation would help venture-math pencil out more neatly.

It’s far easier to invest in startups that burn cash when the revenue they are building is worth, say, $9 in value, instead of $6. Or $4.

The Battery argument goes as follows:

- The valuation premium for tech companies that balance growth and profit — as measured by the Rule of 40 — has reached a local maximum this year. That’s when growth rates and profitability margins add to a combined score of at least 40%.

- Startups are therefore incentivized to burn less.

- But merely spending less can constrain growth, so what could really shift norms for startup value would be an ability to spend less without sacrificing growth.

- Enter AI, which will provide just that.

Let’s take each piece in order.

1. On the valuation premium front for tech companies that meet the Rule of 40, Battery writes that tech concerns “that show a balance of growth and profitability trade at a ~60% premium to those that don’t.” That’s a massive delta, and one that should help startups that are shooting for Rule of 40 feel confident that they are focused on work that matters.

2. There are two levers in the Rule of 40 game: How quickly your startup grows and how much it burns to get there. If you can improve either metric, your score improves. As startups are growth-focused by nature, their best bet is to not curtail revenue expansion but instead focus on cost cuts.

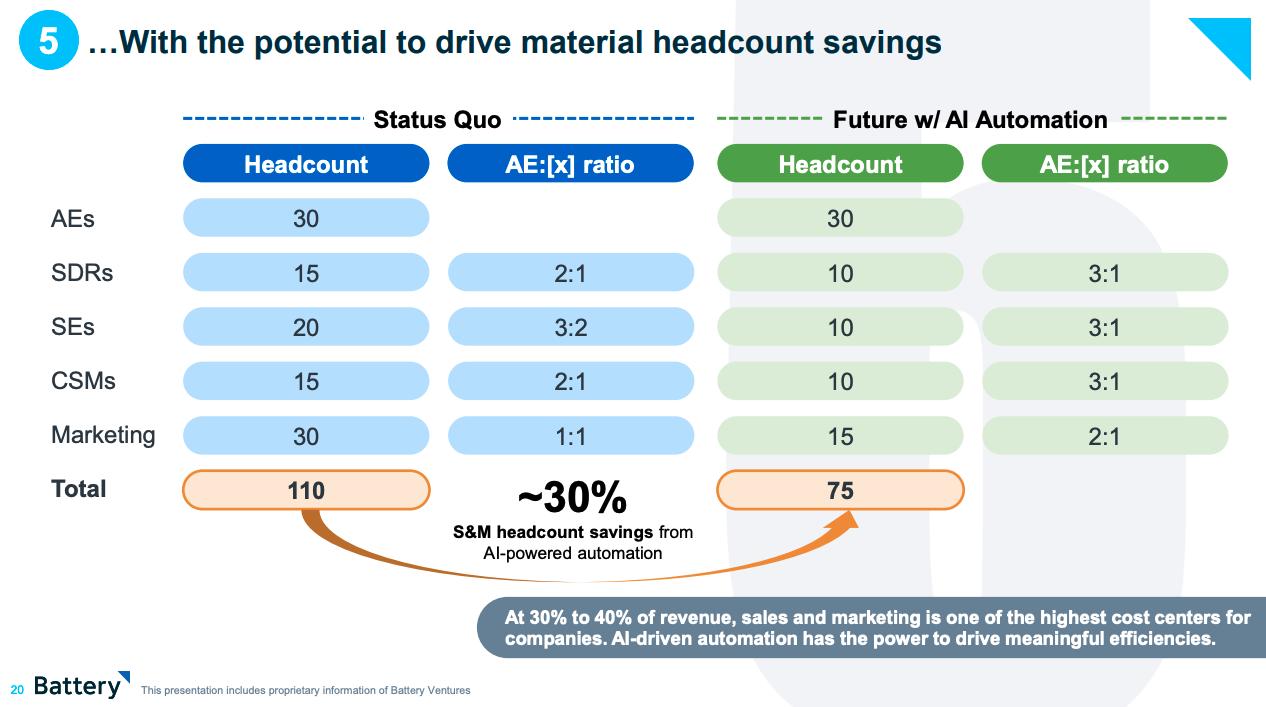

3. If startups are going to reduce spend in a manner that won’t impede growth, they have to find efficiencies. In Battery’s view, some of those spend cuts will come from AI-powered automation making sales and marketing headcount leaner:

Via Battery Ventures, shared with permission. Image Credits: Battery Ventures

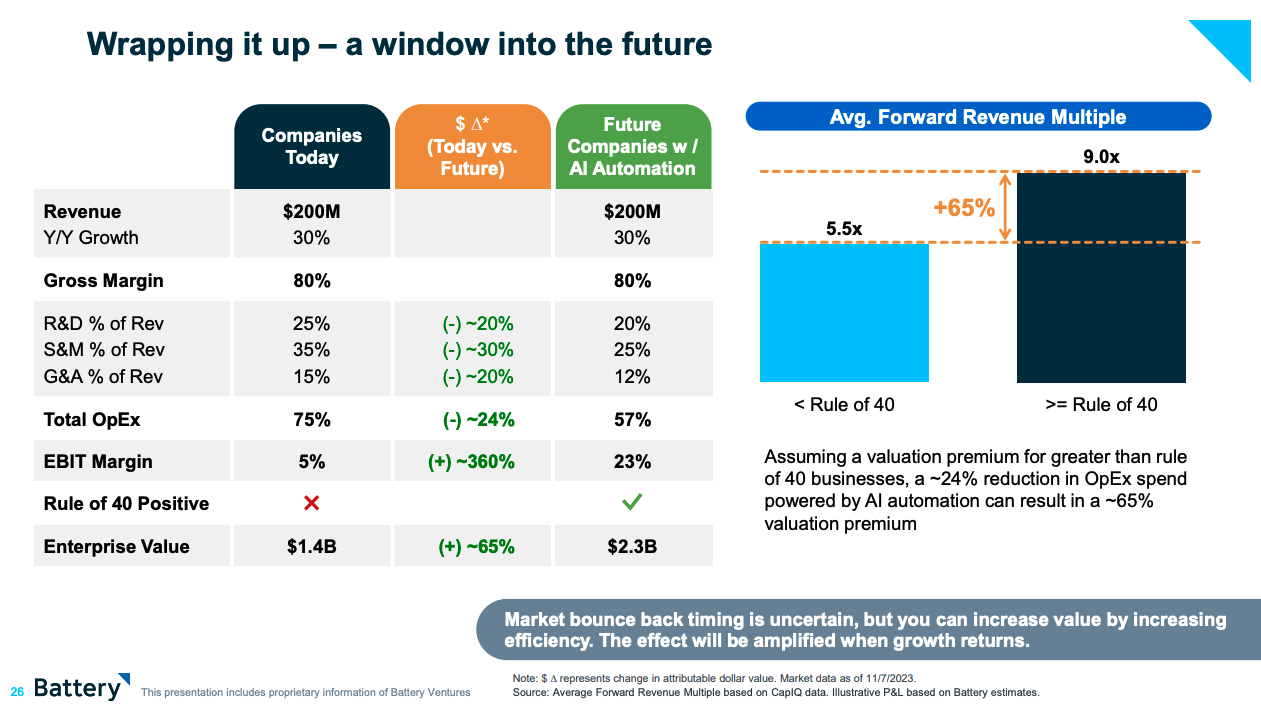

Notably, Battery expects AI-automation to drive similar, 20% cost savings to both R&D and G&A budgets to boot. Those cost savings could shed 24% off a scaled tech company’s operating expenses, boosting profitability and enterprise value sharply.

The venture firm’s math works as follows:

Via Battery Ventures, shared with permission. Image Credits: Battery Ventures

Now, small startups hardly have $200 million worth of revenue. They also grow more quickly than the above example and will therefore have negative EBIT margins. But! So long as they can wring similar AI-powered operating expense savings, they, too, can keep growth up while burning less. That should bring them closer to Rule of 40 passage and thus boost their value.

A startup with $15 million worth of ARR at a 5.5x multiple is worth $82.5 million. No small figure, but at 9x it’s worth $135 million. That leaves much more room for fundraising and the like on its cap table. And you can see that it’s easier to defend prior valuations at a 9x multiple than anything closer to 5x.

The question I have after digesting the future that Battery can spy in the distance is just how long it will take for AI-powered automation to show up in startup operating results. If the savings are even half as good as Battery seems to think that they may prove, startups could be in for a more efficient, and more valuable, future.